Tokenomics 101: Olympus Protocol

The tokenomics of crypto's reserve currency

Olympus Protocol recently launched OHM Lending Markets through SiloFinance and EulerFinance. This feature, called Lending AMO (Algorithmic Market Operations Controller), allows users to borrow OHM against collateral for the first time. The underlying mechanism involves minting OHM tokens into lending pools on SiloFinance and EulerFinance, up to a maximum of 200k OHM. This is yet another excellent showcase of the utility of the Olympus Protocol elastic monetary policy. We will discuss the details of this policy in-depth, but first, let's take a step back and understand what Olympus is.

Introduction

Olympus is a blockchain-based protocol that aims to create a new reserve currency backed by cryptocurrency assets. Reserve currencies are crucial for global economies and are valuable assets that provide a reliable and stable store of value. Currently, no such reserve currency exists in the cryptocurrency space.

Bitcoin's volatility has hindered it from qualifying as a reserve currency. However, the cryptocurrency sector offers great promise for creating a new global reserve currency. Olympus aims to fulfill the requirements of reserve currencies by conducting an autonomous and elastic monetary policy. Its token OHM is designed to achieve relative stability and scalability over time, bridging the gap between FIAT-pegged stablecoins and volatile crypto assets.

In the latter part of 2021, Olympus made headlines in the DeFi ecosystem for its promise of incredibly high returns, exceeding 10,000% annualized percentage yield, through a game-theoretic model that gained popularity through the (3,3) meme. This caused a frenzy among investors, leading to a significant increase in the token's value. However, as the year drew to a close, people began selling their OHM holdings, causing a cascading sell-off that resulted in the token's price falling more than 90%. This led to a public backlash against the project, with many accusing it of being a Ponzi scheme and the founders of being scammers.

Despite the accusations, the founders did not scam any OHM holders. Instead, they shifted the project's focus to becoming a decentralized reserve currency with monetary stability, which was crucial to ensuring the project's long-term success. By doing so, they pivoted away from the unsustainable high APY model and instead chose a strategy that would guarantee the project's future.

Tokenomics

It is essential to clarify that OHM, the token of Olympus, aims to become a reserve currency, but it does not need to be pegged or close to $1. The token has a 1:1 backing, which means that each OHM token can always be redeemed for $1 worth of value. OHM can be freely traded on the market, and the Olympus Protocol has introduced a system called Range-Bound Stability to maintain OHM's price close to a target price determined by a 30-day moving average. It is important to note that this is nots price is not required to be equivalent to the target price. Therefore, if you notice that OHM is trading at a price that is not equivalent to the target price, it doesn't mean that the token has de-pegged. I hope this explanation helps.

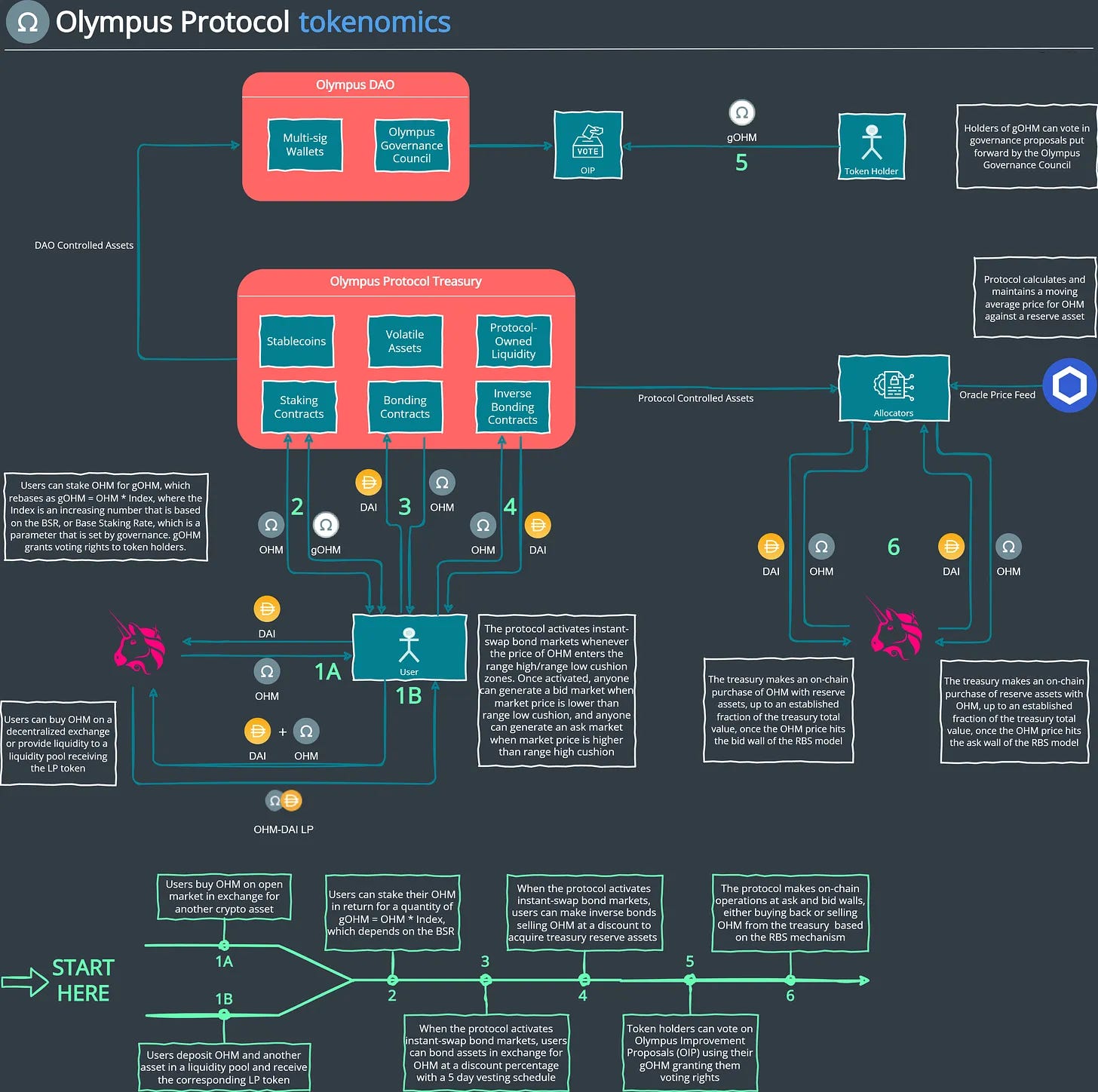

Olympus Protocol consists of two main components that work together to create and capture value:

The Treasury

The Olympus DAO

The Treasury

The Treasury is a crucial component of the protocol as it holds and manages the assets owned by the protocol. It ensures that the deep liquidity criteria required by reserve currencies is met by maintaining sufficient liquidity on open markets, making it easier to exchange assets and carry out market operations. To maintain transparency, these assets, referred to as protocol reserve assets, are stored on-chain in publicly verifiable smart contracts and can be deployed through secondary smart contracts, known as allocators. At present, the treasury holds over 50 assets with a total value of more than 240 million USD, and their balance can be monitored at all times through the Olympus Treasury Dashboard. This basket of assets includes stablecoins, protocol-owned liquidity, and volatile assets, with decentralized stablecoins such as DAI and FRAX making up over half of the assets held.

The Olympus DAO

The Olympus Protocol has some assets that are managed by the Olympus DAO via multisigs and are not directly controlled by the treasury. These DAO controlled assets are managed actively by the token holders' community, which can put forward and execute governance proposals through the Olympus Governance Council (OGC). This council enables faster decision-making and more efficient operations. Users with governance rights can submit proposals in three main areas: treasury, policy, and grants. Each proposal undergoes a thorough vetting process by the Olympus community. If approved, an official governance proposal called OIP is published.

Users have two ways to obtain OHM tokens - through a purchase on an open market such as Uniswap or via a bonding mechanism that we will discuss later. Once users have OHM tokens, they can either pair them with another crypto asset and provide the pair to a liquidity pool, receiving an LP token. Alternatively, users can stake their OHM tokens on Olympus to receive gOHM - the governance token of Olympus. gOHM allows token holders to vote on governance proposals. The number of gOHM tokens a user receives through staking is equal to the amount of OHM tokens staked, multiplied by an index which depends on the Base Staking Rate (BSR). The BSR is decided through governance proposals and can be adjusted to better adapt to the maturity of the project and different market phases. Initially, the BSR was set high to attract capital during Olympus' bootstrapping phase, but it has now been reduced to ensure the sustainability of the protocol.

To ensure long-term stability and reduce volatility, Olympus has introduced a mechanism called Range Bound Stability (RBS). RBS aims to constrain the price of OHM within a channel, fixed in width but can move up or down based on a moving average of OHM price, adapting to market conditions. While OHM backing is still $1 of value in treasury assets, RBS has been introduced to allow OHM to find stability above the backing price, absorbing buy and sell pressure that market volatility might introduce.

RBS enables Olympus to carry out on-chain operations by exchanging Protocol Controlled Assets through allocators. The main objective of RBS is to keep the price of OHM as close as possible to a target price, which is calculated as a moving average of OHM and can vary depending on the market conditions. The price is allowed to fluctuate above and below the target price within a certain percentage range, known as the spread. There are two types of spread, above and below the target price. The cushion spread (referred to as 'Sc' in the diagram) is the maximum variation allowed before the price hits the cushion. The wall spread (referred to as 'Sw' in the diagram) is half the width of the channel and is the maximum variation allowed before the price reaches the walls. The difference between the wall spread and the cushion spread is known as the cushion zone.

When the price of OHM enters the cushion zones, the protocol can activate instant-swap bond markets to bring the price closer to the target price. If the price falls within the low range cushion, Olympus generates a bid market where anyone can bond assets in exchange for OHM at a discounted rate, with a 5-day vesting schedule. Conversely, if the price falls within the high range cushion, Olympus activates an ask market, where users can make inverse bonds, selling OHM at a discount to acquire treasury reserve assets. The cushions are designed to reduce the buy/sell pressure before the price of OHM reaches the range walls. Once the price of OHM reaches the high range wall, the treasury makes an on-chain purchase of OHM with reserve assets. Conversely, once the price of OHM reaches the low range wall, the treasury makes an on-chain purchase of reserve assets with OHM.

One concern that arises is the possibility of a bad actor draining the treasury. However, the protocol's ability to intervene in these on-chain operations is limited. In fact, there is a predetermined fraction of the treasury's total value that the protocol can spend on these operations, after which the price is free to break the range and float freely in price discovery. This value is determined by governance and is put in place to prevent unnecessary spending to confine the price within a range that does not reflect the actual token value.

Distribution and Unlocks

Olympus conducted an Initial Discord Offering as a fair launch event, where 50,000 OHM were allocated to members who joined the Discord server before March 3rd, 2021, at a price of $4 per OHM. An additional 18,260 OHM were offered in an initial DEX offering on SushiSwap, bringing the total initial supply to 68,260 OHM.

Apart from this, Olympus also carried out a private funding round with investors including Zee Prime Capital, Nascent, D64 Ventures, and Maven11 Capital, among others. However, it is important to note that this private funding round did not involve the OHM token. This is because OHM tokens cannot be pre-mined and sold, as they require $1 backing for each OHM issued. Therefore, the Olympus team sold pOHM to investors, which is an option to mint OHM by burning pOHM and providing its intrinsic value ($1). At inception, the team, investors, and advisors vested 11.8% of the OHM supply. The breakdown was as follows:

Team: 330m pOHM and 7.8% supply

Investors: 70m pOHM and 3% supply

Advisors: 50m pOHM and 1% supply

DAO: 550m pOHM and no supply cap

It has been decided that there will be no more token unlocks or allocations. Instead, tokens will be minted and burned based on market conditions via the RBS mechanism. However, each OHM token must always be backed by at least $1 in treasury assets. When the price of OHM is greater than $1, new tokens will be minted, and when the price falls below $1, the same amount of tokens will be burned.

The initial distribution of tokens was mostly directed to the DAO, with only a small fraction of the supply reserved for the team, investors, and advisors. When compared to other protocols, using Moonfire as a reference, it can be concluded that the distribution schedule of OHM is among the best in terms of community allocation.

Value Creation and Value Capture

Olympus is a cryptoasset that provides users with a less volatile option than many other cryptocurrencies, without relying on FIAT-backed stablecoins. OHM is a token of high value for institutional and retail investors who seek safe-haven pristine assets during market instability.

In addition to OHM, Olympus also operates a Protocol-Owned Liquidity marketplace. The marketplace is aimed at early-stage protocols that struggle with liquidity bootstrapping. This marketplace operates via a proprietary bonding mechanism and has spun out as Bond Protocol, in which the Olympus DAO has a stake.

The Olympus DAO also offers an incubator program to support early-stage DAOs. This program allows Olympus to capture value through the equity that the protocol receives in exchange for its services. Lastly, the protocol offers Flex Loans to DAOs and has a grants program running.

Although the value that Olympus creates is only partially reflected in the OHM token price, the protocol still captures value through the fees generated by the Protocol-Owned Liquidity and other yield-generating activities that the treasury carries out. Olympus can also capture the value it creates through the services it provides, including the above-mentioned incubator program.

Demand Drivers

The Olympus Protocol aims to maintain stability for the OHM token price, which limits demand drivers relative to potential future financial upside. However, the protocol is still capable of generating demand by deploying products and financial services that inherently rely on the OHM token, such as liquidity pools pairings that have OHM as collateral. This generates interest in these products and services, which is expected to increase liquidity and thereby reinforce demand for the asset. gOHM makes a great collateral to be used in DeFi operations, as the RBS mechanism acts as a defender of the range, making it easy to predict the future price of OHM and limit the risk of liquidation due to collateral value drops. There are already DeFi protocols that accept OHM as collateral, including VESTA finance, where users can provide gOHM, which earns the BSR, to get the native stablecoin of the protocol that can be used for other DeFi operations.

There are two main demand drivers for OHM token:

1. Staking rewards: Those who buy OHM and stake it on the protocol will receive gOHM, which periodically receives the Base Staking Rate.

2. Governance: Those who buy OHM and stake it to receive gOHM will also gain governance power, meaning voting rights in any proposal the Olympus DAO puts forward.

Observations/Thoughts

The following information highlights some important observations that could potentially turn into issues if not addressed properly. Firstly, it is important to note that the Olympus protocol has experienced a decreasing number of holders since reaching its peak in January 2022. Additionally, some individuals still hold a bias towards Olympus due to their negative reputation from the 2021 hype cycle, where they faced accusations of creating a Ponzi scheme, leading to the emergence of several Olympus forks.

Furthermore, the tokenomics model of OHM has not been tested with a value that is close to reserve backing, i.e., $1 per OHM, and the treasury is still benefiting from the great liquidity influx from the 2021 hype cycle. Thus, it is difficult to make a comprehensive evaluation of the protocol in whole market conditions. Nevertheless, it is worth mentioning that the RBS has been functioning efficiently since its introduction in November 2022, keeping the price of OHM within the predefined price walls.

Regarding value capture, OHM is an interesting case due to its design and mission as a reserve currency. For instance, Frax Finance uses a dual token system where $FRAX serves as the stablecoin, whereas $FXS functions as the value accrual token, reflecting the value created by the protocol, such as infrastructure and POA. OHM should be seen in a similar light; however, the difference lies in the fact that the $OHM token takes on both roles of value accrual and reserve asset. This implies that OHM reflects market value, not the value created by the protocol itself, which is due to the nature of the product and its design.

Another significant observation is in regards to the demand drivers for OHM, which are not particularly strong when compared to other projects that may do a better job in token value accrual. However, if the token succeeds in maintaining its stability due to its RBS system, significant demand for the token could come from users who want to hold a coin with a stable value but is not a stablecoin like USDC or USDT. Additionally, as OHM gains more adoption in DeFi, the token could capture some of this value, translating the demand into an increase in token price.

Summary

In terms of tokenomics, Olympus is one of the most innovative projects in the DeFi space. The project's communication is transparent, making it easy for interested users to make informed decisions. Even if you are not aligned with Olympus' vision or want to hold OHM tokens, following the project's developments would still be beneficial for those interested in learning more about tokenomics and mechanism design. The team behind the project is paving the way for a more innovative DeFi ecosystem.

I think there is an error in the description of how the RBS works.

The treasury assets act as a reserve backing when the price tends lower. They buy up OHM from the market — reducing the supply and increasing the price while giving confidence to OHM holders that there will be a buyer of last resort.

The text in this article says the opposite:

"Specifically, once the price enters the low range cushion, Olympus generates a bid market where anyone can bond assets in exchange for OHM at a discount percentage, with a 5-days vesting schedule"

This would increase the supply of OHM and reduce the price.

The OHM docs mention this — "RBS involves deploying treasury reserves in a downward trending market and selling OHM for reserves in an upward trending market to stabilize price."

Source - https://docs.olympusdao.finance/main/overview/range-bound/