Who Will Buy Your Token?

Thinking About Demand Side Tokenomics

You’d be surprised at how often the above situation happens. In this piece, we’ll go over how we approach the question of token demand.

Why Demand?

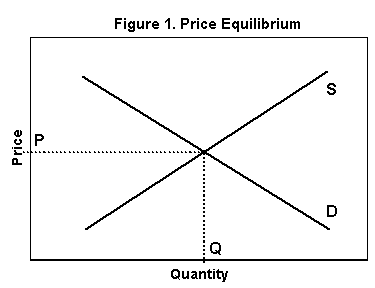

Tokens in web3 can be traded in a permissionless manner (unlike their web2 counterparts) between users via protocols such as Uniswap or Open Sea. If something is tradeable it means that it must have a price (i.e. an agreed-upon exchange between the two parties performing the trade) thus tokens are subject to the laws of supply and demand and price is the intercept of supply and demand on a graph.

The supply/demand dynamic is simply the relationship between supply and demand. As the above image depicts, as more supply hits the market it needs to be compensated with equivalent demand in order to maintain a steady price.

This means that we cannot simply dole out tokens without having sufficient demand to absorb them and thus maintain a somewhat steady price. Creating demand for a token is the key to balancing the supply/demand dynamic.

Sinks and Sources

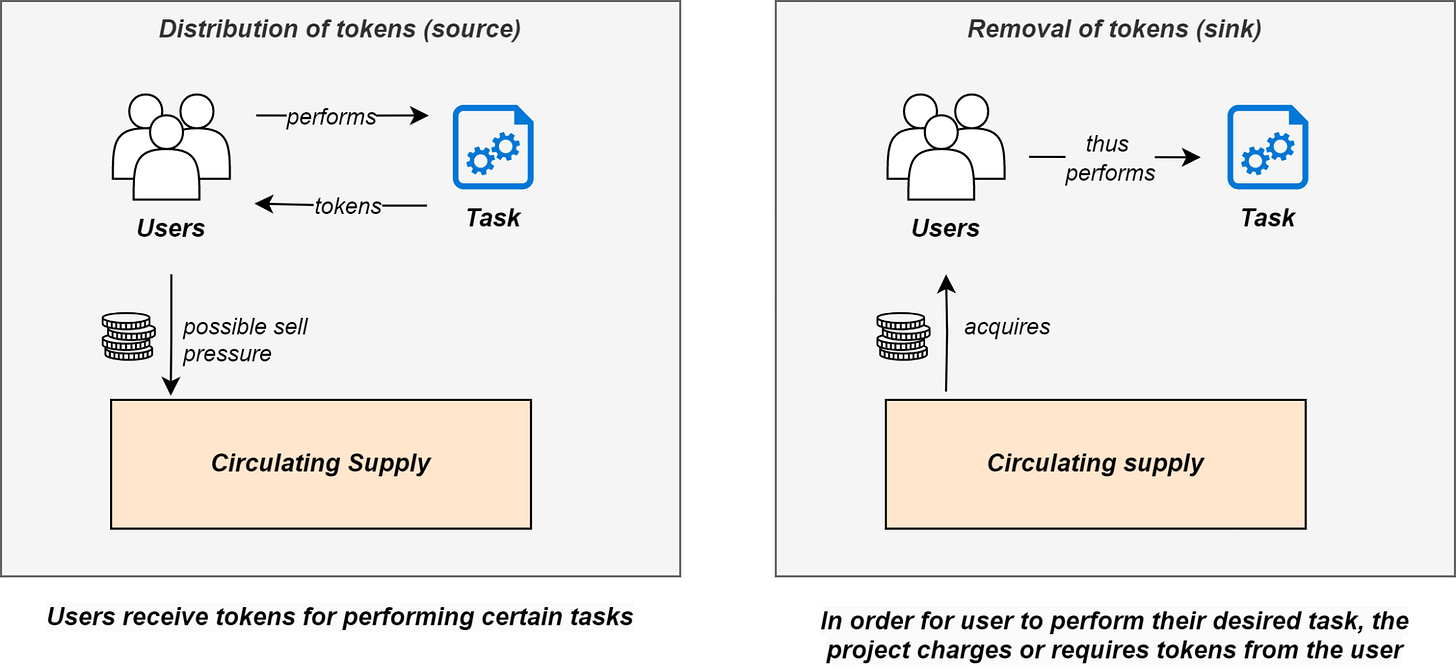

It can be hard to think about demand since it can mean someone (1) buying and holding (e.g. validators) or (2) buying and spending (e.g medium of exchange token). There has to be a balance between holdability and spendability (i.e token velocity) in order to achieve a steady price. For the scope of this article, we can simply think of supply and demand in terms of sinks and faucets.

A source is an increase in the circulating supply of tokens –more tokens hit the market.

A sink is a decrease in the circulating supply of tokens – the removal of tokens from the circulating supply

Why Is Token Price Important?

I know what you’re thinking;

The fact of the matter though is: price is important.

The reason is that, unlike traditional stonks, which are primarily used as an investment vehicle or compensation plan by 99% of those who hold them and can have voting rights, tokens are multifaceted.

Aside from acting as an investment vehicle, tokens can be used:

As an incentive: Token is used to bootstrap

Secure a network: Token used as anti sybil mechanism (i.e PoW & PoS)

Governance: Token used to govern protocol

Collateral: Token used as a form of collateral. Also applicable to insurance use cases.

There are likely more use cases, but for the purpose of this article, we don’t need to list them all. Note that these use cases are closely related to what we call Token Utility.

Let’s take a look at the importance of price in each of the above token use cases.

Token as an Incentive

Here a token is used to incentivise certain actions. It is used as a form of compensation. If the token has no monetary value due to a poor supply/demand dynamic then users will not be incentivised to perform the desired task. Users may receive many tokens but they will have little underlying value. Thus the protocol is left with a hollow or ineffective incentive mechanism and no means of growing in value (or in some cases even functioning).

Token in PoS/PoW Syetems

First, let’s get something straight, mechanisms such as PoW & PoS are not consensus mechanisms but rather sybil resistance mechanisms.

Here a token is used as a requirement to participate as a node in the network. Having a low token price relates to the economic security of the chain. Simply put, if it's cheap to acquire tokens then chain security can become an issue since a single person can spin up multiple nodes and thus reduce decentralisation possibly leading to chain corruption.

Token as a Means to Governance

Here a token is used to allow people to participate in the governance of a protocol. Similar to the above PoS/PoW scenario, if a token is too cheap and a majority can be acquired by a single actor it can lead to the protocol being governed by a small group of people.

Token as Collateral

Normally employed by money markets such as AAVE, this is slightly different than other scenarios detailed above since price is important not because of its number value but rather its stability. If a token is used as a collateral type it should ideally be as stable as possible, large swings in price will likely end in liquidations if health factors are not managed properly. In turn, price is important but in reality, the market cap of the token is what is the underlying factor to monitor here. Since a low market cap means that it will be easier to manipulate token price and thus impair the tokens' collateral quality.

I hope it's evident now that price is important and although every protocol is unique, generally speaking, the goal is to have a stable or slowly increasing price which comes from a balanced supply and demand dynamic.

Where Does Token Demand Come From?

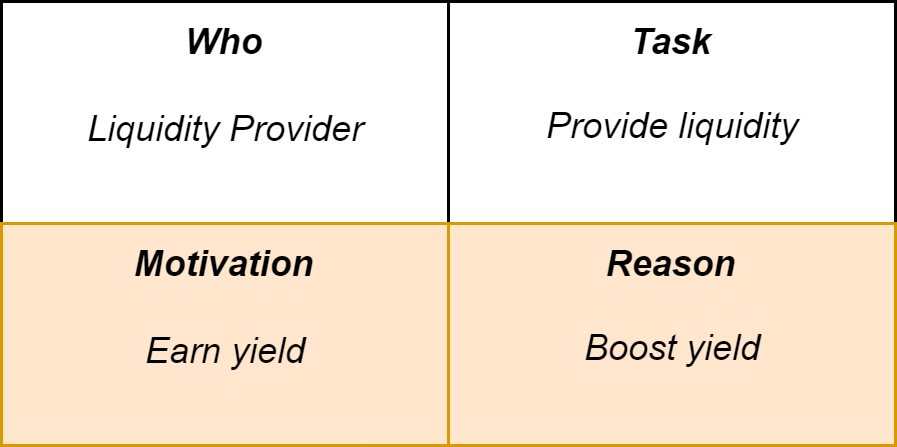

A simple way to think about it is:

Someone buying your token for some reason

Thus, it’s important to know:

Who that someone is

What task they will perform

Their motivation (meta demand)

Their reason for buying the token

Note that motivation and reason are not the same things here.

Motivation relates to the users underlying goal/desire for using the protocol and Reason relates to why they’re buying the token.

E.g Alice wants to participate in Ethereum’s chain security and earn a yield (motivation). To do this, she has to acquire $ETH to create a validator (reason).

Thus, Motivation can be thought of as meta-demand, the thing that users are ultimately trying to get. Whereas Reason can be thought of as a hoop (buy the token) through which users have to pass to achieve their underlying goal.

Motivation

Motivation falls into the realm of behavioural economics. A behavioural analysis of a protocol’s user base is very valuable since it can help to get a better understanding of what this part of the demand may look like and thus better align incentives. However, it must be employed at certain stages. In the early stages of trying to estimate demand applying all the bells and whistles will introduce many variables upon which assumptions have to be made that, later on, will likely result to be far from the truth.

Reason

That leaves us with the other side of demand: the reason, which is much more tangible and easier to think about.

We can break this down into three sources;

Utility: The user has to buy the token because they need to use it within the protocol.

E.g.: stake to create a validator, governance power, membership access, etcDemand Mechanism: The user is incentivised to buy the token because it is required to achieve a certain goal within the protocol, this is closely linked to Utility but does not always mirror it.

E.g.: lock a token to gain yield boost or governance rightsSpeculation: The user buys the token because (1) they believe it will appreciate in price or (2) due to brand/loyalty.

Notably, these are ordered with respect to how much control the protocol has over each type of demand source, from most control to least. –the protocol has the most control over its token utility which is linked to usage. It has control over any demand mechanisms that it puts in place, but less so than demand from utility. It has little to no control over speculative demand since this encompasses many aspects that are out of the control of the protocol.

The aforementioned fall under what we call demand drivers, i.e. something that drives demand (buy pressure or holdability) to your token.

Quantifying Demand

Well, that’s good and all, but how do you quantify this demand?

Essentially, how do you put a number to your framework?

That young degen, we will discover in the next piece. For now, find comfort in the aforementioned framework and may the demand be with you ✊.

all things that every people subscribed to this substack probably know already but put in the right perspective and well explained. gg