Where do token rewards go?

Effectiveness, CAC, demand drivers, Jupiters Airdrop, and more.

I recently got asked this question: “What do receivers of token rewards do with tokens?”

If we look at Jupiter's recent $JUP airdrop, the answer is that most sell.

Receivers of rewards have two options: 1) selling or 2) holding.

If we break these down deeper, selling or holding is a matter of the individual's risk appetite to hold the token. Typically, a crypto startup is quite risky, so people will have a threshold for how much of their portfolio they want to allocate. If rewards go beyond that threshold and the incentive to hold is not strong enough, they will likely end up sold.

Why reward at all?

Rewards are a powerful tool token launchers have at hand. Minting tokens costs nothing, so selling them initially is all profit. A concept called seigniorage.

Projects end up with free internet money and can incentivize others (liquidity providers, users, etc.) to interact with the protocol. By doing so, a marketplace could be bootstrapped. Subsidise buyers and sellers to get the ball rolling.

The plan? Hopefully, the number of buyers and sellers will keep the marketplace running organically without internet money over time.

No doubt, free internet money is a great tool. Nearly every project launching tokens uses it for incentives. The point is, though, how well do these incentives work?

Can they be effective, though?

Staking rewards are incentives, too. In the original form, staking is a mechanism where a Proof-of-Stake base layer pays validators minted internet money.

Non-base-layers, however, have adopted this tactic to pay token holders to hold onto their tokens. Currently, it is a prevalent mechanism that is implemented by many protocols.

If we talk about staking rewards from non-base-layers, the goal is usually customer retention, i.e., people are rewarded for already owning and holding the token.

Can a token reward campaign retain token holders?

In Is Revenue Share Any Good?, I compared the yield GMX is paying to the yield of corporate bonds. Most people are unlikely to hold a risky asset such as $GMX for a yield as low as 3-4%. They will hold the asset for speculation as they see potential in the project and take the yield as a bonus.

In this case, I’d argue that the token reward campaign can’t retain holders or at least has a very low impact.

Average Customer Retention

Token holders and customers are not the same, but some overlap exists.

We can consider staking rewards as customer retention or token holder retention costs. It is similar to dividends as a mechanism to retain shareholders (except that dividends are not payment-in-kind).

In the same way, Airdrops could be seen as a form of customer acquisition cost.

Unfortunately, there is not much data on the effectiveness of staking rewards, but there are some great examples of Airdrops.

Airdrops have mainly failed in acquiring and retaining customers/token holders (see Uniswap, Looksrare, and other NFT platforms).

For example, seven percent of airdrop receivers still held $UNI sometime after the airdrop. This, to some degree, matches Jupiter's airdrop campaign above.

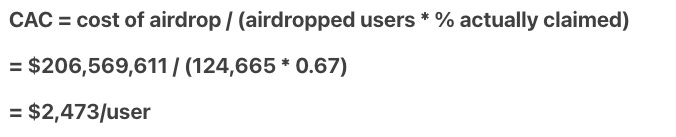

Kerman Kohli takes this further, breaking down the customer acquisition cost for the Looksrare airdrop:

Although Airdrop metrics are not perfectly comparable to staking, they show a poor or expensive rate of actual acquisition with reward campaigns. I assume staking won’t be that different.

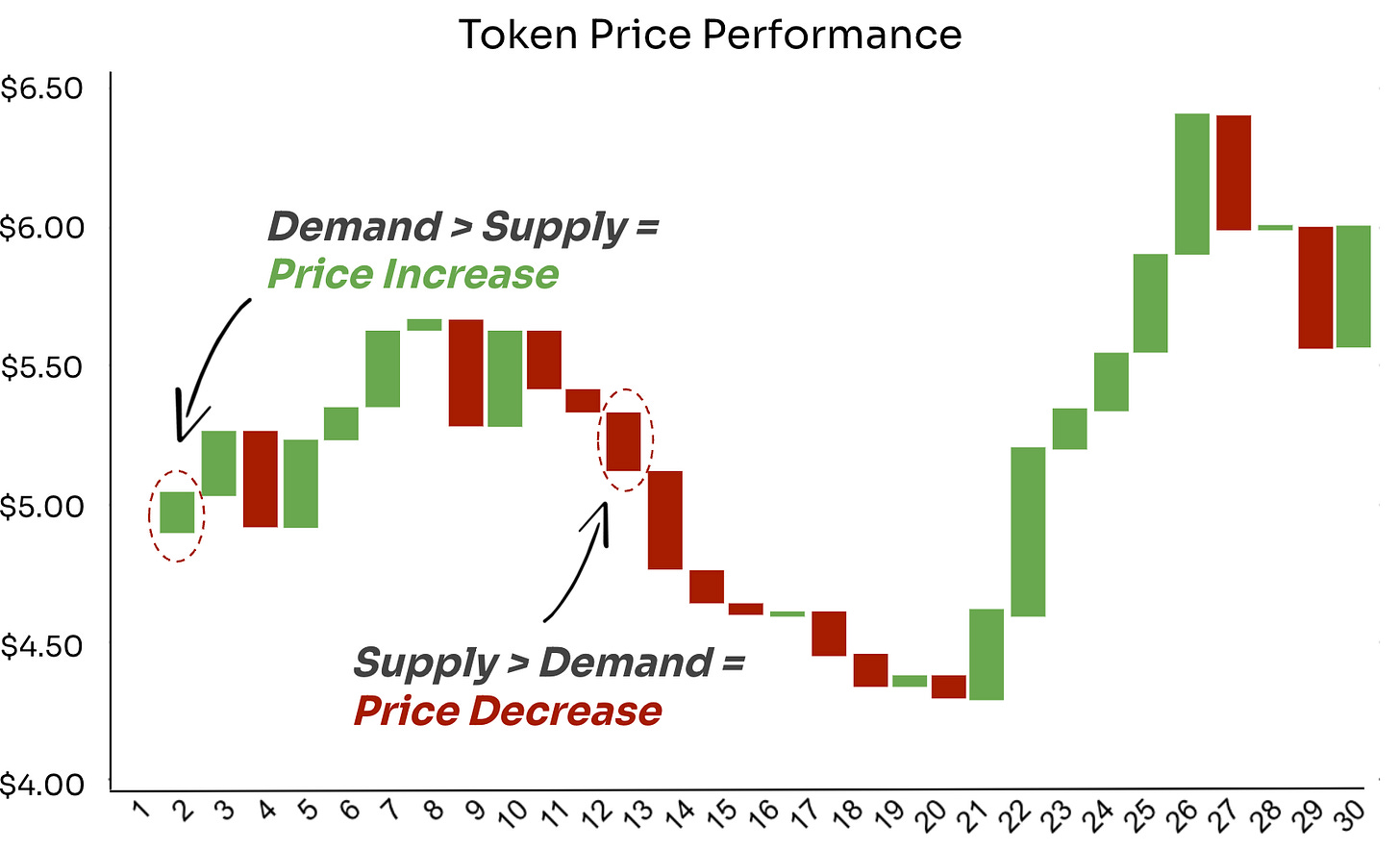

By the way. Here is Jupiter:

For comparison (source):

Supply Meets Demand

What makes it even worse is that projects are not just spending dollars on acquiring customers; they are spending tokens. Many of these tokens will end up as sell pressure on the market.

If they are not met with enough buyers, the token price might drop, making the incentives less powerful (e.g., the same ten tokens are emitted, but each is worth less in dollar terms). A feedback loop.

I guess what I’m trying to say is that token incentives are helpful, but they might not be as effective as one thinks, AND when bringing all these tokens into circulation, one needs to ensure a strong enough reason to buy and hold. This could be a juicy real yield, governance rights, a token buyback, or a good project with solid growth.

Please take a look at the customer acquisition cost and retention rate of the Internet industry and the financial industry to evaluate. Grabping one customer in 1000 apps, the cost of web3 is too low, the operation level is too low, and the cost should be x10.

great article as always!