Tokenomics of a Ponzi Scheme

A score to evaluate the 'ponziness' of a project

There is no shortage of web3 projects being called ponzi schemes and there is no shortage of web3 projects that are actual ponzi schemes.

On our recent podcast we talked about ponzi schemes, pyramid schemes and how web3 compares to the real economy. In this article I want to go through all of the above in a bit more detail and try to find out what it is that turns a web3 project into a ponzi or pyramid scheme.

I’m a big fan of Doombergs substack and can highly recommend subscribing. The focus is on supply chains, commodities etc. with the odd take on things like crypto. So when I came across a piece on Bitcoin, I obviously had to give it a closer look. Here’s how Doomberg describes his first encounter with Bitcoin:

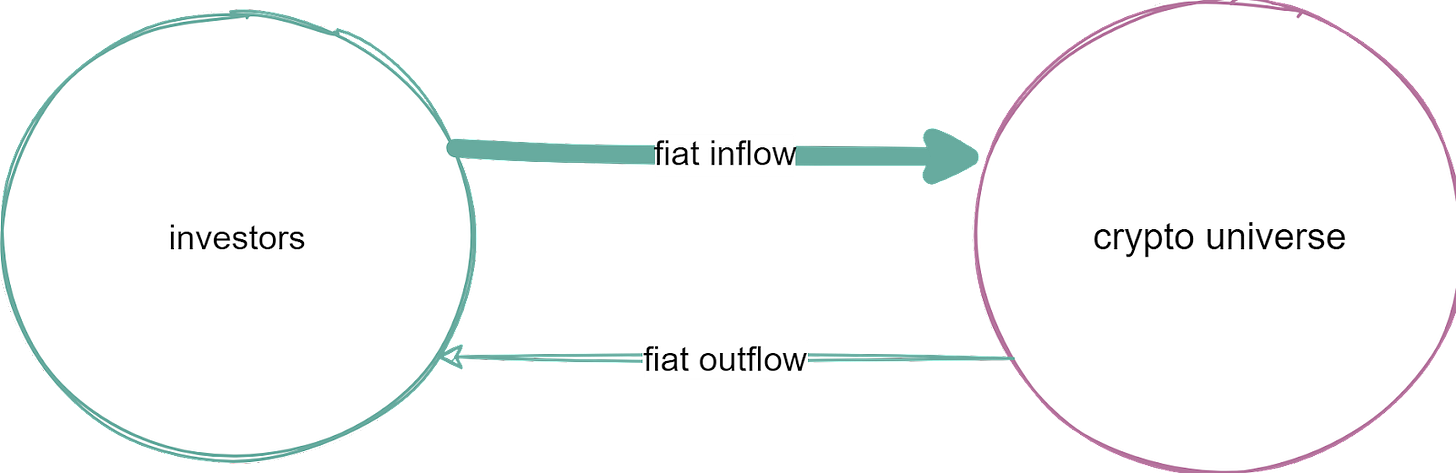

We distinctly recall drawing two circles on a piece of paper. In the circle on the left, we wrote “real economy,” while in the circle on the right we wrote “crypto universe.” We drew two pipes between the circles – one flowing into the crypto universe and the other flowing back to the real economy – and labeled both pipes with “fiat currencies.” While we understood how fiat currencies from investors could flow in, we failed to grasp what could be occurring within the crypto universe that would create more fiat currency for investors to take out at a later date.

Doomberg did not add an image of the diagram described, so I tried to draw it here:

The labelling of the crypto universe is pretty vague. What got me interested however, was the idea that there needs to be more fiat money flowing in than flowing out to keep the system running. I am not entirely sure what to call such a system, but people have used descriptions like ponzi schemes, pyramid schemes and zero sum games. I want to look into how they apply to traditional finance companies and crypto projects alike and create a first version of a framework to evaluate how ponzi something is.

Ponzi schemes, pyramid schemes and zero sum games

According to the SEC, a Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors.

In a broad sense this might be applicable to the diagram above. The SEC also defines some “red flags” to identify a ponzi scheme, making it a bit clearer why the inflow pipe in this case needs to be bigger:

High returns with little or no risk.

Overly consistent returns

Unregistered investments

Unlicensed sellers

Secretive, complex strategies

Issues with paperwork

Difficulty receiving payments

Let’s look at the SEC’s definition of the pyramid scheme next:

In the classic "pyramid" scheme, participants attempt to make money solely by recruiting new participants, usually where:

The promoter promises a high return in a short period of time;

No genuine product or service is actually sold; and

The primary emphasis is on recruiting new participants.

Again, there are a few characteristics to identify a pyramid scheme listed on the website:

Emphasis on recruiting

No genuine product or service is sold

Promises of high returns in a short time period

Easy money or passive income

No demonstrated revenue from retail sales

Complex commission structure

I assume one could use the above diagram to describe a pyramid scheme too.

A zero-sum game on the other hand, is a system in which one person's gain is another person’s loss - Investopedia describes it with a poker game. The only value created during a poker game is the entertainment value.

What all three have in common is that they don’t create any value and while the zero-sum game doesn’t hide this fact, the ponzi and the pyramid scheme try to pretend they do create value.

Ponzi or pyramid schemes might in fact produce some revenue or have small investment returns, but the majority of the returns come from new members joining. This, however, is hidden from investors, making the returns seem much bigger than they are.

In a classic crypto project this could look something like this: The price of a token has recently gone parabolic and a retail investor decides to get in on the action hoping for additional high gains on the token. She might get lucky and the token does another 10x and so she starts telling her friends, who might themselves get in on another 5x. This story can only go on for so long as at some point it either runs out of new investors, early investors will cash out or the market cap is too high to do another 10x.

Essentially, the more the price decouples from value, the harder it gets to keep money flowing in. This is, where in Doombergs’ diagram, the inflow pipe needs to be bigger than the outflow to sustain the current price.

Whenever we get to this type of relationship between price and value, it becomes difficult to sustain. This of course is nothing novel in web3 and you can have the same thing happen with Rolex watches, housing prices or stocks like Tesla. We talked about that on our recent podcast:

A ponzi chases price, not value.

It all boils down to value. What value does the project create and is it likely to create more value? Based on the SEC evaluation criteria above, perhaps we could create an evaluation of ponziness?

How could we evaluate the ponziness of a project? The NGMI score.

On a scale from 1 to 100, what’s the ponziness of a project? I guess it’s not exactly ponziness we are evaluating but also pyramidness and zero-sum gameness, so maybe we can establish a new measure. The ‘Not Going to Make It’ score or short NGMI score maybe? The higher a project scores, the higher the likelihood of it requiring more money to flow in to keep it alive i.e. it might not make it.

The Tokenomics DAO is working on a more detailed version of this and if you have some good ideas, feel free to join us here. I would consider the following questions, the fundamental building blocks to evaluate a project:

What is the perceived value of the project and how does it increase?

Does it promise returns? How risky are they? Where do they come from (is more money required to achieve the returns)?

How Sustainable is the price action?

What does the project produce / sell? Is the project transparent about sales / income / revenue streams?

How many tokens were distributed to founders/investors/advisors and when will they be unlocked?

After answering these questions, one should hopefully have a good understanding of how high a project scores.

In a great piece about Bitcoin, Lyn Alden, goes through why Bitcoin is not a ponzi scheme and answers a lot of the above questions for Bitcoin (the piece was a major source of inspiration for me, so check it out here). Instead of Bitcoin then, let’s see how Ethereum scores on the scale.

Is Ethereum NGMI?

In Doombergs’ diagram, I see Ethereum like this:

Let’s go through the question one by one:

What is the value of the project and how does it increase?:

Similar to Bitcoin, value comes from the payment network it provides, but also from the foundation for other applications to be built via smart contracts. Think of Dapps, DAOs and NFTs that all require Ethereum.

Value in terms of real world use is still limited, as you cannot buy a coffee with ETH and aside from moving tokens around in DeFi there is not all too much use. With DAOs as the future of work, real-estate on-chain and initiatives like Klima DAO, it's only a matter of time until we have a breakthrough in real-world usefulness.

Ethereum has an active community of developers working on migrating the blockchain to proof of stake - debates about PoW vs. PoS aside, one could argue that lower transaction cost and scalability might increase the value of it.

Raoul Pal attempts to value a network, such as Ethereum, by DAILY TRANSACTION VOLUME X NUMBER OF ACTIVE USERS, which is certainly growing on Ethereum.

on the 1 to 100 NGMI, I'd give it a 20.

Does it promise returns? How risky are they? Where do they come from (is more money required to achieve the returns)?:

Ethereum 2.0 will allow holders to stake ETH for a share of the revenue from transaction fees. The returns are not extraordinarily high (4.7% APR) and the risk seems fair given the adoption and distribution of Ethereum.

Returns come from the usage of the Ethereum ecosystem. Each transaction incurs a fee, which is paid to stakers / miners.

Token terminal gives information about the revenue stream of Ethereum, L2s and applications on top. They argue that the token burn introduced with EIP-1559 is like a share buyback and as such increases the value of tokens in circulation.

on the 1 to 100 NGMI, I’d give it a 10.

How Sustainable is the price action?:

The project has had enormous gains over the past 2 years (1950% since March 2020), which certainly attracted many investors and led to even more run-up in price. If however, the market cap doubles from 350bn to 700bn we would see it valued similar to where Bitcoin is now.

On the one side the killer use case for Ethereum might be just around the corner, making the network super valuable or we might see the Ethereum merge running into issues making it less valuable.

Bloomberg analysts seem to value $ETH at $6128 USD based on discounted cash flows, factoring in the 200% annual growth in transaction fees (amounting to 9.8bn in 2021).

on the 1 to 100 NGMI, I’d give it a 20

What does the project produce / sell? Is the project transparent about sales / income / revenue streams?

The fees charged on transactions let users buy a slot on a pretty decentralised immutable ledger that stores transactions and smart contracts that can be executed.

Like most blockchains, the stats around transactions, gas fees etc. can be seen on a block explorer (in this case Etherscan). Transparency is not an issue here.

Even the newly introduced token burning mechanism is very transparent - watch the burn.

on the 1 to 100 NGMI, I’d give it a 1

How many tokens were distributed to founders/investors/advisors and when will they be unlocked?

More than 50% of the circulating supply was given to early contributors, which certainly is a lot. None of that supply is locked.

on the 1 to 100 NGMI, I’d give it a 50

Summary

Ethereum has been around since 2015 and has proven at least some degree of value. It does not promise any returns and even though some might say ETH trades at a premium, it does provide value that is likely to increase over time. All of the development happening in the space is likely to, at some point, produce a breakthrough application.

The inflow pipe does not need to be larger than the outflow pipe. The relevant metric here is usage. If Ethereum is used, transaction fees are charged and paid to miners / stakers, giving them an ROI and burning tokens akin to share buybacks. If usage continues and even grows there must be some value in it.

Averaging my category rankings, my score for Ethereum is ~20, so probably going to make it.

What can the Tokenomics DAO learn from this?

As we indicated in our first post, we want to take the community on the journey of thinking through why the Tokenomics DAO needs a token. Understanding what makes up a ponzi might be useful when designing our own token. Not because we want to create a ponzi, but because we want to be clear and transparent about what we do and why what we do has value.

Defining a set of criteria to evaluate if a project is going to make it, will help us ensure we get this right. It will base a potential token on value, ensuring it has sufficient utility and does not over promise or hide something. As a next step we will take a closer look at the value we want to create and how the token could be used within the community.

Obviously, creating an evaluation framework and establishing an NGMI score to evaluate projects and educate people about how to not just ape into, but look at fundamentals is a part of the value we are already creating.

If you’d like to get involved in the discussions around this framework or defining our tokenomics, join us on Discord.