Tokenomics 101: Tokemak ($TOKE)

a new primitive that will transform decentralized, sustainable liquidity

TL;DR: Check out the summary here.

Introduction

Liquidity in crypto is crucial – it determines the stability and reliability of a token or coin. In other words, markets cannot be made in the absence of liquidity.

For DeFi projects, though, attracting liquidity has proved to be a very arduous task; more than 35% of liquidity providers stop providing liquidity after just 5 days, and 50% stop after 15 days and dump their accrued token rewards on their way out. Essentially, keeping liquidity providers loyal has not been easy in DeFi.

The most used strategy by DeFi projects to attract liquidity is the use of a pool2, which so far has been able to mainly attract temporary liquidity. This liquidity is literally waiting for incentives to dry up and run for the exits when these incentives are no longer lucrative. As a consequence, these liquidity mining programs are often short-lived and result in downward price spirals of great magnitude for the native token of the protocol or DAO.

DeFi projects and protocols knew they had to find an alternative to this broken model, so they started to think about how they could capture liquidity for a long time without hurting their token holders or sending the price of their tokens into the abyss.

Enter Tokemak, the token reactor. Through a seamless decentralized market-making protocol, Tokemak aspires to generate long-term liquidity and capital-efficient markets throughout DeFi. It also offers solutions to liquidity providers who do not want to be victims of impermanent loss. In the article, we will look at how the protocol is able to unlock such capital efficiency and provide solutions to problems prominent in the DeFi ecosystem.

Tokenomics

A zoomable, high-resolution tokenomics diagram can be found here.

Tokemak protocol: Reactors

The protocol functions by having two pools, or “reactors,” as they are called in the Tokemak ecosystem. One of the reactors, called the “pair reactor,” is used to accept deposits of assets that are relatively stable and have deep on-chain liquidity. Some examples include ETH, DAI, and USDC. The pair reactor’s counterpart, the token reactor, is used to accept deposits of tokens that need liquidity. These reactors are spun up based on governance, through an event known as C.o.R.e – something we will be discussing in detail later on in the article. And as with any liquidity deposit, the user is given a receipt token. And in this case, with the Tokemak protocol, when a user supplies an asset (whether it be a pair or a token reactor), they get a tAsset in return.

Understanding the functionality of both reactors will aid in understanding the synchronicity that occurs behind the scenes. As assets are deposited into the two reactors, $TOKE holders (a.k.a. liquidity directors) decide where the liquidity in the pair reactors will go (by staking $TOKE to said token reactor), essentially gaining control over which of the token reactor(s) will secure liquidity and which trading venues the newly formed liquidity pairs are deployed to. For example, liquidity directors direct $ETH from the pair reactor to the $FXS token reactor to form ETH/FXS liquidity on Sushiswap or Uniswap.

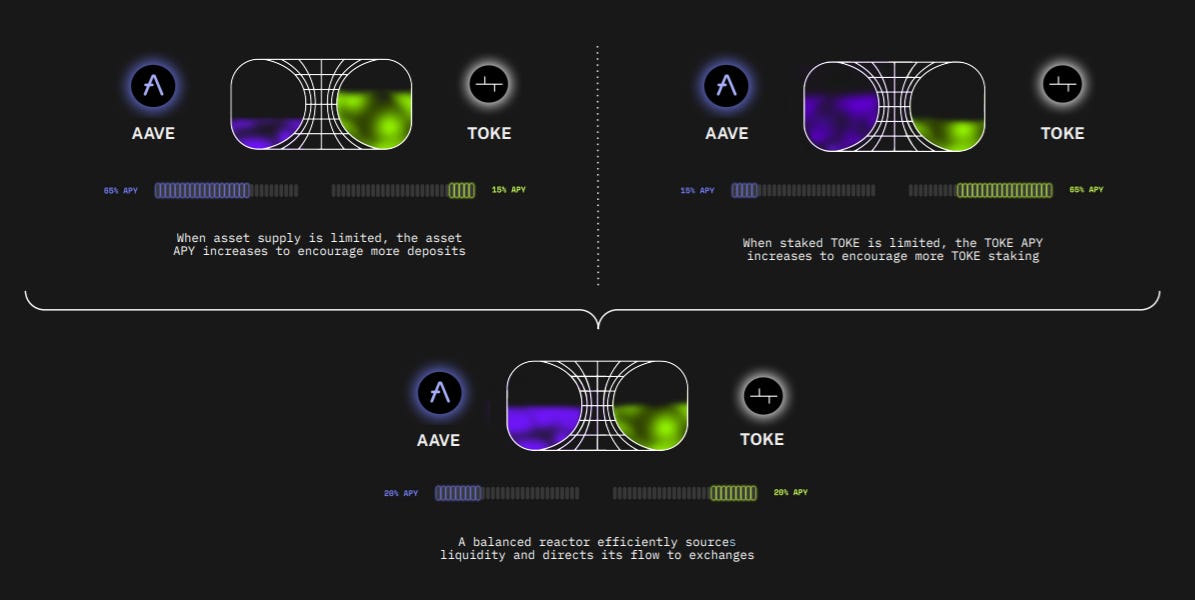

The system of raising funds for both reactors (incentivizing deposits in both reactors) is done through $TOKE emissions. Each pool does not have a fixed allocation of token emissions; rather, token reactors with the best balance of both sets of assets (pair and token) receive the most token emissions. In the protocol, this is referred to as "reactor logic" and will be further explained below.

As seen above, only when the reactors are in their optimum state do they receive the maximum amount of $TOKE emissions; this ensures that market participants that are interacting with the protocol act with maximum greed, bringing out the maximum efficiency in the protocol, i.e. incentives are aligned.

Now, let's talk about how the protocol mitigates impermanent loss for liquidity providers on both sides of the Tokemak spectrum (token and pair reactors).

Since impermanent loss is the unrealized loss faced by liquidity providers when assets fluctuate in price against one another, it is bound to exist in the Tokemak ecosystem (assets being paired against one another is the crux of the protocol), but through a mitigation waterfall, the protocol is able to remove the impermanent loss aspect for liquidity providers in the ecosystem, making it highly desirable to provide liquidity on this platform instead of forming pairs oneself on an AMM directly. We will dive into the mitigation waterfall below.

As mentioned previously, there are two sides to providing liquidity: pair and token reactors. Let’s take a look at how IL is mitigated in token reactors:

To mitigate the IL for token reactors, as seen in the visual representation

above, ABC DAO exchanges 100 $ABC tokens for 100 $TOKE tokens (over the counter). But what does this exchange achieve?

1) The Tokemak protocol now has a reserve of $ABC acting as collateral, which is used to mitigate impermanent loss (for the $ABC token).

2) ABC DAO now has a stake in the Tokemak protocol, which it uses to direct pair assets (like ETH, DAI, etc) to its token ($ABC) reactor.

But how does this help mitigate impermanent loss? Going back to our example, in a DAI/ABC pool, where DAI is the paired asset and ABC is the token reactor asset, if the price of ABC goes up, the Tokemak protocol will not be able to facilitate 1:1 withdrawals of ABC – where 1 tABC can be redeemed for 1 ABC (learn about tAssets here or in the tokenomics diagram above), as there is a deficit on that side of the liquidity pair due to impermanent loss.

The Tokemak protocol pulls the required ABC tokens from its ABC reserve to mitigate the impermanent loss faced and ensure 1:1 withdrawals of tABC->ABC, ensuring that withdrawals can be carried out by liquidity providers/depositors.

Now, let’s take a look at how IL is mitigated in pair reactors:

For pair reactors, IL mitigation works a little differently. Suppose impermanent loss occurs on the other side of the pool (pair reactor side) where there is a deficit of a pair reactor token. In that case, the Tokemak protocol pulls the respective asset from its POA (this term is explained in the “Treasury” section below), which would have accumulated this asset in the form of fees. If this is not the case, it would swap another pair reactor token in the POA for the asset needed to mitigate the IL.

For example, in an ETH/FXS pool, where ETH is the paired asset and FXS is the token reactor asset, if the price of ETH goes up, the Tokemak protocol will not be able to facilitate 1:1 withdrawals of ETH, where 1 tETH can be redeemed for 1 ETH (learn about tAssets here or in the tokenomics diagram above), as there is a deficit on that side of the liquidity pair due to impermanent loss.

The Tokemak protocol pulls the required ETH tokens from its POA (or swaps another pair reactor token from the POA into ETH) to mitigate the impermanent loss faced and ensure 1:1 withdrawals of tETH->ETH can be carried out by liquidity providers/depositors.

Never has there been an instance (even during the peak capitulation stages

post LUNA's collapse) when these steps could not facilitate 1:1 withdrawals; however, some additional mitigation steps are present and may come into play during the worst of market conditions (when IL is very high and the steps outlined in the paragraphs above aren’t sufficient). These are: pulling $TOKE tokens staked to the reactor and protocol-owned assets/POA into the system reserve (to mitigate impermanent loss). Together, these steps ensure that there are always enough assets in reserve to make up for any impermanent loss that depositors might face.

To further understand impermanent loss mitigation (with the help of values), please refer to the following page.

Tokemak protocol: Treasury

Tokemak's treasury plays an essential part in the workings of the protocol. As the protocol deploys the liquidity pairs it forms to different trading venues like Uniswap or Sushiswap, market participants use this liquidity to trade and pay swap fees. Since the trader is utilizing the liquidity controlled by the protocol, the protocol is netting a portion of all swap fees generated by that liquidity pool. The protocol then sends all swap fees to the treasury to be deployed as liquidity to the pair reactors. It is also important to note that the liquidity provider tokens (lp tokens) Tokemak controls are sometimes sent to external farms to earn a yield (for example the Tokemak protocol receives a receipt token "x" from providing liquidity on Curve; this token is then deposited on Convex to earn a yield on top of the trading fees accrued). This yield, too, is sent to the treasury.

The swap fees and yield the treasury receives are called protocol-owned assets, or POA for short. The protocol deploys these accrued tokens to pair reactors, creating a flywheel where more liquidity creates more fees, and so on. At the time of writing, the protocol has amassed a treasury of over $24MM (excluding $TOKE holdings, which are valued at around $28.5MM at the time of writing).

Tokemak protocol: C.o.R.E

Through an event known as the Collateralization of Reactors Event, or C.o.R.E for short, external DAOs or protocols desiring liquidity for their token attempt to secure a token reactor on the platform. They do this by placing bribes on their reactor using a bribe marketplace called Hidden Hand, Tokemak’s bribe partner. $TOKE holders then secure their share of the bribes by using their voting power to vote on particular reactors, and the 5 reactors with the most votes secure a reactor in that C.o.R.E.

Distribution & Unlocks

The total supply of $TOKE tokens is hard capped at 100,000,000 (100MM) tokens, ensuring $TOKE holders won't be diluted after the token's emissions come to a halt.

The emissions of the $TOKE token started on August 8, 2022, and as seen below, 30% of the total supply (30,000,000 tokens) is allocated to incentivize liquidity provision on the platform over the next two years.

Above is also a breakdown of the DAOs', market makers', investors', teams', and contributors' allocation of the total supply. All of these allocations have a 12-month cliff and a 12-month linear vest, ensuring that the protocol's and these parties' incentives are aligned and minimizing the market impact by preventing tokens from being dumped during the protocol's early phases and all at once.

The team was also very picky in choosing the investors (many lined up to get into the seed round), not allowing any one of them to buy the whole round for themselves, and choosing the ones they believed would assist in the development of the protocol.

We can also see that 5% of the total supply was set aside for a "genesis event," in which the protocol could raise funds by selling $TOKE tokens to the general public. Another 9% of the supply was allocated to the treasury for the same reason.

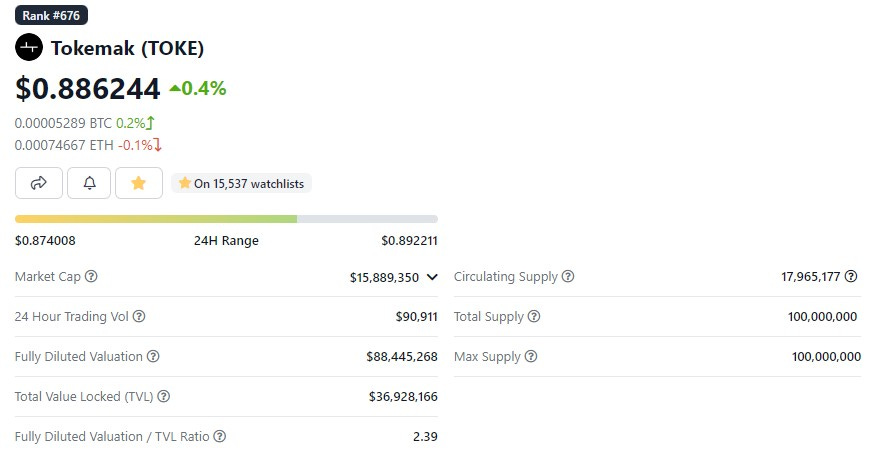

One concern that arises from the distribution of these tokens is the current float of the $TOKE token.

And as we can see from the data above, the float (circulating supply) of the token is only around 18%, making it a big concern for retail investors (they don’t want investors and other insiders to dump on them). However, the ICO price most investors got in at was around $1.55 per token, giving them no incentive to sell their allocations at these prices ($0.88 at the time of writing) as they are in huge losses, -43.2% to be exact.

Other upcoming protocol implementations, like accTOKE (locked $TOKE), will also aid in keeping $TOKE tokens off the market.

Value Creation & Capture

Tokemak creates value through a decentralized protocol aimed at securing sustainable, capital-efficient liquidity for any crypto project. The protocol also creates value for retail investors by allowing them to earn a yield on their tokens without subjecting them to impermanent loss. Yield-generating opportunities, however, aren’t limited to retail investors. DAOs and protocols with treasury holdings can deploy assets to reactors, earning a passive, impermanent loss-free yield. Furthermore, protocols or DAOs with reactors

on the platform (for their token) can deposit their native tokens into these reactors to both earn a yield on them and secure more liquidity for the token.

Below is a visual illustration of the aforementioned.

At the time of writing, each $TOKE token (worth around $0.88 at the time of writing) can direct around $10.6 in liquidity to any token reactor; talk about capital efficiency!

Apart from creating value for $TOKE holders through liquidity direction privileges, the protocol also creates value for $TOKE holders through governance, wherein holders get to choose which token reactors can be spun up on the protocol via events known as C.o.R.E. (we have covered this in the “tokenomics” section of the article. Furthermore, you can read more about these events here). By voting on certain reactors, $TOKE holders get bribes from external protocols/DAOs that seek a reactor for their native token.

The protocol's governance will also be enhanced in the future, enabling $TOKE holders to vote on things like alternative trading venues to direct liquidity (apart from the present ones like Uniswap) or new L2/cross-chain implementation.

The Tokemak protocol, however, isn’t confined to creating value for several parties; the protocol also captures value in the form of fees generated.

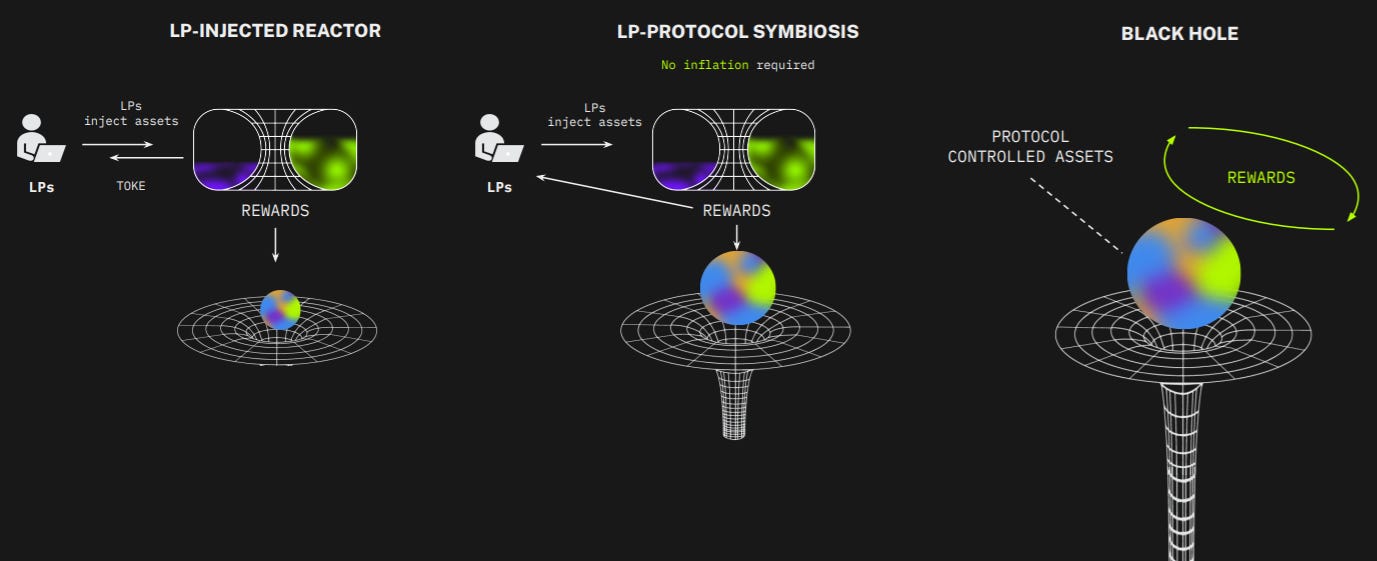

As we know, Tokemak deploys liquidity to external liquidity venues (by pairing "pair reactor" assets with "token reactor" assets) like Uniswap and Curve (popular AMMs on the Ethereum blockchain); this allows the protocol to capture 100% of all trading fees the liquidity deployed generates, getting the protocol closer to its end goal: The Singularity (process outlined in the diagram below) or Black Hole, in which no $TOKE emissions are required to incentivize liquidity on the platform and all trading fees amassed in the protocol's treasury are more than sufficient to meet the liquidity needs of crypto projects – further increasing the capital-efficiency of the protocol.

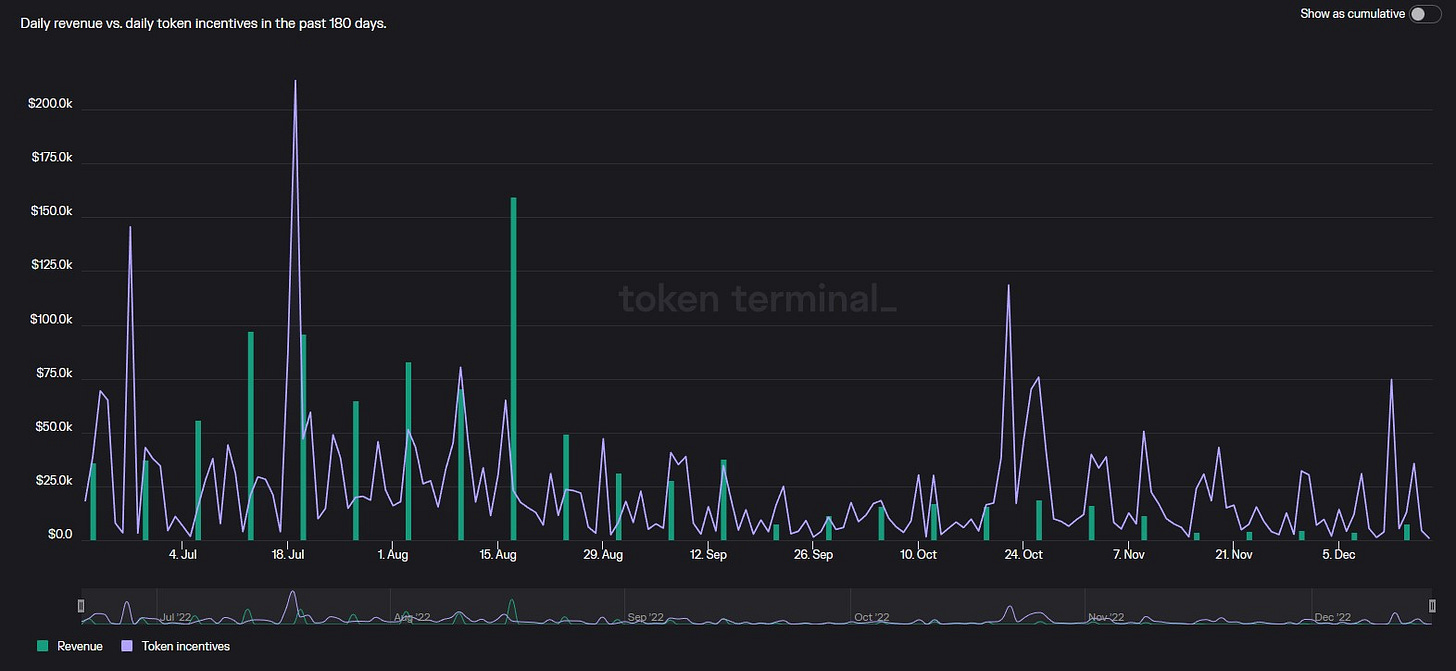

As seen below, the liquidity deployed by the protocol has not been generating a substantial amount of revenue through swap fees; this can perhaps be attributed to the crypto winter and overall market turmoil we are currently facing, with investors being relatively risk-averse in these market conditions.

We can also see that there are more $TOKE tokens emitted than fees generated, hinting towards a possible sustainability issue, but with protocol upgrades coming, this concern – to an extent – is alleviated due to increased capital efficiency, incentive alignment, and reduction in overall $TOKE emissions. You can read more about this here and here.

Demand Drivers

By incentivizing liquidity by emitting the $TOKE token, the protocol is able to grow a basket of assets dedicated to $TOKE holders to direct. This effectively turns $TOKE into tokenized liquidity, which drives demand for the token as a means of acquiring liquidity. Governance over which reactors can set up shop on the platform, too, has a crucial role in driving demand for the token.

With this in mind, we can see why $TOKE will be an attractive asset for DAOs to accumulate.

As seen above, several DeFi DAOs are already accumulating $TOKE in order to direct liquidity to their native tokens on demand and in perpetuity. I anticipate a growth in the number of DAOs accumulating $TOKE in the next few months and years, as – currently – no protocol addresses the issue of liquidity in DeFi as effectively as Tokemak. It's also important to keep in mind that Tokemak doesn't have much direct competition, increasing the chances of the protocol dominating liquidity markets in the foreseeable future.

Some protocol upgrades that will be implemented in the near future, such as accTOKE (a locked version of $TOKE that distributes protocol revenue), could further help in driving demand for the $TOKE token.

Closing Thoughts

As seen above, the Tokemak team has outlined a roadmap to take the protocol to its next stage, reduce the barrier for entry for retail, increase the capital efficiency of the protocol, and increase the utility (drive demand) for the $TOKE token through the accTOKE implementation that’s coming soon.

One thing to note is that in times of extreme market turmoil (impermanent loss usually has a positive correlation with this), $TOKE stakers to a particular reactor may lose out on part or the whole of their position, as their staked amount can be essentially "slashed" to cover the impermanent loss (if the mitigation waterfall fails; this is explained in the "Reactors" section of the article), creating an existential threat to $TOKE stakers. But then again, is it doubtful that an event like this will occur, as even during the peak capitulation stages post LUNA's collapse, the protocol didn’t need to resort to slashing $TOKE stake to cover impermanent loss as their mitigation waterfall worked perfectly.

Overall, I can say with a fair amount of certainty that as crypto gains mainstream adoption and DeFi matures, nothing will be more important than having on-chain liquidity for one's token and that Tokemak is able to create value for $TOKE holders while solving the most important problems in DeFi today by bringing capital-efficient and sustainable liquidity to every corner of DeFi.

Great post and write up!