Tokenomics 101: SUI

The Suinami is at our doorstep, will you know how to swim?

Introduction

Recently, there have been many discussions about next generation protocols and how to qualify for their token airdrop at early stages, like Arbitrum, ZkSync and Sui itself. Unfortunately, Sui recently announced that there will be no airdrop but rather users who joined their discord before February 1st will be able to buy coins at a discount. Check this tweet for more info.

Sui, which is expected to launch during 2023, is not an Ethereum layer-2 but has its own Delegated Proof of Stake (PoS) blockchain that promises to revolutionize the entire crypto space. We will be covering how they plan on doing this in this article.

If you’re looking for a gasless solution with a high scalability framework read along and we’ll explore the new frontier of PoS which is capable of building experiences that cater to the next billion users in web3.

Sui is a low-latency, high-throughput permissionless layer-1 chain. Its instant transaction finality makes Sui a prime candidate for on-chain use cases like DeFi and GameFi. Sui’s smart contracts are written in Move, a Rust-based programming language that prioritizes fast and secure transaction executions. Rust is also the programming language of Solana, another high-speed blockchain.

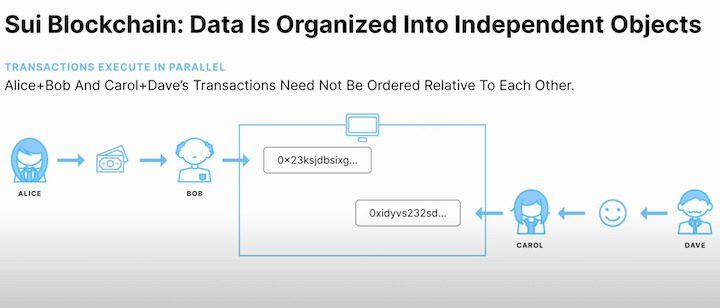

Instead of focusing on vertical scaling as many other cryptocurrencies do, the blockchain utilizes a process called “transaction parallelization”, allowing transaction processing in “parallel agreement.” This horizontal scaling leads to better data organization (built as independent objects) in the byzantine fault-tolerant Proof-of-Stake consensus mechanism and entails a very high throughput (transaction speed).

Sui forgoes consensus to instead use simpler and lower-latency primitives for basic use cases, such as payment transactions and asset transfers. This is unprecedented in the blockchain world and enables several new latency-sensitive distributed applications ranging from gaming to retail payment at physical points of sale.

Moreover, Sui’s gas pricing mechanism achieves the triple outcomes of delivering users with low, predictable transaction fees, incentivizing validators to optimize their transaction processing operations, and preventing spam and denial of service attacks. Nevertheless, the team comprises former Diem developers (Meta), which depending on your outlook is either good or bad.

Tokenomics

A zoomable version of the token flow diagram can be found here:

If you’re interested in the condensed, need-to-know tokenomics information for Sui, check out the report on Tokenomics Hub

It is worth mentioning that $SUI is the native token of the Sui blockchain (layer-1), meaning it is a coin, not a token. Read this simple article if you need help understanding the difference between a coin and a token.

Token Utility

The $SUI coin serves four primary functions:

Stake and delegate to participate in the PoS consensus.

Used to pay for gas fees.

Unit of account, medium of exchange, or store of value — especially for DApps.

Governance and on-chain voting.

$SUI behaves like a typical layer-1 coin needed to transact on the platform and used to reward validators (and delegators) to secure the network. Nothing out of the ordinary here. What matters in Sui is its object-centric design (details in the value creation section) which could dramatically impact the transaction throughput and the platform's scalability, and the gas fee mechanism as a coordination framework for the entire system.

The Gas Fees Mechanism - An Ecosystem Coordination Tool

$SUI fees play an essential role in the ecosystem, acting as a coordination mechanism among validators pushing them toward honest behaviors. In traditional blockchain networks, gas fees go up and down based on the network demand, which can result in a very costly operation, even for a simple token swap. In Sui, users can have more predictable gas fees since validators recurrently vote on a network-wide reference price. The gas price mechanism is designed to establish a reliable and trustworthy price point for users. This helps users have a better idea of how much they need to pay to ensure their transaction gets processed quickly and correctly. It provides reasonable confidence that transactions submitted with gas prices at or near the reference price will be executed promptly.

A unique feature of Sui’s gas price mechanism is that users pay separate fees for transaction execution and for storing the data associated with each transaction.This means that the gas fee can be broken down into:

Computation fees → these are charged on all network operations and used to reward participants of the Delegated Proof-of-Stake mechanism by also preventing spam and denial-of-service attacks.

Storage fees → are used to shift stake rewards across time and compensate future validators for previously stored on-chain data storage costs.

In turn, the gas fees associated with an arbitrary transaction are equal to the following:

The computation price is determined through a three-step process operating across 24-h epochs whereby a validators committee administers each epoch. Meaning that instead of seeing the gas price fluctuate minute by minute, it will maintain stable over a 24-hour period. These recurring steps are:

This aims to establish the Reference gas price for the epoch. It does this by collecting validators' reservation price – the minimum gas price at which they are willing to process transactions. The protocol then sets the Reference gas price to that which the quorum of validators (⅔ by stake, which ensures the Byzantine fault tolerance) is willing to charge to process transactions.

Tallying rule

Since all users' transactions (along with the gas paid) are visible in the system, each validator checks whether or not other validators have charged their actual prices in line with the one set during the Gas price survey. The Tallying rule aims to create a community-enforced mechanism for encouraging validators to honor the Reference gas price.Incentivized stake reward distribution rule

At the end of the epoch, the distribution of emissions across validators is adjusted using validators’ input from the Tallying Rule. Validators who submitted low-price quotes during the gas survey — namely, lower than the reference price — or who processed all transactions above their self-declared reservation price promptly get boosted rewards. Contrarily, validators who submit high-price quotes during the gas survey or do not honor their self-declared reservation price get penalized with discounted rewards. Furthermore, validators’ earning power is proportional to their stake, meaning that validators want to encourage users to delegate their stake to them, the distribution rule incentivizes validators to submit low reservation prices to gain reputation, thus getting higher rewards and, in turn, encouraging other users to delegate their stake to them.

Essentially, the stake reward distribution rule consists of two elements:

It boosts the reward of validators that submit low reference gas prices (during the gas survey), meaning the ones who fall within the 2/3 by stake).

It penalizes validators who don't honor the quotes that they'd submitted originally.

Remember that users know the related reference price at each epoch's start, and they can arbitrarily submit a transaction with their desired fees. If a user submits a transaction with a lower price than the reference price, ideally, only validators who are willing to process it at that price - meaning the ones who said at the epoch's start that they could process transactions at this price - will be able to execute this transaction to not incur in operating losses. This creates a gas mechanism promoting low reference gas prices since the validator is encouraged to set it down to get boosted rewards, but not too low where validators' business models become unprofitable.

For example:

Let’s say that the reference gas price is 5 $SUI. A validator who stated a gas price of 10 $SUI during the gas survey (i.e. its reservation price = the minimum declared price they’re willing to afford to process transactions) can accept transactions that require the 5 $SUI, but they’ll get slashed rewards.

Essentially, they should have declared their affordable price –their reservation price, during the survey, i.e closer to the 5 $SUI, rather than trying to be more extractrive and charge higher. Don't get smart now!

Wrapping up the above elements, we can conclude that a validator (and, in turn, delegators who staked with them) receives:

Furthermore as the above diagram showcases, $SUI is also used to pay for the Sui storage fund. This is used to shift stake rewards across time and compensate future validators for previously stored on-chain data costs. Note that the storage price is set according to the governance process, and it should usually be stable.

All in all, when a user makes a transaction, they pay:

Computation fees that accrue to stake rewards

Storage fees that accrue to storage fund

While a validator receives:

A % of the delegated staking rewards (delta) as a commission for managing delegated assets

A % of the staking rewards (gamma) that result from computation fees plus any optional coin granted by the protocol as validator subsidies (see next chapter for details)

You may notice that validators do not receive stake rewards directly from the storage fund; nevertheless, their income increases proportionally to its size (1-alpha). This guarantees that the fund never loses its capitalization and can survive indefinitely. The fund pays validators a fraction of its inflow, causing it to grow indefinitely at a rate determined by the demand for storage. If demand is high, the fund grows quickly, resulting in higher indirect earnings for validators. Conversely, if demand is low, the fund grows at a slower rate, leading to proportionally lower earnings for validators. The storage fund receives the remaining % of the staking reward (1-gamma).

So, the higher the demand for storage, the higher the rewards for validators will be. It ensures that future validators are compensated for their storage costs by the past users who created those storage requirements in the first place. Remember that storing data on-chain is a critical technology factor for the entire ecosystem; ideally, a blockchain is not designed to store large amounts of data and thus often needs to rely on a third-party storage provider not to lose efficiency. Read this article to understand how data storage could influence a blockchain’s scalability. There exist different solutions that address this kind of concern such as IPFS.

The storage fund also includes a deletion option by which users obtain a storage fee rebate whenever they delete their previously stored on-chain data. It should be noted that this is a partial refund of the storage fees paid originally and that the deletion option doesn’t mean erasing past transactions. These are immutable, as usual, for a decentralized blockchain system. The critical property of this function is that the rebate amount (outflow) is always less than the original associated storage fees previously paid (inflow). This mechanism guarantees that the storage fund is never depleted and that its size moves in line with the amount of data held in storage.

Let’s wrap up what we have learned so far:

When a user transacts, he pays storage fees leading to an increase in the storage fund (if there is a rebate, then the storage fund directly pays users).

In the same transaction, the user also pays computation fees that entirely accrue to the staking rewards basket.

Staking rewards are the sum of computation fees and optional validator subsidies coins Sui owns as a fraction of community reserve.

Delegators receive staking rewards minus management fees (that go to validators).

Validators instead receive management fees from delegators and stake rewards (gamma) proportional to the storage fund size (1-alpha).

The storage fund then receives the remaining part of the staking rewards.

Lastly, the storage fund’s presence creates relevant monetary dynamics in that higher on-chain data requirements translate into a larger storage fund, reducing the amount of $SUI in circulation. Overall, since the storage fund inflows are always greater than the outflows, the fund will constantly increase, and the demand for storage determines the speed of such an increase.

Distribution and Unlocks

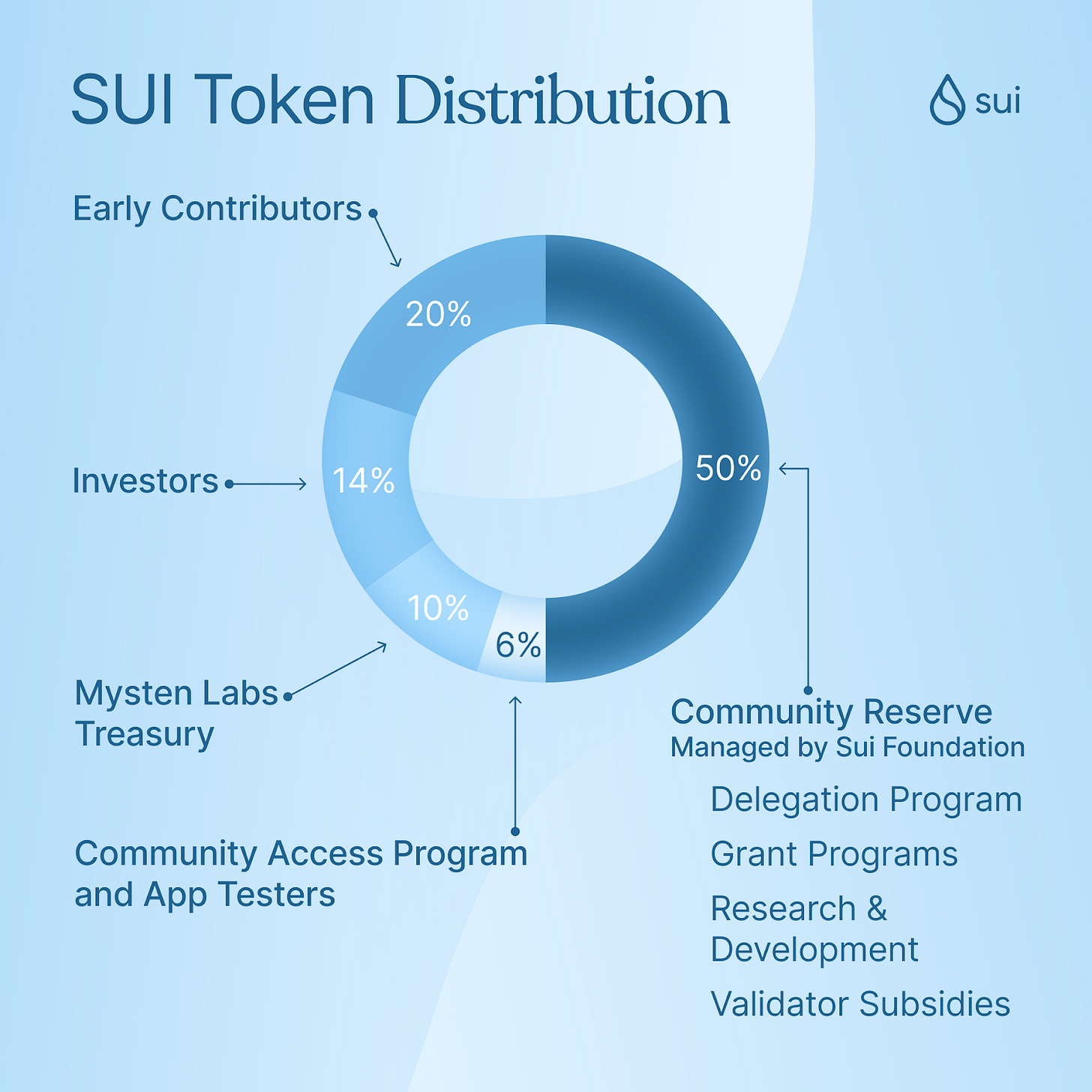

The forecasted max supply of $SUI is 10 billion, and the distribution is as follows:

The breakdown consists of:

20.00% is allocated to Early Contributors

14.00% is allocated to Investors

10.00% is allocated to Treasury

6.00% is allocated to Community Access Program and App Testers

50.00% is allocated to Community Reserve

A share of $SUI’s total supply will be liquid at the mainnet launch, with the remaining coins vesting over the coming years or distributed as future stake reward subsidies.

The Community Reserve, managed by the Sui Foundation, owns half of all $SUI coins, and they will be used across a variety of community programs:

Delegation Program → it will help bootstrap community-run validators and promote an event stake distribution across network validators by delegating its stake to aligned third parties.

Grant Program → The Foundation will distribute coins directly to developers, community ambassadors, and other participants who are building on Sui and creating the educational materials to make it easier for onboarding into Sui.

Research and Development → The Foundation will support the further advancement of the Sui protocol, ensuring its technological edge remains true even in the future.

Validator Subsidies → The Foundation has set aside substantial coins to subsidize stake rewards in the network’s early innings.

The Community Access Program lets Sui enthusiasts obtain $SUI directly without having to participate in the Foundation’s programs. These coins will also support community members who have interacted with and tested Sui Apps to help improve Sui’s ecosystem during the devnet and testnet phases. In particular, Sui recently announced that discord members registered before February 1st could access discounted coins tokens through some CEXs.

Notably, the Sui Foundation will prioritize the reward and distribution of $SUI coins to the ecosystem’s early community members.

The above pie chart contains an approximate description of the $SUI coin allocation at the Mainnet launch. However, note that the $SUI allocation is a living being that will change radically over time as the network ripens into decentralization.

Value creation and Value capture

Some of the main problems of today’s blockchain are still limiting mass adoption that wants an easy-to-use interface, low fees, and concrete use cases. Sui is trying to overcome some of them by adding value to users and facing scalability issues.

High-throughput horizontal scaling

In traditional blockchain networks, transactions are executed one by one or sequentially (vertical scaling). This would limit the scalability of the system. Contrary to other blockchain systems where every single transaction is ordered relative to each other, even fully independent transactions, Sui recognizes that many of them have no relationship with each other. So it aims to overtake other layer-1 blockchains by employing a different consensus and transaction processing mechanism. Instead of focusing on vertical scaling, Sui aims to scale horizontally immediately. Indeed, Sui can apparently execute up to 120,000 transactions per second thanks to parallel transaction execution. For reference, Ethereum can handle 7–15 transactions per second, and Visa has a 24,000 transaction-per-second processing speed.

While most smart contract platforms are built around accounts, Sui's global state consists of a collection of programmable objects with Move.

According to the technical documentation, the blockchain includes three main components:

Objects → Sui has programmable objects built and managed by Move-enabled smart contracts, also called objects.

Transactions → Any modifications and updates to the Sui ledger are described by transactions.

Validators → Independent validators manage the entire Sui network.

Sui's object-centric design lets validators execute transactions using a causal-ordering approach no matter which transaction is processed first (if they are uncorrelated).

This compelling design lets Sui parallelize the transaction processing of non-shared objects. Hence, each validator can scale horizontally and increase its transaction throughput by adding more computing power.

Once Sui enables horizontal scaling, validators can add more workers as demand for on-chain activity scales. This increases their costs linearly at the same pace as network activity and lets them process more transactions at the same low gas prices. Since computation price is equal to the reference price plus any optional tip given to the validator, in extreme network congestion where validators cannot scale fast enough, the tip’s presence provides a market-based congestion pricing mechanism that discourages further demand spikes by increasing the cost of transacting on the Sui platform.

A variety of use cases

The team is confident that providing various Sui’ SDK-based tools will enable software engineers to create DApps with improved UX (software development kit). Sui’s fast transaction finality and low-latency capacity would allow a variety of use cases:

On-chain DeFi and TradFi primitives

Reward and loyalty programs

Complex games and business logic

Asset tokenization services

Decentralized social media networks

Upgradable NFTs

It's worth noting that a user in Sui could also benefit from Sponsored transactions where an address pays gas fees on behalf of the user. This could help web2 users when entering web3, as they often have to purchase coins to perform a transaction on-chain. Sponsored transactions also facilitate asset management since users don’t need to maintain a minimum amount of coins in each account to transfer funds. A similar feature is also accomplished by the recent EIP-4337, which comprises, among others, the wallet recovery and bundle transaction functions.

Wrapping up the value created by the protocol:

Highly scalable (horizontally)

Fast transactions finality

Very cheap to transact

Multiple use cases leveraging (low-latency features)

Predictable gas fees

Rebase option

Do the incentives create a commonwealth, and are they value-aligned?

Sui’s gas pricing mechanism aims to solve fluctuation and gas fee spike problems encountered in many other blockchains and bestows users with an important monitoring role. Since users want transactions to be processed as quickly and efficiently as possible, user clients such as wallets encourage this behavior by prioritizing communication with the most responsive validators. Such efficient operations are compensated with boosted rewards relative to less responsive validators. An unresponsive validator is thus doubly exposed to the gas pricing mechanism: they lose directly through slashed rewards and indirectly through a reduced delegated stake in future epochs as stakers move their coins to more responsive validators. Such a mechanism implies value-aligned behavior by users (validators and delegators) in honoring suggested gas fees and rewarding responsive validators while penalizing the bad performers.

The $SUI coin enables the aforementioned benefits the protocol could deploy in the future and acts as a coordination element among the ecosystem's participants embedded in an exquisite and practical incentive model. More importantly, $SUI captures value in the form of staking. We can expect many coins locked out of circulation thanks to the staking program. It could be helpful to recognize that if more people interact with the platform, more fees are spent and more earnings for validators. An increased staking reward could lead to an additional coin lock, reducing circulating supply and creating further buying pressure. Lastly, the storage fund creates deflationary pressure over the $SUI coin in that increased activity leads to more storage requirements and more $SUI removed from circulation.

Ecosystem users and Demand drivers

Ecosystem users

First, let’s analyze the main stakeholders involved, their goals, and the rewards provided.

The ecosystem mainly recognizes, among the others, three key participants:

Users → they use the platform to create and transfer digital assets or communicate with Dapps powered by smart contracts.

Coin holders → delegate their coins to validators to participate in the Delegated Proof-of-Stake mechanism. Moreover, a coin holder bestows governance rights to a validator.

Validators → carry out transaction processing and execution on the platform. The Sui network keeps its security features as long as two-thirds of the total stake is allotted to honest parties.

Sui, being a very scalable and low-latency blockchain, could fit several purposes like DeFi, SocialFi, decentralized identity management, and P2E.

A general user would interact with the platform to create Dapps or use them for different reasons. Users appreciate quick transaction finality, a good UI/UX, and low fees. Besides leveraging Sui Dapps, a user can earn more $SUI by staking and delegating.

A coin holder is more of a protocol believer who desires voting rights and participates in the governance process by staking their coins. His portfolio accrues staking rewards, and his goal is to generate profit from price appreciation and also join governance discussions.

Validators put assets at stake and secure the network by validating transactions and participating in the Reference gas fee decision process. Their goal is to realize net profit considering staking rewards and operative expenses.

Demand drivers

Thanks to Sui's ability to parallelize transactions, each validator can freely scale horizontally and increase their stake by supplying more computing power.

This means that Sui can target verticals such as NFTs, gaming, messaging services, social networks, and decentralized identity platforms that heavily leverage single-writer apps and build them with web3 properties at web2 speed of execution. Thus, an expansion into different niches/verticals means the requirement of more validators which have to acquire $SUI. That is one of the main demand drivers for the protocol. Note that 30M $SUI is the minimum threshold to set up a validator node (note that this 30 M also comes from delegators, not just the validator's stake). The node is automatically removed if the validator's stake falls under 15M $SUI. However, the voting power is proportional to the staking amount, but the individual validator's voting power is capped at 1,000 (10% of the total).

Speaking about token demand drivers, $SUI is certainly desirable due to governance rights, which let validators vote on important matters about the protocol’s development, and for staking that gives the ability to users to earn more $SUI while staking their assets to secure the protocol by participating in the Delegated Proof-of-Stake consensus mechanism. Finally, reasons why a user would buy $SUI are also driven by speculative forces that find strength thanks to the team’s and investors’ recognizability.

Is the coin supposed to be held or spent?

The coin $SUI is supposed to be held since it grants owners voting rights. Furthermore, the overall staking mechanism incentivizes coin holders to earn passive yield while contributing to securing the network. Nevertheless, $SUI by design is also a medium of exchange needed to transact within the platform.

Observations / Thoughts

The variety of potential use cases can guarantee consistent user demand over time. As a result, Sui can position itself in a very crypto niche with high long-term expected capitalization.

The fee pricing model design encourages validators to operate with low gas price quotes – but not too low- or they receive slashed stake rewards. Consequently, Sui’s gas price mechanism and Delegated Proof-of-Stake system encourage healthy competition for fair prices where validators set low gas fees while operating with viable business models. In the long run, as the costs of storage fall due to technological improvements and the dollar price of $SUI evolves, governance proposals will update the storage price to reflect the new dollar target price. Sui has not yet disclosed how it intends to ensure staking rewards once the total supply reaches its maximum, but we can argue that transactions’ tips will naturally increase to compensate for them.

Mysten Labs, a team composed of former Meta engineers like Evan Cheng, Adeniyi Abiodun, Sam Blackshear, George Danezis, and Kostas Chalkias, secured backing from high-profile crypto VC funds like a16z, which invested $36 million in a Series A raise in December 2021. Another $300 million Series B announcement followed, putting the company valuation at $2 billion. Many funds support Sui, such as Jump Crypto, Binance Labs, Coinbase Ventures, and Circle ($USDC issuer). This creates a considerable expectation around the protocol's success and can be considered a project risk. On a similar note, crypto native users are not so enthusiastic about the team’s background and its former highly-centralized project flop (users bias), Diem.

Regarding direct competitors, Aptos and Sui share many similarities, such as the founders of both blockchains came from Meta and use the Move programming language. Aptos uses the core Move's global storage, while Sui uses its own. Moreover, Aptos does not have a concept of resources or objects owning other resources, instead, it uses an address-centric model like Ethereum. Any Sui address can own an unlimited number of the same type of resource. Sui reportedly handles 120,000 transactions per second, while Aptos can supposedly handle 160,000. However, this number fell dramatically at the mainnet launch, it remains to be seen if the same will happen with Sui. Due to its scalable design, Sui, among others like Polkadot, Solana, and Cardano, is a perfect candidate for the Ethereum killer narrative. During 2023 Ethereum will probably upgrade its protocol to reach scalability thanks to a new parallelization framework called Sharding. The time to market will also be a pivotal aspect to consider when evaluating Sui.

The current roadmap will gradually introduce stress-test features and mechanisms required for a production-ready mainnet. The purpose of the testnet will be to validate designs, validate validators, full nodes, wallets, developer toolchains, and gain operational experience. It is organized in waves mainly based on network development and staking functionalities.

Also, note that Sui shares the same layer-1 blockchain criticalities regarding security. Indeed, Sui maintains all its security properties if over 2/3 of the stake is assigned to validators that follow the protocol. However, many auditing properties are maintained even if more validators are faulty.

The protocol has other technical limitations to take into account in light of its intrinsic design and the use of a new and not yet stress-tested programming language. Refer to this article to know what these limitations are.

Summary

The Sui blockchain seems to have a lot of potential, and many blockchain proponents seem to approve of its technological features, development approach, and goals. It is also true that Sui will have to compete fiercely with other blockchains and continuously develop its ecosystem if it hopes to gain wider popularity.

Its ecosystem is growing rapidly and already counts of numerous applications such as Ocean DEX, a hybrid central limit order book and automated market maker decentralized exchange, Sui Name Service (SuiNS) a decentralized identity provider analogous to ENS on Ethereum, and Ethos a web3 self-custodial wallet service for Sui.

Given the designed PoS system, a large portion of total supply is expected to be locked out of circulation reducing selling pressure to the coin, and since the supply is finite, increased network activity will significantly increase demand for the coin. Sui's incentive mechanism anchors stakeholders' behaviors to the protocol's objective functions that aim to create a general commonwealth and push users toward value-aligned activities.

Finally, Sui’s low-latency and transaction finality makes it a valuable candidate for many on-chain use cases, pushing out the potential adoption to its boundaries.

As promised, I showed in the article the main Sui's functions and why it is different with respect to competitors. Now you have proper knowledge of the protocol and can autonomously play with it.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Feedback and Collaboration

Interested in having your protocol reviewed by Tokenomics DAO or want to collaborate on an article? Feel free to reach out via email here. Feel free to join the Tokenomics DAO discord if you want to learn more about tokenomics.

If you’re interested in the condensed, need-to-know tokenomics information for Sui including all the resources used for this article, check out the report on Tokenomics Hub