Tokenomics 101: Streamr Network $DATA

Examining the Tokenomics of the Decentralized Real-time Data Network

Introduction

As the world continues to digitize, data has emerged as a valuable commodity, being collected, stored, and traded at an extraordinary rate. While social media platforms already earn billions of dollars by utilizing their user’s data to earn advertising fees (ca. $190bn in 2022), the Internet of Things (IoT) has given rise to countless connected devices that generate and transmit data constantly. With an estimated 75.4 billion IoT devices to be active by 2025 (an increase of ca. 245% since 2020), the sheer volume of data generated is staggering, with the potential to revolutionize the way we live and work.

Simultaneously, there is a megatrend towards distributed and decentralized data storage and distribution. This trend is primarily driven by the need to eliminate inefficient data silos and single points of failure. Conventional methods of storing and distributing data have several drawbacks, including a lack of resilience, susceptibility to cyberattacks, and concentration of power in a single entity (comp. Streamr Whitepaper). However, emerging decentralized storage systems like Filecoin, Arweave, and Storj, while being beneficial, are not suited for transmitting high volumes of real-time data due to their design.

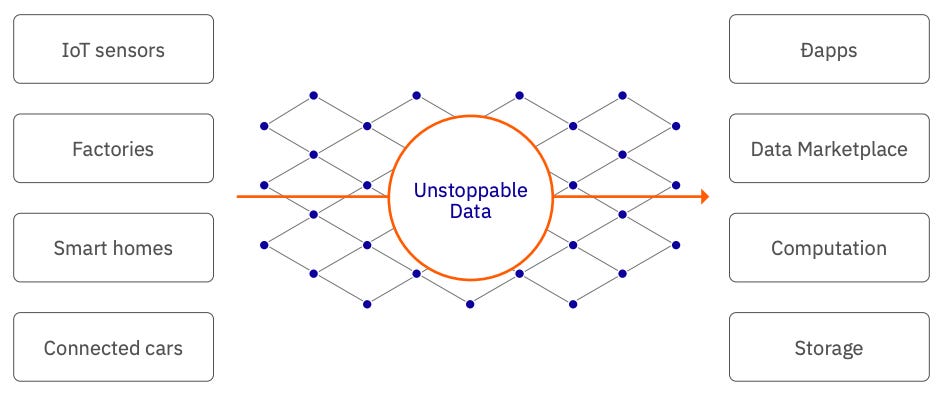

Unstoppable data to unstoppable applications

This is where Streamr comes in - a decentralized network of thousands of globally distributed nodes that provides scalable, low-latency, and tamper-proof data delivery. The Streamr network enables anyone to monetize their data in a decentralized and permissionless manner while providing reliable and secure data streams for applications, such as dApps, that rely on them.

This article delves into the integration of the $DATA token into the Streamr network, how different user groups interact with the token, and the sources of its value. It aims to provide an in-depth exploration of the $DATA token and its role within the Streamr ecosystem.

To better comprehend the Tokenomics of Streamr, it's helpful to have a basic understanding of a relay network. Therefore, here is a brief explanation of what a relay network is:

A relay network is a communication system that uses intermediate nodes (relays) to transmit information between two or more endpoints that are not directly connected. Each relay receives the transmitted data and retransmits it to the next relay until it reaches the destination. This technique can be used to extend the range of wireless networks, to provide redundancy in case of network failures, or to improve network performance by reducing interference and congestion. Relay networks are commonly used in wireless sensor networks, mobile ad hoc networks, and satellite communication systems.

Tokenomics

(A zoomable version of the diagram can be found here)

The Streamr Network is composed of five user groups that perform distinct roles and interact with the $DATA token in various ways. Let's take a closer look at each group and explore how they utilize $DATA within the network:

If you’re interested in the condensed, need-to-know tokenomics information for Streamr including all the resources used for this article, check out the report on Tokenomics Hub.

(In advance as an additional resource, Streamr has created an animated video explaining the participants and their workflows within the network which I consider very helpful)

Publishers and Subscribers

Firstly, to begin, there must be an entity responsible for collecting real-time data. This entity, referred to as the Publisher, can gather a diverse range of data, including off-chain and on-chain data, weather data, gas prices, and more. The data is fed into the Streamr network via a Node deployed by the Publisher. Publishing Data Streams is a permissionless process and does not require staking $DATA. The only cost associated with it is the gas fee. Data Consumers, also called Subscribers, can then subscribe to the data stream and pay the fee set by the Publisher. The Publisher can choose to offer data streams for free or require payment in $DATA or any other currency of the Publisher’s choice.

Sponsors

Publishers can enhance the quality of their data stream in terms of reliability, robustness, and security by incentivizing nodes to perform better. They do this by creating a Bounty, a reward pool filled with $DATA for the desired data stream that can be mined by nodes over a pre-defined period. These mining nodes, referred to as Brokers, are primarily interested in farming the Bounty and not in the data itself. It's worth noting that the entity creating a Bounty for a particular data stream is referred to as a Sponsor. Sponsors can also be the Publisher of the data stream, a charity, or any other organization that aims to improve the data stream's quality.

Brokers

Brokers keep a constant lookout for available Bounties on the Streamr network and can stake $DATA on them to mine the Bounty. By staking $DATA, the Broker subscribes to the stream and commits to transmitting the data stream with high quality over the agreed time period. If the Broker delivers on this commitment, they can claim the mining rewards after the agreed period proportionally to their stake compared to the total $DATA staked on the Bounty.

This section made apparent that one function (i.e., Utility) of $DATA is that of being the Medium of Exchange (MoE) within the Streamr network. This is because Sponsors must use $DATA to pay Brokers for their services (enhancing the performance of the data streams), while Subscribers (or better said Data Consumers) can pay $DATA to access data streams.

Delegators

Additionally, Delegators can finance Brokers by delegating $DATA to them, allowing them to earn passive income in return. Delegators do not mine Bounties themselves, but by delegating tokens to the Broker, the Broker can increase their $DATA stake on Bounties using the Delegator's tokens and share the rewards with them.

It's worth noting that the Streamr protocol itself does not (yet) generate any revenue. Instead, it's the network participants like publishers, brokers, and delegators who earn revenue from their activities within the Streamr network.

Finally, there is the Data Fund (part of the allocation “Held by Streamr”), a grant program established by Streamr to encourage projects that advance the concept of a decentralized data economy. Recipients can receive up to $50,000 worth of $DATA, and the fund has a total allocation of 10 million $DATA for awarding grants. Although the Data Fund is not an essential component for the operation of the Streamr network, it adds value by bootstrapping activity on the network.

Distribution and Unlocks

Please note: The details surrounding the allocation and distribution of $DATA are extremely scattered, unclear, and, in many cases, nonexistent. I spent hours sifting through their Discord channel, Snapshot and forums in search of information.

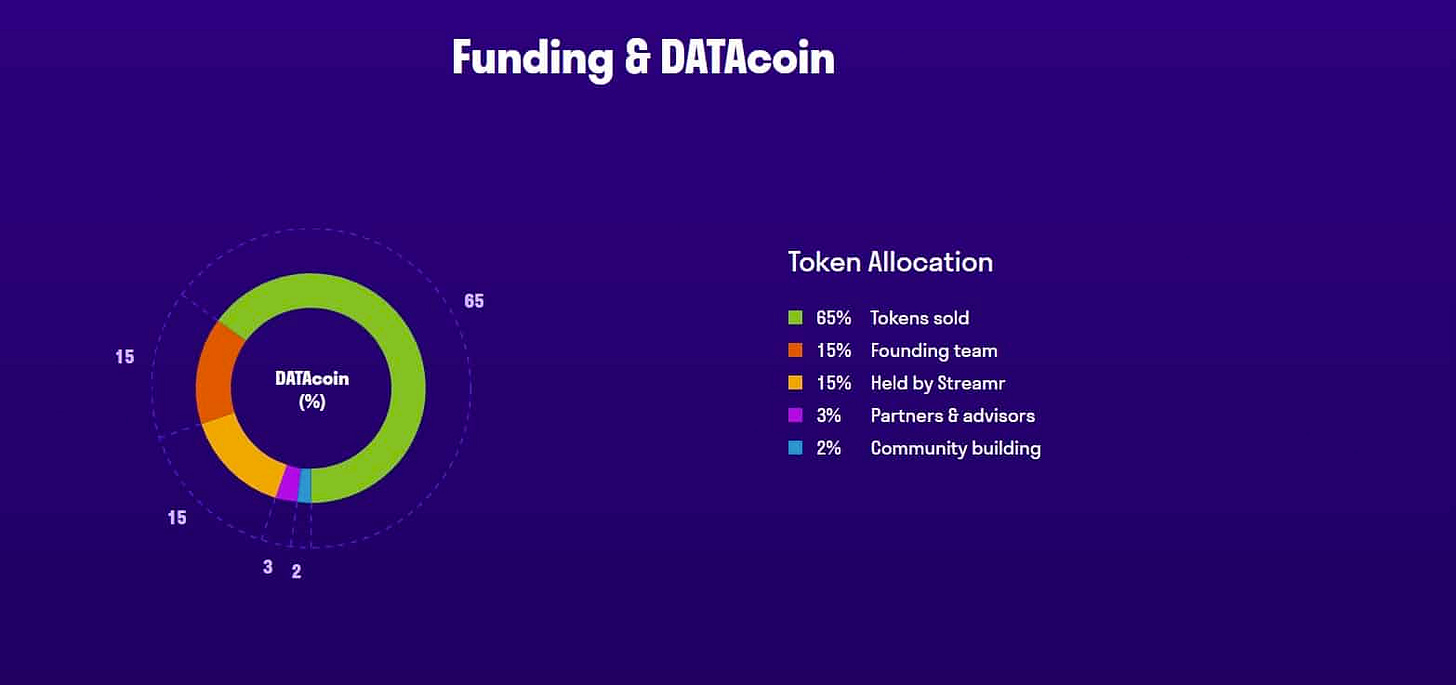

Based on data provided on Streamr’s ICO drops profile, the initial distribution of 1B $DATA in 2017 was as follows:

Token Sale: 65% (This was also confirmed in Streamr’s ICO Announcement Article)

Founding Team: 15%

Treasury: 15%

Partners & Advisors: 3%

Community Building: 2%

However, at the beginning of 2021, Streamr decided with the SIP-1 proposal to conduct a migration of the $DATA token to double the hardcap of $DATA from 1B to 2B. Streamr's decision to increase the hardcap provided them with the flexibility to sell more tokens over the counter (OTC) to VCs in the future, which would help secure further funding. In addition, the increased token supply could also be used to incentivize network participants in various activities, such as voting on governance proposals or “incentivizing the long-term maintenance and development of the Streamr codebase” (SIP-1 proposal). The main objective of doubling the hardcap was to avoid the need for future migrations as they require significant effort from the team to communicate with all the relevant parties involved.

It is worth noting that the creation of any new tokens, and subsequently increasing the circulating supply, requires a separate governance proposal that clearly defines the quantity and intended use of the tokens. In addition, token holders must vote on the proposal, and tokens can only be minted if the proposal is approved, as stated in the SIP-1 proposal.

In summary, the allocation and release of additional $DATA tokens are subject to the governance proposals put forth by the Streamr community. The community's involvement in the decision-making process is essential in determining how the tokens are utilized and distributed, ensuring that resources are allocated to initiatives that align with the community's goals and priorities.

To provide context on previous proposals, below are some significant Snapshot proposals that impacted the token supply:

SIP-1 (February 2021): “Double the hard-coded maximum supply from 1 to 2 billion DATA.”

SIP-5 (May 2021): Authorizing the minting of 2M $DATA as rewards for testnet participants

SIP-6 (May 2021): Authorizing the minting of 100M $DATA, which can be sold to VCs at a maximum market discount rate of 20%.

SIP-9 (November 2022): Allocate the 100M $DATA from SIP-6 to create a project treasury intended for post-roadmap expenses, due to unfavorable market conditions.

Value creation and Value capture

Streamr enables data owners to monetize their data in a secure and decentralized manner. The relay network of Streamr - together with incentives paid by Sponsors - enhances the quality of data streams and aims to eliminate single points of failure, which is particularly beneficial for decentralized applications (dApps) that require reliable and uninterrupted functionality. Decentralized data streams from Streamr enable dApps to operate independently, thus creating value through the exchange of real-time data.

The $DATA token functions as the Medium of Exchange (MoE) within the Streamr network, enabling in some way the capture of the value the network generates, assuming a balanced demand and supply. While charging fees are a common method of value capture, Streamr captures value through the use of $DATA as the MoE, and no fees are currently charged. As the network grows and the number of transactions increases, the token's value is expected to increase as well.

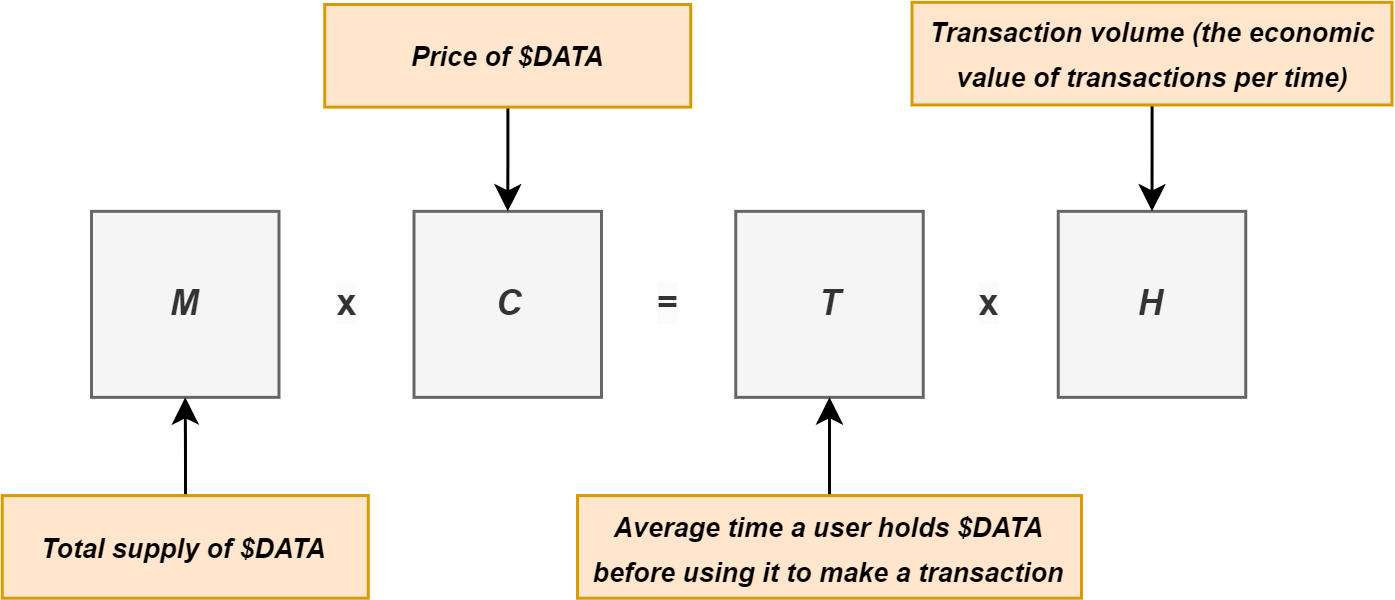

Vitalik's version of the Equation of Exchange helps to understand the value capture.

The Equation of Exchange basically says that the total amount of money (or tokens) exchanged in an economy will always equal the total monetary value (or total value in tokens) of the goods and services exchanged in an economy.

Without delving too deeply into the equation, which is beyond the scope of this article (for more information, please refer to the linked resources above), the formula is:

Solving the equation for C results in:

An increase in transaction volume T and/or a decrease in velocity (increase in holding time H) should lead to an increase in the price C of $DATA, according to basic math principles. Without considering factors that are outside of the Streamr network, such as speculation, market sentiment and even the value of participating in the governance, this formula provides an understanding of the potential appreciation or depreciation of the value of the $DATA token.

Furthermore, participants in the network, particularly Brokers and Delegators and to some extent Publishers, capture the value of their services directly by earning $DATA for the services they provide. However, there is no indication of any other means of direct value capture to the protocol itself. The value capture is comparable to that of Ethereum and other public, permissionless blockchain networks, where network participants (Nodes) are the ones who capture the value they generate, rather than the protocol as an entity itself.

For a better understanding of the concept of Value Capture in Web3, read this.

Demand Drivers

The main incentive to buy and hold the $DATA token comes from Sponsors, Brokers and Delegators: Sponsors have to fund Bounties in $DATA to increase the performance of the data streams of Publishers. Brokers on the other hand have to stake $DATA on said Bounties to mine the rewards and finally, Delegators can delegate tokens to Brokers to receive a proportional reward in $DATA. This demand driver helps reduce the velocity of the token, leading to a potential increase in its price based on the formula mentioned earlier.

Another reason to buy the token, but not necessarily to hold it, is its utility to pay for specific data streams that require a $DATA payment to subscribe. This demand driver primarily targets Subscribers or data consumers. This demand driver can also positively impact the price of $DATA by increasing the transactional volume, leading to a potential price increase using the formula mentioned earlier. A noteworthy point is that this demand driver can be increased by making all paid data streams payable in $DATA and not in any type of tokens chosen by the Publisher, which is how the system currently works.

Furthermore, there exists a modest demand driver for taking part in Streamr's governance. Owning $DATA tokens grants users the power to vote and potentially impact decisions regarding the network's functioning, particularly concerning the $DATA supply.

Observations/Thoughts

MoE Tokens Do Not Always Create Value

The value added to the network by the $DATA token is a matter of debate. Medium of Exchange tokens are often replaceable by tokens explicitly designed for that purpose, such as USDC, BUSD, and other leading stablecoins. Currently, Sponsors can only create Bounties by using $DATA tokens. However, Brokers who mine the Bounty would prefer to be compensated with a less volatile asset, such as USDC, which they could use more likely to cover cost of expenses (aka pay their bills). Furthermore, there is a higher likelihood of Brokers selling $DATA they mine due to this reason. Technically, the full incentivization mechanism of staking $DATA and mining $DATA can be achieved with existing stablecoins, e.g., Sponsors funding Bounties with USDC and Brokers earning USDC from mining the Bounty.

This problem is not unique to the $DATA token; other tokens, such as $SAND and $MANA, the native tokens of Sandbox and Decentraland, the most established Metaverses, face similar challenges. Rather than using USDC or another stablecoin to buy assets on their marketplaces, users must first purchase the corresponding token and then pay for their purchases in SAND or MANA, respectively. This approach creates an unnecessary obstacle for new users and does not solve any issues. It would be highly inefficient and inconvenient to have to purchase a different currency for each store you shop at in your local economy, right?

It is crucial to acknowledge that while $DATA's role as a medium of exchange may be replaceable, there are several other utilities that make $DATA unique and not easily replaceable by other tokens. For instance, $DATA offers governance features that are a crucial part of its supply strategy. Additionally, Streamr can leverage the sale of $DATA to venture capitalists to acquire funding for their operations.

The token could become more appealing by introducing a fee-sharing mechanism whereby a fee is charged wherever value is created, be it through the earning capabilities of Publishers, Brokers, and Delegators or the reliable, secure, and robust data streams provided to Subscribers. This fee could be either burned or distributed to token stakers. Such a mechanism would decrease token velocity by providing an additional incentive for token holders to hold onto their tokens, furthermore if fees are denominated in other tokens as per the Publishers choice when charging for a data stream, Brokers who capture this fee would have less necessity to sell their DATA to cover cost of expenses, thus sell pressure on $DATA could be reduced.

Publishers Are Still Susceptible to Single Points of Failure

While Streamr is making significant contributions towards a decentralized and effective data economy, there is still a concern about a single point of failure if the data publisher goes offline or becomes victim of a cyberattack. Streamr is aware of this problem and introduced Data Unions, where multiple publishers of similar data can join forces to publish and manage data streams collaboratively. In a data union, if one publisher leaves the network, the data stream can still operate because the remaining publishers can continue to supply data.

Summary

Data has become a valuable commodity in the digital world, and with the rise of the Internet of Things, the amount of data generated, as well as the amount of data being to be distributed, is only going to increase. Streamr is a decentralized network of globally distributed nodes that provide scalable, low-latency, and tamper-proof data delivery, enabling anyone to monetize their data in a decentralized and permissionless manner while providing reliable and secure data streams for applications that rely on them.

The Streamr network is composed of five user groups that perform distinct roles and interact with the $DATA token in various ways, including Publishers and Subscribers, Sponsors, Brokers, and Delegators.

$DATA is used as a Medium of Exchange (MoE) within the Streamr network for subscribing to data streams but mainly for paying Brokers for transmitting data streams with high quality. Delegators can delegate $DATA to Brokers to earn passive income without the need to run a node themselves.

Additionally, $DATA holders can participate in the governance of the protocol, in particular, to decide about the further allocation and distribution of $DATA into the circulating supply.

The Streamr token model provides a solid base for network scalability and is deemed robust. Serving as a Medium of Exchange Token mainly between the Sponsors and Delegators, $DATA is projected to appreciate in value as the network expands. This expansion includes an increase in published Data Streams, a rise in subscribing Data Consumers, and a surge in Sponsors who fund and encourage high-quality data streams. As per the Equation of Exchange, the transaction volume will rise with the aforementioned activities, which is a crucial factor impacting the price of $DATA.

Feedback and Collaboration

Interested in having your protocol reviewed by Tokenomics DAO or want to collaborate on an article? Feel free to reach out via email here.

If you’re interested in the condensed, need-to-know tokenomics information for Streamr including all the resources used for this article, check out the report on Tokenomics Hub.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Great write-up of a very complex system. I feel like Streamr did not do us any favors in terms of the names and jargon they use to describe the roles and flows of their token economy. Thank you for bringing in real world examples to help us understand this better