Tokenomics 101: The Sandbox

web3 competitor of Minecraft and Roblox, medium of exchange token with lack of hold-ability

What is the metaverse? Some say it’s the futuristic game world in which people fully escape from their real life (aka Ready Player One), some think it’s Facebook's Meta, including the comicky characters, others might see it as normal games as we know them but with ownership of assets.

The Sandbox seems to tackle the latter aspect of the metaverse, by letting people design, build and own parts of the game.

The voxel based architecture that has become very popular in games such as Roblox and Minecraft, is a great way to allow users to create content. The problem with traditional games is that people spend a lot of time creating game content but don’t have great ways to monetize their creation.

Let’s take two identical games. One that lets you own and monetize your creations and one that doesn’t (or does limited). All else equal, it seems users would choose the one that lets them own and sell assets. With that in mind, I think it will only be a matter of time until games generally incorporate ownership of assets.

The Sandbox establishes the technology and then lets players and creators use it as a platform. All they need to do as a platform is kickstart the ecosystem, improve the infrastructure and collect fees.

Tokenomics

The Sandbox uses the ERC20 token $SAND as medium of exchange for all in-game transactions. It has a bunch of other NFT tokens such as Land, Assets, Gems and Catalysts, which are all part of the ecosystem.

Aside from being a medium of exchange, SAND is used for governance and ‘staking’:

The total supply of $SAND is 3 billion and the total number of LAND 166,464.

The below diagram shows how the token flows and is used within The Sandbox. Find a zoomable version of the diagram here.

The Sandbox

Core of The Sandbox are games and activities on an open map. Players can download a client for free, configure an avatar and enter one of the many games from a map. Games could be quests, monsters to slay or races to race. There are no real limits - a set of tools allow anyone to get creative and design.

The interesting part is how it all connects. Gaming company Atari decided to purchase a piece of land and build a game. The Land itself is an NFT and the game, once designed, needs that Land to be deployed on. The Land and the game can then use a multitude of other NFTs called Assets to build out the experience. The owner of the Land decides all of this and might choose to charge for the game or pay players to play (this is planned).

All transactions; buying land, buying assets for the game or even entering a game, require the $SAND token.

Sandbox Tools

Here is where the voxel architecture kicks into gear (if you like the block-looking design that is) and turns The Sandbox into a platform. The simple block-looking design makes it easier for everyone to build and is a tradeoff between gamestudio-designed high end games and player-designed games.

Anyone can download the Voxel Asset Editor and start designing assets. Assets are in-game characters, wearables, equipment for characters, art or pieces of the game world.

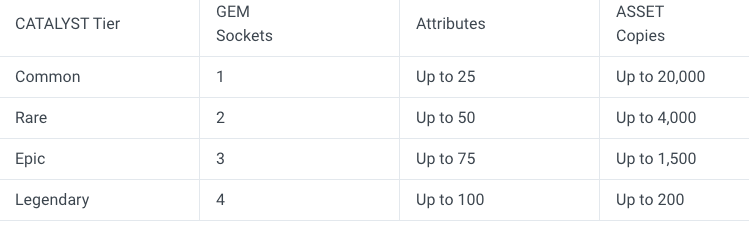

Once designed, Assets can be sold on the market or used in games. An asset is minted with a number of copies defined by Catalysts and Gems. Gems define attributes that can be used to set the stats of an asset, making them more useful and can be earned by staking $SAND. Gem NFTs are burned upon adding them to an Asset. The Sandbox is not very clear on how Catalysts can be obtained, but they likely will be scarce and require some sort of activity.

Each copy is sold individually and can be assigned to only one land at a time.

The second tool is the Game Maker. It allows creators to combine Assets with game logic and create experiences for players. One does not require Land to start designing a game, but in order to deploy the game, Land either needs to be bought or rented.

Sandbox Market

Land, Gems, Catalysts and Assets are primarily traded on the Sandbox Market, using the $SAND token. The Sandbox collects a 5% fee on all transactions on the market. Since all tokens are ERC tokens on the Ethereum network (soon Polygon), they can also be sold on secondary markets such as Opensea, where The Sandbox collects a 5% royalty fee.

Foundation

50% of the 5% transaction fee and fees from Land sales, premium NFT sales and subscription service accrue to the foundation. The foundation is tasked to govern over these funds and stimulate growth of the ecosystem by issuing $SAND grants for game makers and creators to build out the metaverse platform. The other 50% goes to stakers.

Governance over the foundation is mentioned in the help docs, but seems to be a concept not fully implemented yet. Messari has some thoughts on this and mentioned that $SAND allocated to the foundation will be governed by $SAND holders in the future.

Distribution and Unlocks

3 billion $SAND tokens have been minted and allocated as shown in the table below on August 13 2020 and will be fully unlocked (vested) by 2025.

The release schedule of tokens shows a 10% increase in circulating supply every ~ 6 months. At the time of writing (November 2022), the fully diluted market cap is roughly double the size of the market cap, meaning that 50% of supply is yet to be unlocked and will require demand in the coming years.

23% of tokens or 705 million were released at launch (TGE/genesis), which gave the project a decent circulating supply to start with.

In terms of funding, The Sandbox raised ~ 7 million USD in three rounds prior to launching the token and launched at a market cap of ~ 33 million USD which comes to a funding-valuation-ratio of 4.6. From Coingecko:

Value creation and value capture

Value creation clearly comes from providing the tools, infrastructure and funding to kickstart this gaming ecosystem. It gives users a similar platform as those of Roblox and Minecraft but expands their rights with ownership and monetization options. The web3 playbook applied to games.

The Sandbox whitepaper (section 3.8) has a good breakdown of the benefits it sees itself having compared to game platforms without blockchain assets.

Tools + ownership should enable users to create a great deal of value. A whole economy emerges, in which The Sandbox itself doesn’t have to build games but instead leaves it to other parties while focussing on the infrastructure. It becomes an open market environment in which those who see an opportunity can build and offer a great game and profit from it, if it fulfils the needs of players (to play an exciting, interesting game).

How is the value captured within the $SAND token?

The transaction fee partially goes to stakers (i.e. those who have tokens can collect more of them). The fee distributed should increase with transaction volume.

The second part of the transaction fee goes to the foundation, which will grant $SAND to projects that build new games and create assets etc. All of this should help make the game more attractive for players, increase the transaction volume and demand for $SAND to be used as medium of exchange.

Once governance is implemented, the value capture should improve a lot as SAND holders govern over part of the revenue.

Overall it’s a very generic value capture mechanism. The more great games, the more players will join and transact with $SAND. The steady demand to pay for transactions could then capture the value of the growing ecosystem.

There is one problem though. $SAND is a medium of exchange token with little real utility other than spending it. Tokens like these typically have a high velocity, meaning they are transacted frequently and NOT held. People buy them only when they need to transact and if there is no good reason for them to hold them, then they likely won’t. This piece analyses the same problem for ChainLink, referring to it as a spending token.

Many others have observed the problem with medium of exchange type tokens and the common remedy is to implement a reason to hold, such as sinks, profit share or a lockup of some sort.

Giving 50% of transaction fees to stakers might be a good start, but staking where the yield is paid in the same currency as the staked asset, doesn’t really create a strong demand as stakers will likely sell the yield for profit.

The price of SAND doesn’t seem to matter much in this equation as people likely account in USD anyway, meaning that when SAND goes up in price, the number of SAND tokens charged for an asset would go down to keep the USD price relatively stable.

Demand Drivers

What then, makes people buy the token? I see a few groups. The main driver for demand aside from speculation on the growth of metaverse style games, comes from staking.

Staking in itself is quite boring, but when $SAND is staked together with Land, it earns Gems and Catalysts (Collecting Catalysts is not fully defined yet). These are core parts of The Sandbox as they allow creators of Assets to define their scarcity. Scarcity has a lot to do with demand. People love status symbols, the rarer the better. Think Rolex, Lambos, Bored Apes and Punks.

As the monthly active user base (MAU) grows, there will be more demand for games that can be played, Assets to be bought and with that probably also an increasing demand for Gems and Catalysts to make Assets scarce.

More users would also lead to an increased demand to transact but due to the velocity problem above, might not have a strong impact on the token price. When users transact on the market, the buyer buys the token prior to transacting and the seller sells it afterwards. The demand created here is quite temporary and might not balance out the supply from sellers cashing in on what they made by selling Assets for $SAND.

A high velocity however, should create a lot of transactions and by that the transaction fee seems to be a great mechanism. More transactions, more fees. Fees are collected on the primary market and as royalties from secondary markets such as Opensea. The transaction fee revenue is shown below:

Closing thoughts

I really like the concept of The Sandbox. With the easy to use and well known voxel architecture, it allows everyone to create content and taps into the enormous pool of Roblox and Minecraft players. Ownership alone however won’t be able to attract all players and so gameplay and experience will be the biggest success criteria.

Designing the token as a medium of exchange token has its benefits; more fees with rising transaction volume, but the downside is the lack of a real reason to hold the token. Both design aspects sort of contradict each other. If the hold-side is too strong, it could decrease transaction volume and vice versa. Why spend when the incentive to hold is so strong. It will be interesting to see how the team handles this in the future.

I also see an issue with Land. The largest profit is made on the initial sale. From then on, The Sandbox only collects a fee when a Land changes hands. What this doesn’t do, is incentivise landholders to build out the land. They could just hold it for speculation, which perhaps benefits the holder, but is detrimental to the game - empty Land is unrealised potential. Governments around the world have implemented a land-value-tax to solve this problem and it might be something for The Sandbox to consider in the future.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.