Tokenomics 101: Redacted Cartel ($BTRFLY)

Decentralized cash cow encompassing all things ve related

TL;DR

Check out our summary on the Tokenomics Hub

Introduction

The Curve Wars are a never-ending fight to gain control over which liquidity pool on Curve – the leading AMM for stablecoins – receives $CRV emissions. By receiving $CRV emissions, a pool is able to deepen its liquidity.

When protocols or DAOs need liquidity, they will often bribe $veCRV or $vlCVX – in any token/coin – to direct $CRV emissions to their desired pool.

Many DAOs have realized the opportunity at hand to either deepen their token’s liquidity on Curve, or accrue value by accepting bribes. Accordingly, they have started accumulating and locking massive amounts of $CRV and $CVX.

Redacted Cartel was no exception. The cartel used the mechanism of bonds(issuing $BTRFLY at a premium in exchange for other governance tokens) to accumulate and lock $CVX and other ve tokens for a stake in the respective protocols’ governance system. This was, initially, the core focus of the nascent OlympusDAO fork.

As the bear market started to form and OHM forks were wearing off, Redacted Cartel bid farewell to the unsustainable hyper-inflationary tokenomics and strived to re-engineer the protocol with its second version that fully encompassed the concept of meta governance. This time, it would distribute real yield to tokenholders using its impressive treasury and through its core products, while creating sustainable flywheels that contributed to the long term success of the protocol.

Tokenomics

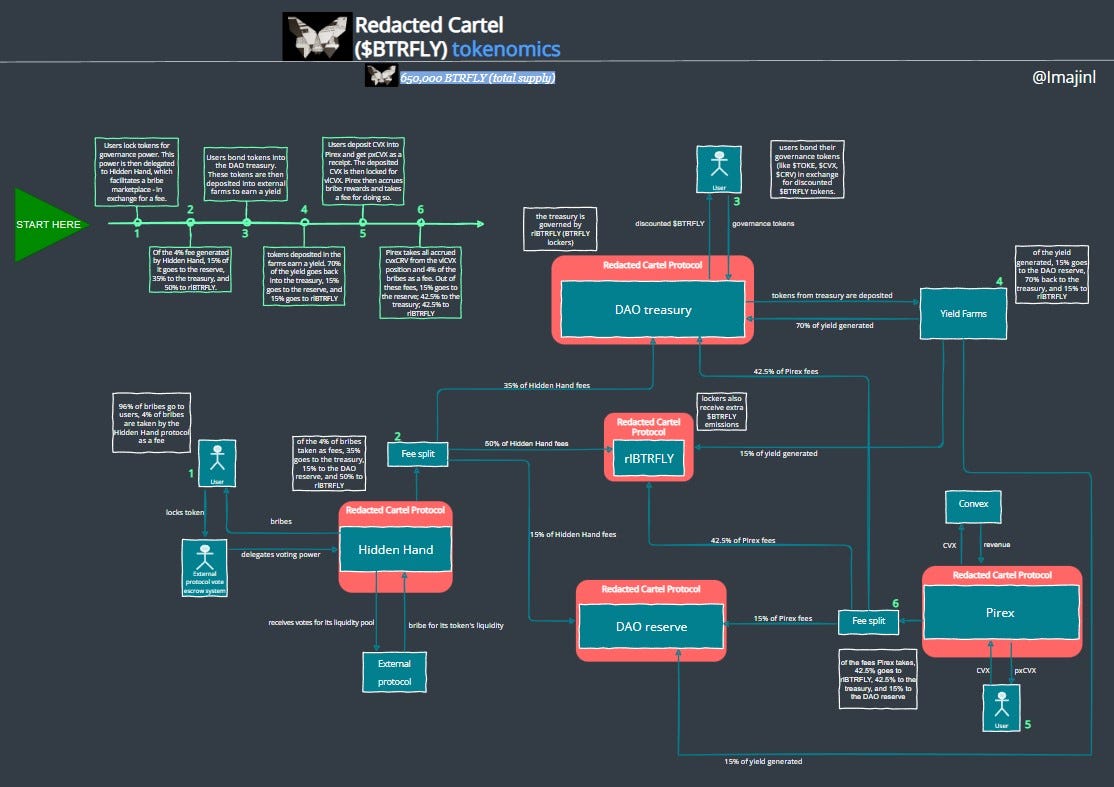

A zoomable, high resolution tokenomics diagram can be found here.

Redacted Protocol: Hidden Hand

The Hidden Hand is one of the cartel’s core products, and aims to be a liquid proxy for any vote-escrow (ve) token protocol. It is essentially a bribe marketplace where external protocols can place their bribes (in any token) in exchange for governance votes that direct liquidity to their desired liquidity pool. Users with governance power in the respective protocol can vote for any pool they want and receive the bribes placed on that pool proportionally. Users can also choose to have the Hidden Hand protocol use an algorithm to figure out the best way for them to vote in order to get the most bribes.

For every bribe that is placed on the platform, a 4% fee is taken and distributed as follows: 35% to the DAO treasury, 15% to the DAO reserve, and 50% to rlBTRFLY ($BTRFLY lockers). Hidden Hand currently facilitates a bribe marketplace for some of the biggest ve token protocols; Frax, Tokemak, Ribbon, and Balancer are among them.

Redacted Protocol: Pirex

Another one of the cartel’s main products is Pirex. It aims to create liquid wrappers of ve tokens (or other locked tokens) that come with a multitude of benefits. Apart from the ability to trade these wrapper tokens, users benefit from auto-compounding of rewards, unionizing of gas fees, and additional utility in DeFi (lending and borrowing, futures, etc). These benefits leverage capital-efficiency and allow for smaller retail users to cut down on gas costs and have a hands-off exposure to yielding DeFi assets. But, as with any dApp, smart contract risk is the biggest downside to using a protocol like Pirex.

Pirex’s first product is built around vote-locked CVX (vlCVX). The protocol has introduced a wrapper for vlCVX called pxCVX; the wrapper token is minted proportionate to the CVX deposited into the protocol, hence ensuring all pxCVX is 1:1 backed by vlCVX. The deposited CVX is then locked on Convex Finance, and the pool(s) with the highest bribes (ROI) are voted on, allowing bribe revenue to accumulate and be claimed by pxCVX holders every two weeks. Pirex takes 4% of the accumulated bribe revenue and the additional platform fees that vlCVX positions receive on Convex as fees for providing the service. Out of these fees, 42.5% goes to the DAO treasury, 15% goes to the DAO reserve, and the rest (42.5%) goes to rlBTRFLY.

In partnership with Llama Airforce, Pirex has also been able to develop uCVX, an auto-compounding vault for their pxCVX token. This will allow the accumulated bribe revenue to be automatically converted into more pxCVX, in other words, auto-compounding accrued rewards in order to earn more rewards. However, this comes at a cost. 7% of the accrued bribes is taken as a fee, along with a 1.5% exit tax that goes to all uCVX holders. It is important to note that the fees taken from uCVX vaults do not go to Pirex, but rather to Llama Airforce. However, adding this utility for pxCVX users is important as it allows pxCVX to generate increased revenue from fees – even if users only utilize the uCVX vault.

Redacted Protocol: DAO Treasury

The DAO has amassed a massive treasury since its inception. Some claim it is one of the most influential treasuries in DeFi; take a look for yourself.

source

As you can see, it currently ranks #4 in total DAO $CVX holdings. The rest of its $25MM treasury comprises other governance tokens such as $OHM, $TOKE, $CRV, $FXS, and most importantly, its own liquidity!

What sets this DAO’s treasury apart from the others is the fact that it owns its own token’s liquidity, around 70% of it. This is especially important since there won't be any need for a capital-intensive liquidity mining program in the future and the existing liquidity for the $BTRFLY token is permanent.

Redacted Protocol: DAO Reservce

To ensure there are always enough funds to build out the protocol and cover operational costs, 15% of the $BTRFLY supply and 15% of all protocol revenue will stream to the DAO reserve.

The DAO reserve will use its funds to cover the following:

-Team Compensation

-Audits/Bug Bounties

-Marketing Materials/Conferences

Redacted Protocol: rlBTRFLY

$BTRFLY is the protocol’s native token. The locked version of this token, revenue locked BTRFLY (rlBTRFLY), is the value accrual and governance token of the protocol. It accrues value from Redacted Cartel’s core products and the treasury’s productive assets.

Users can lock $BTRFLY tokens for 16 weeks (4 months) and earn a share of the revenue generated every 2 weeks, in $ETH tokens. Below are the revenue streams that they will have a share in:

-42.5% of Pirex revenue

-50% of Hidden Hand revenue

-15% of the yield generated by the treasury

Distribution and Unlocks

The total supply of $BTRFLY is 650,000 tokens. Of these tokens, 146,000 are currently in circulation. Below you can find the emission plan for $BTRFLY tokens over the next 10 years (emissions started on the 9th of August).

The emission plan includes a four-year "high growth" period to continue bootstrapping the protocol during this crucial phase of its development. After this time of rapid expansion, there will be a six-year phase of "low growth", during which tail emissions will continue to fund the cartel’s projects. Revenue generated by the protocol, however, will always be the primary driver of growth.

The allocation, vesting, and unlocks of these emissions are as follows:

-6% of the total supply (39k tokens) is allocated to investors

-9% of the total supply (58.5k tokens) is allocated to the founding team

-10% of the total supply (65k tokens) is allocated to OlympusDAO, since Redacted was initially an Olympyus subDAO

-15% of the total supply (97.5k tokens) belongs to the DAO reserve

-22.5% of the total supply was migrated over from the v1 of the protocol (in the v1 of the protocol, $BTRFLY supply expanded through rebases and bond issuance)

-37.5% of the total supply (243.75k tokens) is allocated to use of pulse emissions

These pulse emissions will be used to incentivise current and future Redacted cartel products (only $BTRFLY lockers are receiving pulse emissions at the moment), seed $BTRFLY liquidity pools, build the DAO treasury (by issuing bonds, initiating DAO treasury swaps, etc) and participate in seed rounds.

The investor allocation is vested quarterly for 3 years based on the following back-weighted vest schedule: 15% in the first year, 35% in the second, and 50% in the third. The vesting schedule for the founding team and the OlympusDAO allocation is the same, and there is also a 6-month cliff.The DAO reserve, on the other hand, has no cliffs nor vests. In other words, this allocation is unlocked from the get-go.

At the time of writing, the $BTRFLY token has reached about 22% of its fully diluted valuation, with the rest of its supply being released into the market over the next 10 years. As you can see, $BTRFLY lockers/holders are going to be diluted heavily over the coming years.

Value Creation & Capture

Redacted Cartel creates value not only through its main products, which are Hidden Hand and Pirex at the moment, but also through its very lucrative treasury.

All the governance tokens in the treasury earn a yield – either by being deposited into external farms or by voting in gauges to accumulate bribes. Even the protocol owned liquidity (POL) generates a yield through swap fees.

As seen above, the yield generated by the treasury is split according to the size of the treasury. Based on the current size of the treasury, 15% of the yield goes to rlBTRFLY, 15% to the DAO reserve, and 70% back to the treasury.

On top of creating value through the assets it holds, the treasury also creates intrinsic value for $BTRFLY holders and essentially backs the $BTRFLY supply. This is especially useful in volatile and unfavorable market conditions as it creates a sense of confidence and security.

Furthermore, the protocol creates value through the process of metamorphosis.

This process creates value for bonders by offering discounted $BTRFLY tokens and, in return, increases the value of the treasury.

The protocol's bribe marketplace (Hidden Hand) and the liquid wrapper (Pirex) also play a vital part in the Redacted ecosystem's creation of value. Above – in the Tokenomics section – we talked about the value that these products create and for whom.

Below, we will look at the value the Redacted ecosystem is capturing.

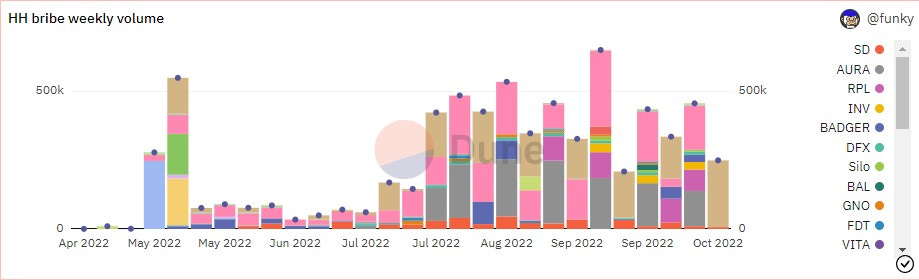

As seen in the diagram above, Hidden Hand is currently generating an average of $410,000 in bribe volume weekly (over the past 13 weeks) without any token incentives! Out of these bribes placed on the platform, the protocol takes a 4% fee; we can see how that looks below.

Around $16,500 in revenue is generated each week by the Hidden Hand protocol, and considering the platform already has 10 partnerships in place (with ve system protocols), we can reasonably assume the same revenues can be sustained over the long term.

Pirex, on the other hand, isn’t capturing as much value as initially anticipated. This – to an extent – can be attributed to its lack of liquid wrappers (it only has one currently). Some liquid wrappers are currently in the pipeline, such as for GLP. And to further incentivize building on the platform, the protocol will offer developer incentives (in the form of referral fees and grants) – this will ensure there are many use cases for Pirex and liquid wrappers will constantly be shipped out based on current narratives and demand.

By sharing the revenues generated by Hidden Hand, Pirex, and the treasury, Redacted Cartel has created a strong incentive to lock $BTRFLY.

$BTRFLY lockers received an average of 2.13% ROI per distribution and a total ROI of 6.4% over the last three reward distributions; if these numbers are maintained, $BTRFLY lockers could earn an APY of 66.3%. Standing at 77.4% (at the time of writing), the locked percentage of $BTRFLY reflects this yield.

Demand Driver

Most of the demand for the $BTRFLY token comes from the cash flow it generates. Apart from this, governance over the treasury and its contents also plays a huge role in driving demand for the token.

Since the treasury holds DeFi blue chip tokens, the protocol essentially creates a proxy for exposure to these tokens – through the $BTRFLY token.

The adoption of ve tokens also serves as a tailwind for the Hidden Hand protocol and Pirex, allowing them to onboard new partners and create liquid wrappers, respectively. This can help generate more revenue and further make locking $BTRFLY attractive.

Observations

Redacted’s team has built out many interesting products without placing any extra token incentives (in $BTRFLY) to drive usage.

As seen above, many of the biggest DeFi protocols require a significant amount of token emissions (incentives) to generate the revenue that they do. Some even need up to $11.5 in token emissions to generate a single dollar of revenue. These models are clearly unsustainable as token emissions don't last forever and can become worthless very quickly.

Redacted Cartel, on the other hand, has built one of the largest bribe marketplaces and is consistently generating significant revenue without emitting any tokens/incentives; talk about a sustainable product!

($316,500 in cumulative revenue with $0.00 in token incentives).

However, it's not all sunshine and rainbows for the Redacted Cartel protocol. The $BTRFLY token still has very low liquidity, $5MM of it. Considering the token’s market cap is around $30MM (at the time of writing), the liquidity the token currently has is not enough. The consequences of this are increased token volatility and small dumps causing widespread panic. In the future, I recommend the DAO propose using some of their $vlCVX voting power to direct $CRV emissions to the BTRFLY/ETH pool on curve in perpetuity.

Another thing to note is the majority of the $BTRFLY supply is yet to be emitted, but if the protocol is accruing as much value as it currently is to $BTRFLY lockers, then the forthcoming supply will definitely be matched with demand to lock the token.

Closing Thoughts

The Redacted Cartel has really come through with the v2 of its protocol. By structuring their core products around markets with huge upsides and implementing a solid tokenomics model, they have positioned the protocol in a very financially beneficial way.

As we see the paradigm shift from valueless governance to governance as value accrual, Redacted Cartel will be at the forefront of this narrative. The team has been releasing new features and implementations on a regular basis to give the protocol an edge over others. And if the cartel plays its cards right, it could be building an ecosystem that will be pivotal to DeFi as a whole.