Tokenomics 101: Perpetual Protocol (PERP)

Perpetual seeks to increase token holdability, but needs to better compete with other DEXs to grow

Introduction

Perpetual protocol is a decentralized exchange (DEX) for perpetual futures and leveraged trading. Before getting into more details on the protocol itself, I’ll give a brief introduction on the history and purpose of the futures market. Feel free to skip to the next section if you’re familiar with futures; otherwise, bear with me on this financial ride.

Future contracts were first introduced in 1864 by the Chicago Board of Trade for agricultural products such as wheat, corn and soybeans, with the primary function of protecting producers and suppliers from commodity price fluctuations (i.e., hedging). According to Investopedia, “a futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future.” Let’s illustrate their use with an example:

Alice is a wheat farmer that wants to ensure a stable income at the end of harvest season.

In January, the price of wheat is $5 per pound. She sells future contracts equivalent to 100 pounds (total: $500).

In June, she sells 100 pounds of wheat at $4 per pound (total: $400).

To close her position in the futures market, she buys the equivalent 100 pounds in future contracts at $4 (total: $400). She earned $500 from selling futures and spent $400 to buy them, hence her final profit is $100.

Her final income was $400 (from wheat) plus $100 (from futures), totalling $500.

If the price in June was $6 per pound, she’d earn $600 from selling wheat. Her position in the futures market would close at a loss of $100 ($500 - $600). Final income: $500.

Hence, future contracts allowed Alice to preserve her revenue regardless of the price of wheat. That’s called a hedge.

Take a deep breath, let it settle in.

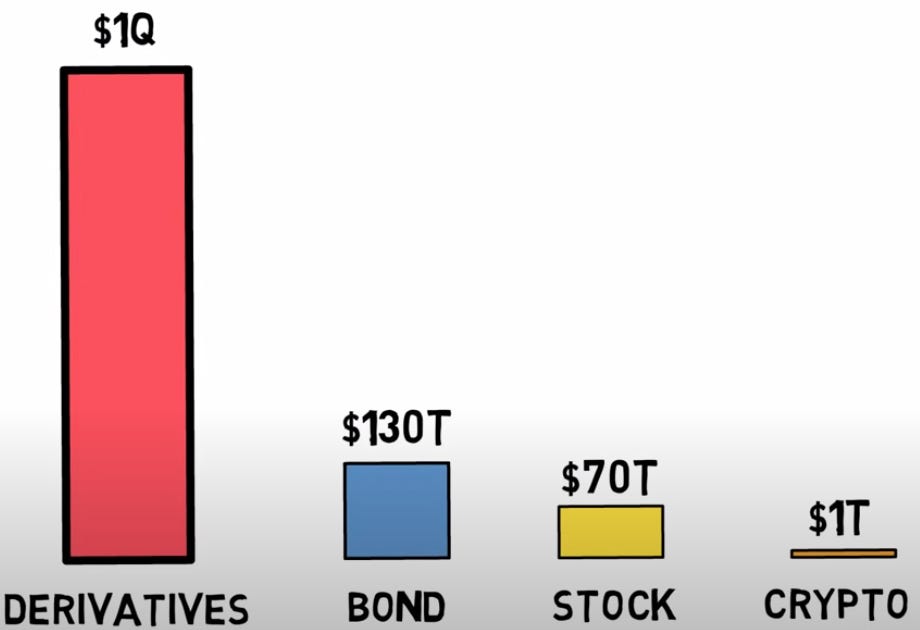

Futures are derivatives, meaning they derive their value from another asset (in the example above, wheat). Futures also allow traders to speculate on an asset’s price movements without holding the underlying asset. That makes them an important price discovery mechanism for institutional investors to place large orders (think hundreds of millions of dollars) without wreaking havoc in the spot market. The derivatives market cap thus dwarfs its underlying asset classes. See this Finematics example (note: the video is from Jan-21):

Institutions can also help the crypto markets mature, since they tend to have a longer investment horizon and increase overall liquidity, which should decrease market volatility over time. That said, in the short term derivatives can also make price breakouts more violent as they add fuel to price movements (see this example), so volatility should still take a couple of years, if not more, to decrease.

Perpetual Protocol

Perpetual offers self-custody for perpetual futures, a product that is unique to crypto and was first introduced by CEXs such as Bitmex and Bybit. Perpetual futures don’t have an expiration date (hence the name). Traditional future contracts have an expiration date, which requires traders to account for time in their strategies. The time component also leads to convergence between futures and the spot price – i.e., the contract’s premium decreases as the expiration date nears.

Perpetual futures have a funding rate to limit divergences between futures and the spot price. The rate determines periodic payments made to or by traders based on the position they’re opening and the difference between futures and spot prices. For example, the graph below shows the BTC futures funding rate at Perpetual. The funding rate has been mostly negative, meaning the price of BTC futures at the exchange were below the spot price. Hence, traders entering a short position (i.e., betting BTC’s price will fall) pay traders in long positions (i.e., betting BTC’s price will rise). This incentivizes traders to take the unpopular side of the market.

Aside from perpetual contracts, Perpetual also offers up to 10x leverage for traders and liquidity providers (LP). Traders can open multiple leveraged positions using the same collateral (cross-margin), or use multiple trading wallets to split their collateral. This distinction is important to avoid liquidations.

Perpetual is currently on its V2 implementation, deployed on Optimism, which enhances scalability and provides lower gas fees for traders. Perpetual V2 also leverages Uniswap V3’s concentrated liquidity pools to provide trading (more on that below).

Tokenomics

You may have noticed that we haven’t mentioned the PERP token up until this point. The reason is that PERP is a governance token, which is not required for trading or LPing. The settlement token for the Perpetual Protocol is USDC, meaning closed positions always withdraw USDC regardless of the traded token. USDC is the main collateral, but Perpetual also supports ETH/WETH and FRAX deposits at a reduced weight. For purposes of the tokenomics diagram, I’ve only included USDC as collateral. Let’s have a look (zoomable version here):

Perpetual Protocol

Perpetual offers futures and leverage by exchanging collateral for virtual tokens (managed by the Clearing House), which facilitates trading and provides liquidity to the platform. Perpetual charges a flat trading fee of 0.1%.

Virtual tokens are stored in Uniswap V3 liquidity pools (e.g., vBTC-vUSDC pool for BTC trading), which are characterized by their concentrated liquidity. In short, concentrated liquidity means that LPs need to select a price range for the tokens they’re providing. For example, if an LP provides BTC liquidity for the $19,000 to $21,000 price range, they’d only receive the trading fees from trades within that price range (e.g., a buy order at $19,250 price, a sell order at $20,850 price). Concentrated liquidity requires LPs to manage liquidity actively, ensuring deeper liquidity on the most traded price ranges.

There’s an insurance fund to maintain the protocol’s solvency in periods of high volatility. The insurance fund ensures that profitable positions can be paid out in full and liquidated traders do not end up with bad debt. For example, if a trader gets liquidated but doesn’t have enough margin to cover the insurance fund and liquidator fees, assets are drawn from the insurance fund to fill the gap. The insurance fund accrues 20% of the protocol’s trading fees and charges a 5% fee upon successful collateral liquidations.

Clearing House

The Clearing House smart contract manages trading and liquidity provisioning. Once traders and LPs deposit collateral, the Clearing House automatically enables 10x leverage by minting vUSDC tokens (which are up to the trader/LP to decide whether and how much to use). Therefore, the flow to trade assets would look like:

(i) trader deposits USDC and receives vUSDC,

(ii) trader wants to long BTC so they trade vUSDC for vBTC in a vUSDC-vBTC pool,

(iii) trader closes the position by selling vBTC and claims the profit/loss in USDC.

Since my drawing is pretty poor, I’ll borrow another visual from Finematics (in this example, a trader is longing BTC):

Perpetual DAO

The Perpetual DAO manages the treasury, which received 54.8% from the genesis supply allocation (~82M PERP) and is used for reward distribution and ecosystem growth. The PERP token is used to vote on governance proposals, including allocation of the DAO’s treasury, insurance fund threshold and exchange parameters (e.g., fee level and distribution).

To streamline DAO governance, operational tasks are divided among a growing set of sub-DAOs. New sub-DAOs may be proposed and added or removed as required. The Grants DAO oversees funding grants that help accelerate and expand the Perpetual Protocol ecosystem. The Token Listing DAO approves or rejects new markets and co-marketing spends for token listing campaigns. There are also two sub-DAOs in the proposal phase: Community DAO (to decentralize community initiatives and build the Perpetual brand) and the Treasury DAO (to manage the Perpetual DAO treasury and fund all other sub-DAOs).

Perpetual recently introduced the voting escrow (vePERP), which aims to strengthen the decentralized governance by introducing lockup periods (if you’re not familiar with ve, check this article on ve tokenomics). vePERP should protect governance from sybil attacks (e.g., using flash loans to accumulate tokens and inflate the voting power) since Perpetual’s ve gauges account for both the amount locked and locked period – i.e., long-term stakers have extra voting power, which should increase skin in the game and improve alignment with network interests.

vePERP Utility

The utility of vePERP is centered around reward distribution. Its first use case was to overhaul the referral rewards program. The program allows referral partners to earn a share of the fees generated by referred traders depending on the proportion of vePERP they hold relative to all other referral partners (i.e., the larger the referrer’s stake, the larger the rewards they get from referred users’ trading fees). To claim referral rewards, Perpetual requires users to lockup PERP tokens for at least 4 weeks. In addition, referred traders can earn 20% rebates on their trading fees.

Perpetual also distributes PERP rewards every week (maximum cap: 25K PERP per week) for users that locked up their PERP tokens (Lazy River). The team plans to provide 10% of the protocol’s trading fees as USDC rewards for stakers, which should improve yield quality. The USDC yield switch will be implemented once the insurance fund reaches 10% of the 30-day open interest across all markets. Upon reaching this threshold, the 20% fees allocated to the insurance fund will be split across vePERP holders (10%) and the DAO treasury (10%).

Additionally, LPs are eligible to receive dual token rewards (PERP + OP) as part of the liquidity mining program (Pool Party). At the time of writing, there were no vePERP requirements for this program.

Distribution and Unlocks

The PERP token public sale took place on Sep-2020 leveraging Balancer’s Liquidity Bootstrapping Pool (LBP). In short, tokens launched in Balancer’s LBP start at a very high price to disincentivize front running and price speculation (spoiler: we plan to publish an article on token launches – stay tuned for more details in the coming weeks). The total PERP token supply is 150M; future governance can decide to mint more tokens, but that’s unlikely since it would dilute stakeholders. 5% of PERP’s supply were sold in the public LBP sale, with the remaining distribution looking like:

Let’s analyze this distribution following Lauren Stephanian’s optimal token distribution framework:

Ecosystem and rewards: 51.8% of the PERP supply, compared to Dapps’ 44.7% average (ecosystem: 20.5%; mining/staking rewards: 6%; other incentives: 18.2%).

That gives Perpetual some buffer to drive growth and distribute rewards.

The introduction of vePERP should ensure incentives flow towards long-term holders, which is generally a good sign.

The community chooses how to spend these tokens via DAO (also a good sign).

Team and advisors: 24% of tokens, which exceeds Dapp averages (team: 19.9%; advisors: 1.3%).

Grouping the team and advisor token allocations is not a best practice, as it obscures how much is going to each party.

The team allocations play an important role of keeping employees committed to the protocol’s long term success through ownership, voting rights, a share of protocol fees (for stakers) and upside potential.

Advisors could add potential selling pressure since they won’t necessarily have the protocol’s best interests in mind in the long term.

Investors: 19.2% PERP allocation (seed + strategic), compared to Dapp averages of early LPs (7%) and investors (15.7%).

The seed investor amount was allocated to Binance Labs, which invested in the development of the Perpetual Protocol in 2018.

Perpetual was able to negotiate a good deal as investors also tend to add selling pressure when things turn difficult.

All investor tokens have been fully issued and vested, while team tokens began vesting 6 months after launch, with a quarterly vesting schedule for the following 30 months. Ecosystem and rewards tokens were unlocked after the community governance implementation.

Although most tokens have vested, the circulating supply is just 47% of the total supply according to CoinGecko, mainly driven by ecosystem & rewards, the DAO treasury and pending team unlocks. Ecosystem and DAO treasury funds are governed by PERP stakeholders, which means there are abundant funds to promote growth and invest in the ecosystem. Since most investor tokens have already vested, the inflow of tokens shouldn’t generate a huge selling pressure as long as incentives are deployed appropriately. The vePERP implementation should further enhance the token’s holdability while the DAO’s ~$1M USD treasury makes governance attractive, since the protocol has significant funds to implement community proposals.

Value creation and value capture

Perpetual’s value creation is pretty straightforward – the exchange adds value to traders by providing access to robust financial products with self-custody, while LPs benefit from liquidity mining rewards and protocol fees. The protocol captures value through its flat 0.1% trading fee, which currently accrues to stakeholders and LPs in PERP. The USDC yield switch will make staking rewards more attractive.

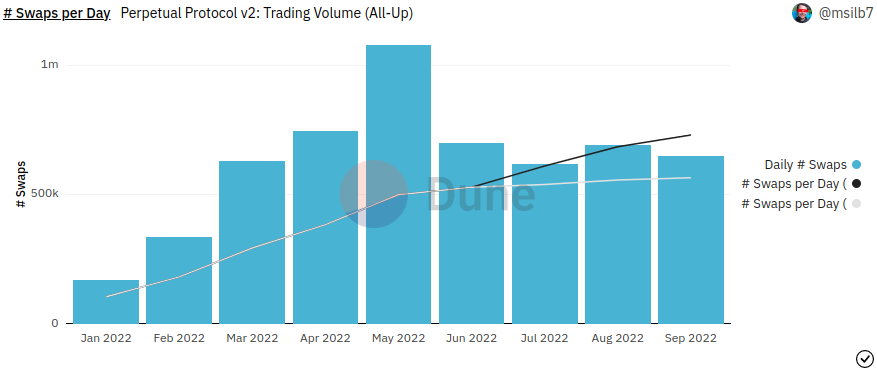

Value capture obviously depends on trading activity in the protocol. @msilb7’s dashboard provides some interesting data to assess usage:

YTD monthly swaps peaked in May, but have since decreased significantly (Sep vs May: -40% swaps), which is to be expected in a bear market. Bear market sentiment reduces speculation with futures and use of leverage, which is especially risky given crypto’s volatility. It’s interesting to compare the number of swaps (absolute) with their notional volume (denominated in USD). Since crypto prices have been dropping in 2022, the notional volume trend shows a more significant decrease (Apr vs Sep: -76%):

Low trading activity translates into decreasing trading fees for the protocol (from @yenwen’s dashboard with daily granularity):

On the other hand, the number of active traders spiked in Sep-2022, which is a great sign. The increase was mainly driven by Optimism’s quests, which provides NFTs for users to complete certain actions within Dapps deployed in the network. Perpetual’s quest requires users to respond to a quiz and open a trade with a minimum of $100. Although this quest led to a 500% MoM increase in active traders, the MoM number of swaps (-6% MoM) and their notional USD volume (-20% MoM) decreased, indicating gamification could be a powerful awareness driver but there are challenges to raise engagement among these new users.

Still, attracting more traders is fundamental to increase trading activity, which in turn should bring more LPs to provide liquidity to the platform given they benefit from trading fees. An increase in trading activity could also increase staked amounts, however the current hard cap on reward distribution ($25K PERP) limits stakeholders’ gains if fees start booming in the short term.

Competition in the space is also fierce and Perpetual still lags behind more established DEXs on the futures/leverage market like dYdX and GMX in terms of daily trading volume. Although dYdX’s lead has decreased, on Oct 10th Perpetual registered trading volume of $14M, compared to $406.6M dYdX and $109.4M GMX.

Part of the reason could be the number of active traders (note: GMX doesn’t provide this data yet). dYdX has a more consistent number of active traders, which translates to higher trading volume per trader. Due to data availability, let's use the weekly active traders as a proxy for daily active traders so we can analyze the daily average trading volume per trader:

dYdX registered 2.2K weekly active traders on the week of Oct 3th vs Perpetual 5.4K.

However, on the week of Sep 12th (prior to the Optimism quest), Perpetual had 625 active traders (vs dYdX 3.4K traders).

Since the minimum trade to earn an NFT on the Perpetual quest was $100, the huge trader inflow just diluted the average daily volume per trader by 94% (Oct 10th: ~$2.6K vs Sep 12th: ~$46K). Perpetual’s daily traded volume decreased by 62% comparing those dates.

dYdX’s average daily volume per trader decreased by 36% in the same period (Oct 10th: ~$18.5K vs Sep 12th: ~$29K). dYdX daily traded volume decreased by 59% comparing those dates.

Although daily trading volume registered a similar decline in both dYdX and Perpetual, Perpetual’s daily volume per trader dropped much more significantly. This indicates a more consistent trading activity at dYdX.

On one hand, the decrease in daily volume per trader across the board supports our bear market sentiment thesis. However, the significant decrease in Perpetual’s average daily volume per trader could mean the boom in active traders will be short-lived. Expanding this analysis over time could provide more insights on the long term trend for this metric, however that’s outside the scope of this article.

One final point to take note – dYdX provides a fee structure that incentivizes larger trades, whereas Perpetual doesn’t. dYdX’s fees range from 0% to 0.05%; traders with a monthly trading volume between $100K-$1M pay a 0.05% fee, whereas traders with a trading volume higher than $200M pay a 0.02% fee. There are also additional discounts ranging from 3%-50% depending on the amount staked. Conversely, Perpetual charges a flat fee of 0.1%, which is at least 2x higher than dYdX and provides no economies of scale – hence, it ends up disincentivizing larger trades since the fees grow proportionally to the trade’s size.

Demand Drivers

The biggest reasons to hold PERP are to participate in governance, earn staking rewards and benefit from the protocol’s growth (i.e., speculation). The first seems to be the most interesting use case since there are still a lot of funds to govern over, which should provide room for the community to get creative on how to best allocate for protocol growth.

Staking rewards' biggest advantage will be the distribution of USDC instead of PERP. That doesn’t make up for the high trading fees charged by the exchange, but will provide a high quality value capture mechanism to stakeholders.

Potential growth is always a demand factor and there’s reason to believe in Perpetual given the large uptick in active traders in Sep-22. Conversely, competition should continue to increase over time so figuring out how to attract and retain customers is paramount for sustainable growth in the long term.

Closing Thoughts

Perpetual Protocol caters to professional traders by offering sophisticated financial products in a self-custodial way. The Optimism implementation optimizes transaction speed and cost. Perpetual also leverages the DeFi “money legos” ethos by building on top of Uniswap V3’s liquidity pools, incentivizing LP optimization. However, that’s not enough to differentiate the protocol as there are more well-established DEXs offering similar products, with dYdX being the indisputable leader in the space.

Since Perpetual is catering for professional traders, they should consider adjusting their fee structure to incentivize trading in larger amounts, which would ultimately benefit all users and stakeholders in the platform. There’s still ~50% of the token supply out of circulation, so paving the avenue for growth is critical for the token price to appreciate. There is reason to be optimistic (pun intended), since gamification brought an explosive growth in active traders, indicating there is a lot of interest around this platform.

Additionally, the introduction of vePERP should create some interesting dynamics to incentivize long-term holders. I’m especially curious to see how the USDC fee distribution will play out, given that it will allow stakeholders to accrue part of the protocol’s fees with great quality yields.

Investment take

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.