Tokenomics 101: Osmosis DEX Protocol

Creating lots of value, but capturing very little

TLDR: Read the summary on the Tokenomics Hub.

Introduction

Osmosis is a Proof of Stake (PoS) blockchain in the Cosmos ecosystem. More specifically, it is an app-centric chain inspired by the utilities of Balancer that aims to be the main DEX and source of liquidity of the ecosystem. Technically speaking, Osmosis protocol is a trading platform and automated market maker (AMM) protocol that allows developers to build customized AMMs with sovereign liquidity pools. It uses the Inter-Blockchain Communication (IBC) to enable cross-chain transactions.

In general, the Web3 space is full of AMMs and some have a similar product. So:

Why does Osmosis exist?

Customizability of liquidity pools: There is no one-size-fits-all solution to determine the optimal parameters of an AMM. For this reason, Osmosis provides the possibility of creating pools that try out different experiments to find out the optimal bonding curve of an AMM. For example, Liquidity Bootstrapping Pools (LBP) can be used for discovering the price of new tokens.

Self-governing liquidity pools: In comparison to other protocols that only offer revenue shares, the liquidity pool shares of Osmosis are also used to participate in the strategic decisions of the specific pool. These are incentives for long-term stakers with lock-up periods that offer higher mining revenue and/or higher voting power

AMM as service infrastructure: Osmosis aims to offer a flexible infrastructure so that the continuously evolving financial products that want to build on top can adapt different AMMs to their needs.

Osmosis as an app-centric app chain

In his piece the inevitability of UNIchain, the founder of Nascent outlines the increasing popularity of app-centric chains interacting with each other. This might give Cosmos chains and more specifically Osmosis an advantage due to being first mover with its top notch technology in this space (Cosmos SDK & the IBC).

This is however not a sufficient reason to prefer Osmosis over competitors such as Balancer. There are other metrics such as revenue share, trading volume, or TVL that are very important.

The fact that Osmosis is a DEX and a Blockchain increases the complexity of the analysis against other competitors. In order to fairly compare Osmosis, the analysis needs to go beyond the evaluation of the metrics mentioned and include some specific ones such as chain activity or the number of connections through IBC.

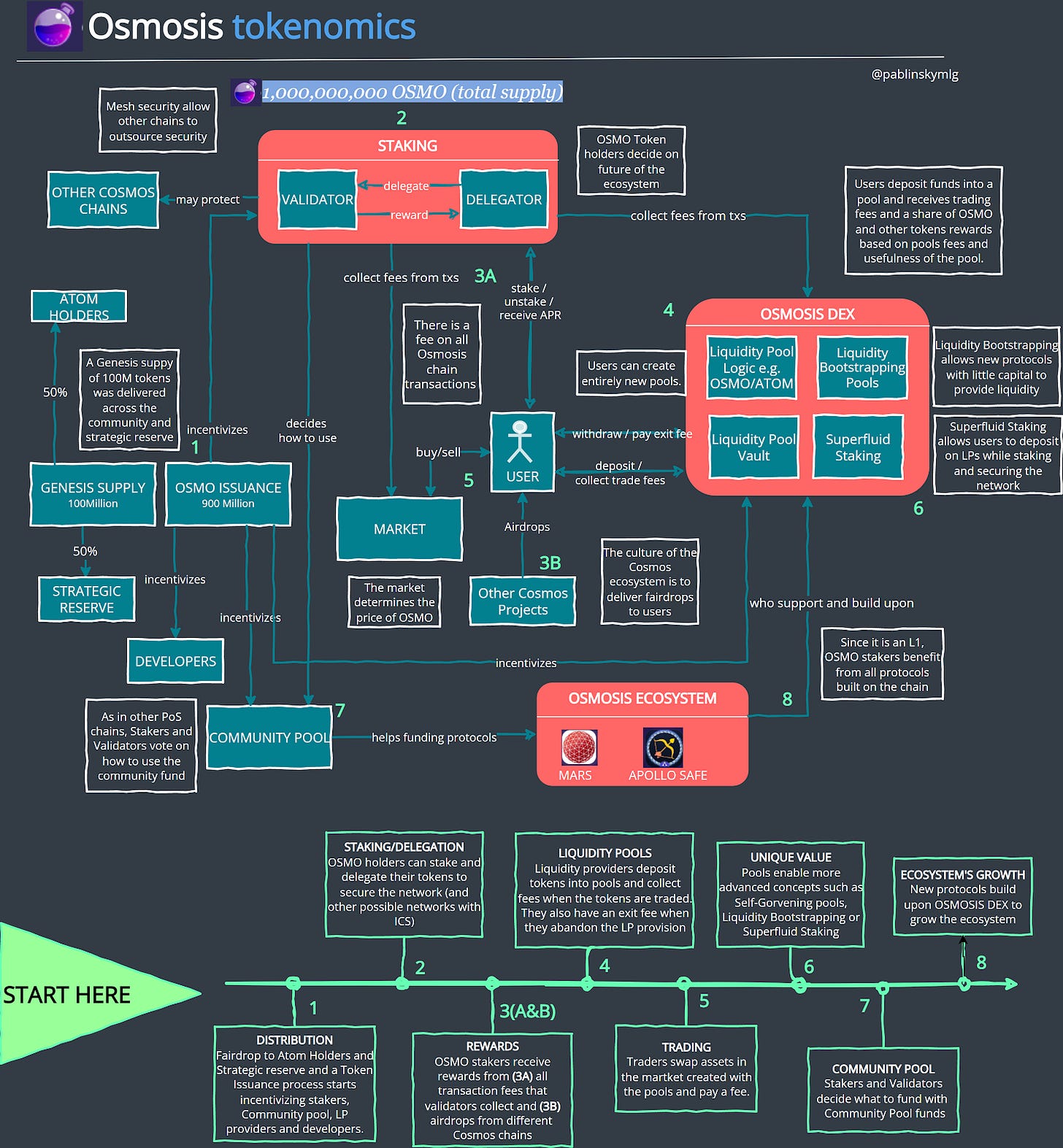

Tokenomics

A zoomable version can be found here.

The utility of the OSMO token can be divided into:

Governance: Osmo stakers can use $OSMO to decide over the future of the blockchain and the protocol, by voting on protocol upgrades, allocation of liquidity mining rewards, or setting the base network swap fee.

PoS Security: Holders can stake their $OSMO tokens to secure the network, rewarding the validation of transactions with innovative procedures such as Superfluid Staking.

Transaction fees: $OSMO is needed as gas to pay for transactions.

Distribution and Unlocks

Supply

A total of 1,000,000,000 tokens will be distributed with a process involving an initial fairdrop, a release schedule, and an end distribution of $OSMO.

Fairdrop of Genesis Supply

The first distribution of $OSMO tokens constituted 10% of the total supply (100,000,000 tokens) in the form of a fairdrop.

This genesis supply of the $OSMO token was released in June 2021 among ATOM holders. 50% of it went directly to the strategic reserve (that later will become the community pool) and the other 50% was claimable for a certain period by ATOM holders. However, around 30% of the claimable tokens were not claimed on time so they were also redirected to the community pool.

Release schedule

After TGE in June 2021, instead of issuing tokens every block like other Cosmos chains, Osmosis issues tokens at the end of each epoch (one day). Similar to Bitcoin’s halving method, Osmosis’ token issuance follows a ‘thirdening’ schedule. This means that the issuance level is cut by one-third every year.

During the first 365 epochs (year one), the issuance of $OSMO tokens was 300 million. During year two, starting on the 20th of June 2022, Osmosis will issue 200 million tokens. In year three, the amount decreases to 133 million tokens.

With this method, the circulating supply will reach 90% of the total supply by the end of year 6. Nonetheless, this process will continue until the circulating supply reaches the maximum supply of 1 Billion $OSMO.

This means that $OSMO will be highly inflationary in the beginning but, over time, the issuance tapers off and becomes a lesser percentage of the circulating supply.

Final distribution

After the genesis supply, the issuance of the rest of the supply gets distributed on the following basis:

The current state of supply of the $OSMO token is shown in the picture below gathered from Mintscan. As we can see, around 47% of the total supply has already been minted and only around 23% of the circulating supply is liquid because tokens are locked in delegations, in liquidity pools, or belong to the community pool.

When all the tokens are released, the final distribution will look like this:

Community pool

The holdings of the Osmosis community pool can be seen here. The pool contains different tokens that may serve as treasury or that have not been yet deployed as incentives in the DEX.

In the picture below we can see the history of the Osmosis Community Pools holdings over time. The initial inflow of unclaimed tokens is followed by a governance initiated redirection of $OSMO incentives towards the community pool as a bear-market strategy.

Value creation and value capture

Osmosis was born in a market where most of the liquidity is on Ethereum and where many competitors like Balancer offered similar products. However, the Osmosis chain was the first app-centric chain DEX. Besides this first-mover advantage, most of the value created by Osmosis comes from:

The current 0 gas fees on transactions: This allows all types of users to comfortably explore, and interact with the chain without costs. However, this might also decrease the relevance of holding $OSMO.

Sovereignty: The implementation of app-centric chains is gaining popularity. This has given Osmosis some advantages over other DEXs developed with similar features on other chains.

Take the level of customization of the product. $OSMO stakers have power over the transaction fee structure of the blockchain. Furthermore, due to the Cosmos SDK, Osmosis is one of the DEXs on which it is easier to build on. This is the reason many protocols have decided to move and build on Osmosis after the Terra crash.

The implementation of Superfluid staking: Superfluid staking introduces the unique concept of “Proof of Useful Staking” which seems to be a great success by offering liquidity providers a better yield while the network gets more secure.

Network Hub with IBC: The IBC is currently one of the most secure and user-friendly bridge infrastructures. It will soon allow Osmosis to have more options such as ERC-20 tokens with its connection with other chains such as Evmos or Nomic. Osmosis can become a hub for cross-chain token trading.

The possibility of mesh security: Although this feature is still in its final stages of development and not usable yet, the Cosmos infrastructure is built to enable outsourcing of security. This means that big chains such as the Cosmos Hub or Osmosis can receive incentives (possibly other tokens) from other chains to secure their network.

Source: Map Of Cosmos Zones

The value capture on the other hand, might be one of the weaker aspects of the protocol. $OSMO captures value by:

Offering yields on staking and liquidity pools that contain $OSMO based on:

The issuance of $OSMO directed to incentivize $OSMO stakers and liquidity providers.

Bribes received from other Cosmos chains that want to become listed and obtain liquid pools by incentivizing $OSMO/X pools.

Fee accrued from the IBC, chain and protocol transactions.

Also, the DEX offers a small lock-up period (up to 14 days) that allows the liquidity provider to increase their yield and voting power on the pool’s governance.

Giving stakers the power over deciding the allocation of the community pool funds that receives a small percentage of the issuance of $OSMO, bribes and the transaction fees.

Offering stakers airdrops from other chains based on the time $OSMO is staked: Token airdrops from new chains/protocols are based on snapshots that usually go back in-time and make sure that the receiver is involved in the ecosystem for a certain amount of time.

Generally, Osmosis` approach does not seem sustainable in the long term due to the ‘mercenary’ money that leaves the chain when the issuance of $OSMO decreases. The volume and fees generated per day are still too low in comparison to their TVL, especially after Terra’s fall in May. Osmosis needs to find new ways to increase its revenue and create a positive flywheel of value creation and capture so it becomes sustainable over time.

The data provided by Token Terminal confirms it:

Demand Drivers

Right now, there are several reasons to buy $OSMO:

Governance: One of the main reasons to buy OSMO is the value of governing one of the main growing chains of Cosmos.

Inflation Rewards: A short-term driver but, right now, there are incentives for users to buy and provide liquidity on Osmosis with the high yields provided with the superfluid staking. In the future, these yields will have to come from the revenue generated.

Exposure to the Cosmos ecosystem: Buying and staking $OSMO means receiving airdrops and rewards from other chains. An investor might be interested in diversifying along the whole Cosmos ecosystem by passively increasing his exposure by just staking $OSMO.

Resilience after the Terra-Luna Crash and the 5M$ exploit

May and June of 2022 were difficult months for Osmosis. The fall of Terra compromised Osmosis stability since UST was the primary stablecoin of the DEX and the most traded token on the DEX was LUNA. Furthermore, in June, the DEX suffered a $5M exploit.

These events resulted in Osmosis dropping from a Top 5 to the 15th DEX by volume according to DefiLlama. However, although the TVL and volume have obviously decreased since these events, Osmosis has demonstrated resilience. Many protocols built on Terra decided to move to Osmosis (e.g. Mars Protocol and Apollo Safe) and other Cosmos chains have worked hard to bring stablecoins such as USDC through the Axelar bridge, or provide their own ones (IST, USK…). This shows that Osmosis has high potential and the Cosmos community is engaged to make it succeed.

Decentralization

A fairdrop assures that there are no big whales that threaten the network’s decentralization. However, due to the PoS consensus and the fact that the validators that are able to collect fees are currently limited to 150, there are possibilities of having validators with too much power.

According to Mintscan, the top 10 validators have a voting power exceeding 40%.

Moreover, SmartStake provides metrics that indicate that the ecosystem has still a lot to improve to achieve high levels of decentralization.

Only 7 nodes are needed to compromise the chain and too many validators are below the average voting power. These numbers are not sufficient to ensure the resilience the chain wants to gain.

The power to change these metrics relies on the $OSMO stakers and the Cosmos community incentives. It is fairly easy to redelegate to other validators and the community is pushing toward this. For example, many protocols have already stated that they will airdrop to stakers that validate outside the top 20, thus incentivizing redelegations outside the Top 10.

Competitors

Osmosis has various competitors. For example, other cosmos chains like the Cosmos hub and ATOM can be seen as a competitor for becoming the main hub of the ecosystem.

As a DEX, it might be relevant to compare Osmosis to Balancer, the Ethereum competitor with the most similar product.

Balancer's approach is very different and it might be hard to compare to Osmosis. Balancer currently offers a higher variety of financial services such as the asset manager tool and flash loans. Additionally, the veBAL token might have advantages at retaining liquidity and incentivising long-term holding when compared to the 14 days lock-up Osmosis DEX offers on their pools. However, Osmosis DEX has a better infrastructure to grow and increase its feature set and to create more synergies in a multi-chain environment that increase the revenue streams for OSMO (i.e. Mesh security).

Another thing to consider is that Osmosis is no longer the only DEX in Cosmos. Other chains such as Evmos or Injective Protocol have their own DEXs and have other strengths such as their Ethereum compatibility. Although this may be worrying, the reality is that these chains have their focus on other niches around their product and are not yet a direct threat to Osmosis. Nonetheless, it is clear that this environment will become more competitive over time and Osmosis needs to keep evolving and deliver improvements to its product and tokenomics. That being said, it seems that bridges to other chains like Ethereum or stable swaps are some of the features that will come in the near future.

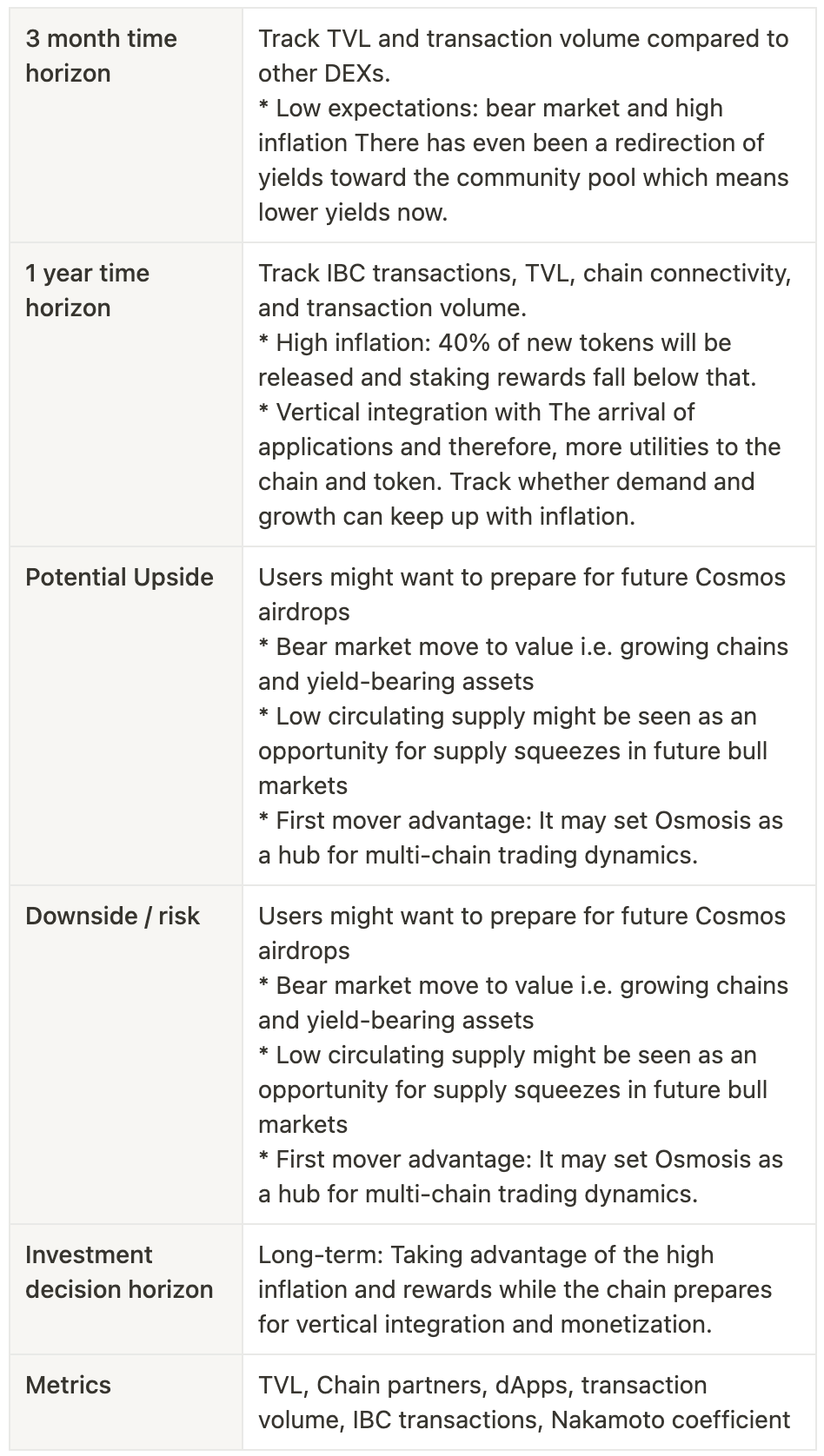

Closing Thoughts

The AMM field in which Osmosis falls is very popular and relevant for the success of DeFi. Therefore, it is important to see what developments and initiatives succeed. This is why Osmosis’ experiment is such an interesting case for the crypto space. It is a reality that Osmosis runs under a different ideology than its competitors while offering top innovations, an engaged community, and a great user experience. Also, the dynamics of Osmosis as a chain and the internal development of the whole Cosmos ecosystem will be key determinants of Osmosis' success.

However, the chain needs to keep evolving to generate more revenue and increase the value capture for the token. The potential that the infrastructure has to develop an excellent product is not fully matched with a token design that captures value in the long term and that is relevant for the success of the chain. For this reason, the design of $OSMO might have to evolve. In the same way, Balancer incorporated a ve-design, Osmosis should look at the alternatives that are in the market (lock-ups, time-based tokenomics, rewards vesting systems) and rethink how incorporating these may increase the relevance of $OSMO.

Investment Take

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.