Tokenomics 101: Maple Finance

private credit, under collateralized lending, and ‘real yield’

Introduction

Maple Finance is a decentralized corporate credit marketplace connecting institutional crypto-native borrowers with DeFi depositors. The protocol is one of the few lending platforms in the market today that provide undercollateralized loans – a key primitive required for DeFi to reach mainstream adoption truly.

Today, DeFi lending platforms like Compound and Aave offer permissionless loans facilitated by smart contracts. What does this mean?

Anyone can borrow on the platform (permissionless, democratized access) because they are required to post collateral exceeding the value of the loan itself

Overcollateralization provides a capital buffer in volatile market conditions; if the collateral value gets too low, smart contracts automatically liquidate the collateral to protect the loan principal

Overcollateralization prevents true credit creation and limits capital efficiency, preventing businesses from accessing credit for productive use. As a result, on-chain borrowing today has primarily been retail-driven, used to facilitate additional leverage and, more often than not, speculative trading

On the other hand, undercollateralized lending in crypto has been difficult to crack because of two key challenges. For one, protocols currently lack the tools to properly assess the credit risk profile of anonymous borrowers from their on-chain activity, as using on-chain credentialing for non-collateralized lending is still in the early stages of development. Secondly, low collateral values do not provide the capital buffer to protect the loan principal.

Maple Finance solves these two key problems above by reintroducing elements from the lending models in traditional finance. First, they employ 3rd-party agents called ‘Pool Delegates’ to underwrite undercollateralized, permissioned loans to KYC’ed, positive cash-flow businesses. Secondly, they ensure the loan principal is fully protected by using 3rd-party agents that provide insurance in the form of a capital buffer, or “Pool Cover”. These two elements are tied together through their well-designed tokenomics model, facilitating a lending flywheel that has resulted in Maple originating $1.5bn loans to date.

Tokenomics

Maple operates similarly to traditional lenders with interest income and loan origination fees as their primary revenue streams, while funding costs, underwriting fees, and insurance premiums are their main expenses. However, what sets Maple apart from other lenders is the innovative use of MPL, their native token. MPL is an excellent example of how tokens, when utilized effectively, can enhance a strong business model.

Lenders

Lenders or depositors can gain access to the private credit market and earn higher interest on their capital by extending undercollateralized loans while taking on risks.

Borrowers

Maple is a platform that provides loans to businesses with positive cash flow after conducting a KYC (Know Your Customer) check. Currently, the platform offers its services to delta-neutral market makers or CeFi (Centralized Finance) platforms. However, Maple has plans to expand into new verticals such as crypto mining and fintech companies. Borrowers are responsible for paying the loan origination fees and interest fees. In the future, borrowers who stake or lock up their MPL (Maple Token) will receive rebates on their borrowing costs.

Pool Delegates - (Underwriters)

Pool Delegates are experienced managers who specialize in credit underwriting. They are responsible for all aspects of the underwriting process, which includes performing KYC on borrowers, evaluating their credit risk, and negotiating loan terms. In return, they receive a portion of the interest income and loan origination fees. Since pool delegates don't use their own funds to underwrite the loans directly, they must assume a portion of the underwriting risk by becoming a pool cover provider. This helps to align their interests with the protocol and all other market participants.

Pool Cover Providers (Insurance)

Pool Cover Providers are 3rd-party agents that provide insurance for the lending pool. They provide a capital buffer in the form of 50-50% USDC-MPL Balancer Pool Tokens (BPTs). These BPT tokens become the first-loss collateral in the event of loan default, protecting depositors from losing their loan principal, but also ensuring there is adequate liquidity for the trading pair. As part of a new Maple Proposal, pool cover providers will also be able to provide one-sided pool cover in the future in the form of xMPL to reduce their exposure to impermanent loss. For providing insurance, they earn 10% of the interest income (their insurance premiums) and earn additional MPL awards.

Stakers

Stakers can be compared to equity investors in the protocol. They receive rewards in the form of MPL tokens for buying and staking the MPL token. The reward is equivalent to 50% of the protocol's revenues from open market buybacks. In Q2'22, the average annual percentage yield (APY) for stakers was 3.76% in MPL tokens.

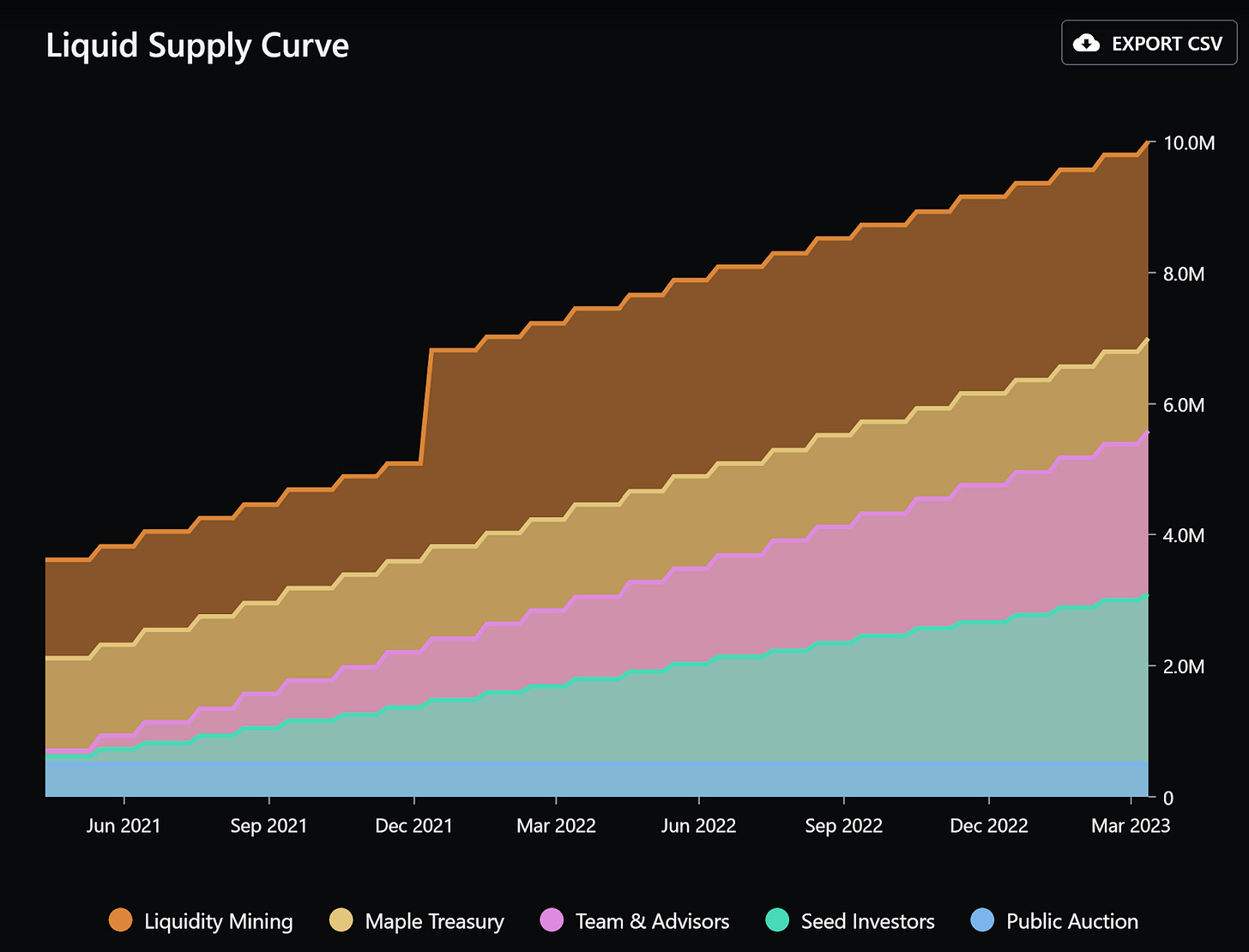

Distribution and Unlocks

Maple has a fixed total supply of 10 million MPL tokens. The Token Generation Event (TGE) for Maple occurred on April 28, 2021, and the supply was distributed and allocated to the groups shown below.

The recent public auction was conducted using a Balancer Liquidity Bootstrapping Pool (LBP) and managed to raise $10.3 million from 1080 participants. Tokens that were previously held by insiders and investors are now unlocked and will be distributed gradually over a period of 1 to 2 years, as per the vesting schedule mentioned below.The recent public auction was conducted using a Balancer Liquidity Bootstrapping Pool (LBP) and managed to raise $10.3 million from 1080 participants. Tokens that were previously held by insiders and investors are now unlocked and will be distributed gradually over a period of 1 to 2 years, as per the vesting schedule mentioned below.

It's worth noting that private investors had the chance to buy tokens at a discount. This will probably keep the pressure to sell high until the tokens are fully vested. As of August 8th, 2022s circulating supply is around 69% of its total value. This shows that the token has been around for a while. Basically, the token's demand only needs to increase by 31% to meet the additional supply that will be entering the market.

Value Creation and Capture

Maple provides a unique solution to depositors and insurance providers by granting them access to the private credit market, which offers significantly higher yields compared to traditional investment options. By investing in real cash flows, these providers can reap the benefits of a diversified portfolio while minimizing their exposure to risk.

Furthermore, Maple helps businesses in need of working capital expansion by extending under-collateralized loans. This not only enables these businesses to meet their financial goals but also gives them access to funding that they might not qualify for through traditional bank and specialty finance lenders.

Although Maple's closest competitors are GoldFinch and TrueFi, each of these companies has its own unique mechanisms and focuses on different borrowing verticals. The global commercial lending market is valued at around $8 trillion, making it an enormous opportunity for all protocols to grow and expand. Additionally, there is an untapped market of borrowers who do not have access to these lenders, which presents a significant opportunity for Maple and its competitors to tap into.

Demand Drivers

The MPL token has multiple use cases and flows through various stakeholders. This generates demand for the token and captures value from the protocol in different ways. Let me explain each one below:

Governance: Indirect Control Over Treasury

Users hold power to make decisions on budget and proposals, which is crucial for DeFi protocols. Proper governance is needed to manage and allocate large treasury balances.

Staking: Accrue MPL Rewards from Open Market Buybacks

Stakers who lock up their MPL tokens can claim 50% of the protocol's revenues in the form of MPL rewards from Open Market Buybacks. While this creates natural buying pressure for the token, it relies on stakers who lock up their funds for yield. The quality of this yield is questionable, as stakers are not rewarded in stablecoins or major cryptocurrencies like ETH, but more native tokens. In a bear market, staking yields become less attractive as MPL prices fall, which is further accelerated as stakers sell their tokens (there is no lock-up period for staking). As of writing this (8/8/2022), staked MPL represents 39.3% of the total circulating supply.

Pool Cover: Earn Insurance Premiums (10% of Interest Revenue)

All pool delegates must provide pool cover in the form of MPL tokens, creating recurring demand for the token as more pool delegates are onboarded to the platform. Furthermore, third-party agents that buy MPL tokens for pool cover receive 10% of Maple's interest revenue (their insurance premiums). This is one of the strongest demand drivers for MPL, as MPL token holders can accrue non-MPL interest rewards. However, in the event of a loan default, selling BPT tokens to cover the loan loss could have a significant negative impact on MPL's price.

Borrowing Rebates

Maple Finance has proposed providing rebates to borrowers that stake MPL tokens. The structure of these fee rebates has yet to be released, but they are likely to create another strong demand driver for the MPL token.

Closing Thoughts

Maple's tokenomics are more complex compared to other DeFi protocols due to the involvement of a large number of stakeholders. The MPL token is used to incentivize activities that add value to the protocol. However, it is important to consider how long Maple can continue paying out MPL tokens as rewards, especially to stakers who are not required to have a lock-up period and may lose their incentive to continue staking if MPL rewards decrease. Therefore, further consideration needs to be given to ensure the sustainability of MPL rewards.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.