Tokenomics 101: LooksRare $LOOKS

Beyond Bootstrapping: Assessing the Tokenomics of LooksRare and their Viability in the Long Run

Introduction

LooksRare is a community-centric NFT marketplace that distinguishes itself from its main rival, OpenSea, by distributing 100% of the trading fees generated to its token stakers and incentivising collectors and traders with its LOOKS token rewards.

Upon its debut in early 2022, LooksRare experienced a surge in daily trading volume, facilitating a total volume of NFT trades of over $600 million on January 31st, 2021, more than double that of OpenSea as the graphic visualizes:

However, a significant portion of these figures was due to wash trading. If you need a refresher or are unfamiliar with the concept of wash trading, you can find a valuable resource for guidance here.

Nonetheless, excluding the volume resulting from wash trades, LooksRare managed to attain roughly 10% of OpenSea's trading volume within the first few weeks of launch, which is a significant achievement (Source). In this article, LooksRare's success factors will be examined and the future of LooksRare and its LOOKS token will be evaluated. The focus will be on their challenge to transition from incentive-fueled platform usage to a more sustainable usage through a competitive advantage for example.

Tokenomics

LooksRare incorporates LOOKS as its inherent and fungible utility token. LOOKS is specifically designed to provide the utility functions described by LooksRare and to facilitate their transfer (comp. Source).

Currently, the primary utility of LOOKS is to commit it to the staking pools in order to receive a proportionate share of the transaction fees generated on the LooksRare marketplace.

(A zoomable version of the diagram can be found here)

The tokenomics of LooksRare are fairly easy to understand. Users can buy and sell NFTs on the marketplace, and every transaction incurs a 2% fee in WETH based on transaction volume (in comparison, OpenSea charges 2.5%). This revenue is split proportionally among LOOKS token holders who have staked their tokens (Source). There are two staking options available to users:

Standard Method

Stakers receive their share of the revenue in WETH, which is considered a safer asset than LOOKS and provides diversification benefits. This option is ideal for users who prioritize lower risks and a diversified portfolio. The committed LOOKS can be withdrawn at any time, along with the WETH rewards earned.

At the time of publishing this article (4th of April, 2023), ca. 345,000 LOOKS (worth approx. $49M) are staked using this method.

LOOKS Compounder

The LOOKS Compounder, on the other hand, enables users to earn LOOKS as rewards, as WETH from transaction fees are swapped for LOOKS and distributed to this staking pool. The LOOKS rewards earned through this option are auto-compounding, eliminating the need for gas-inefficient re-staking and ensuring greater APY.

At the time of publishing, 260,000 LOOKS (worth approx. $37M) are staked using the LOOKS Compounder.

Additionally, LooksRare offers 3 types of token incentives to its users, which include:

Staking rewards

Token stakers earn LOOKS tokens on top of their staked tokens, regardless of the pool they have committed their LOOKS to. The distribution of 18.90 LOOKS per Ethereum block is proportional among the token stakers until the reward allocation is fully used (Source).

Trading rewards

Users who trade NFTs (buying and selling) on the LooksRare marketplace receive LOOKS tokens as a reward. Both buyers and sellers are rewarded, with sellers receiving 95% of the reward and buyers receiving the remaining 5%. Around 44 LOOKS per Ethereum block are distributed as trading rewards (Source).

Listing rewards

Users who list eligible NFTs for sale on the LooksRare marketplace also earn LOOKS tokens as a reward. Eligible NFTs are mainly blue-chip NFTs from well-known collections such as Bored Ape Yacht Club, Azuki, and Clone X (Source). However, on the day of writing this, LooksRare announced discontinuing the distribution of listing rewards and will introduce a new system for allocating and distributing rewards shortly.

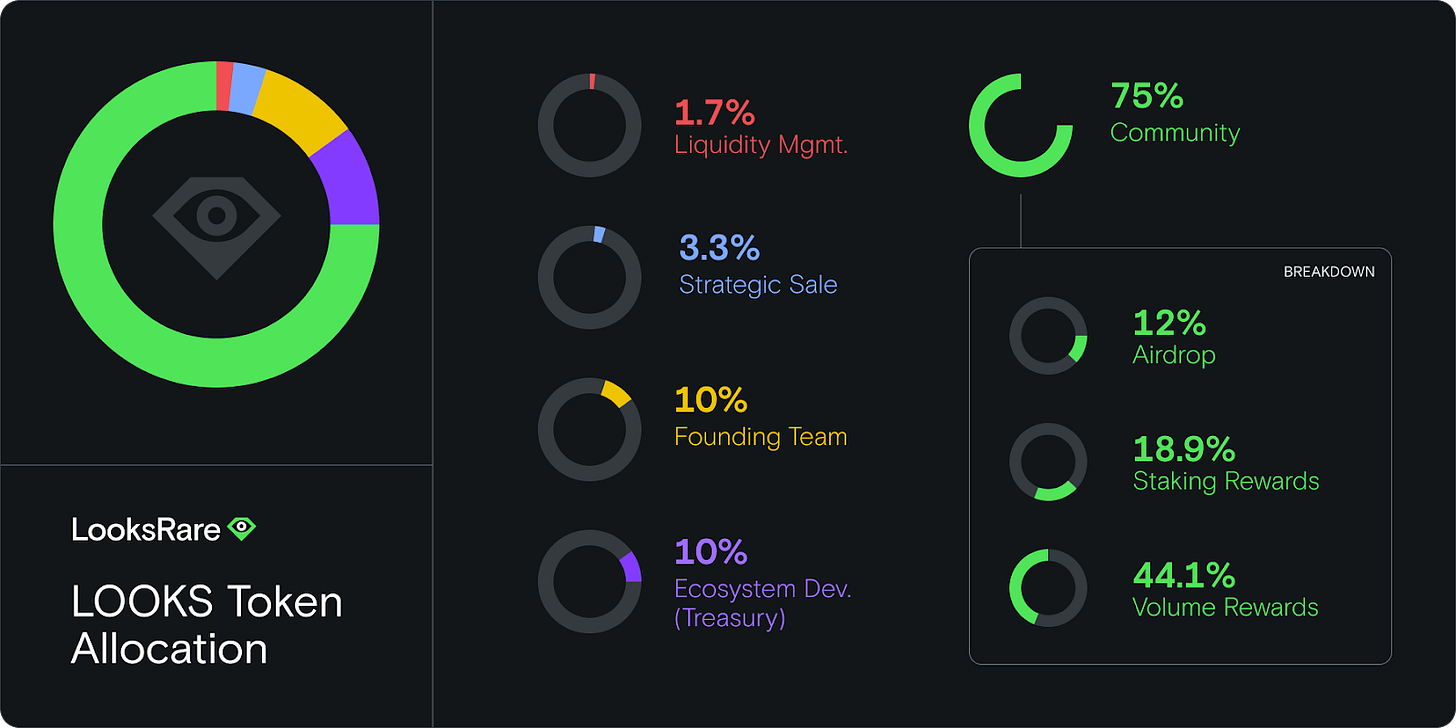

These incentives make up 63% of the total supply (see token allocation details below), which means that when they are distributed, they increase the circulating supply and if demand is not counterbalancing or surpassing the selling pressure, the price of LOOKS will decline. This also implies that existing token holders who choose not to sell their tokens are indirectly funding these incentives. In other words, they are forgoing the opportunity to sell their tokens at a potentially higher price, before the incentive payment influences the market.

The purpose of these incentives, particularly the trading and listing rewards, is to encourage the usage of the protocol. However, it's worth noting that these incentives also lead to wash trades, which account for approx. 95% of LooksRare's trading volume according to CryptoSlam (Source). Since the platform is permissionless and doesn't require its users to complete KYC, the LOOKS incentives serve as a gift to wash traders. This incentive model doesn't establish a long-term user relationship as it fails to bind them to the protocol.

Distribution and Unlocks

A total of 1 billion LOOKS tokens have been minted and allocated to the groups shown below on the 10th of January, 2022. The tokens will get released over a 2-year period (720 days).

There are two release schedules for LOOKS. One is for LOOKS tokens that can only be staked but not traded on the secondary market or transferred in other ways. The other schedule enables the staked tokens to be traded on the secondary market. However, as the following release schedules visualize, the difference between the stakeable tokens and tradeable tokens in circulation is minor:

In order to examine the current state of the release schedule, at the time of writing this article (15th of March 2023), 430 days passed since the launch and start of the release schedules. Meaning, around 80% of the total LOOKS supply is already in circulation.

The remaining token releases account for around 20% of the total supply, which could negatively affect the token's price. This is especially true for the team and treasury tokens, which are unlocked on specific dates, unlike the reward allocations and the tokens from the strategic sale whose release schedules are more streamlined. There may be higher price fluctuations than usual during the release of the remaining team- and treasury tokens.

It is worth noting that the LOOKS token's stability - just as with most other tokens - depends heavily on the token's demand, which must grow by at least 20% until the release schedule is finished in order for the token price to stay at the current level.

Furthermore, it is important to consider how the price of LOOKS will evolve when the reward allocations are fully released. As the allocations for the listing- and trading rewards are used up, the demand for using the LooksRare marketplace may decrease, which would ultimately decrease the platform's revenue and therefore the APR users can earn through staking. The lower APR might lead stakers to unstake their committed LOOKS and as there is no other major utility as of now, the tokens would be sold, potentially causing a price drop.

Value Creation & Value Capture

LooksRare was one of the first NFT marketplaces that shared 100% of its revenue with its community. The platform has consistently improved its technical infrastructure and introduced innovative features to make NFT trading more pleasant for its users.

One key aspect of LooksRare's value creation is its incentivization program for trading and listing NFTs. These incentives not only attract new users while keeping existing ones, but they also lead to an increase in trading volume, resulting in generating more fees that are distributed to token stakers, thus potentially increasing the token's value. The platform's incentive for listing blue-chip NFTs has been particularly effective in attracting high-value transactions and boosting overall trading volume.

The result of the value creation on LooksRare - trading volume - is captured by the LOOKS tokens, as all trading fees generated are proportionally distributed among LOOKS token stakers. As a result, the incentives that drive trading volume on the platform are aligned with the interests of token stakers, despite potentially increasing inflation.

It is important to note that LooksRare's success can be attributed primarily to its token incentives, which have resulted in a significant amount of wash trading. As stated before, approximately 95% of the platform's trading volume is a result of wash trading. However, it is also true that there are users who do not wash trade but use LooksRare because of the token incentives offered and/or because of some unique features, which may not be available on other NFT marketplaces such as OpenSea.

This conclusion makes it obvious that it’s crucial for LooksRare to maintain and further strengthen its competitive advantage against other NFT marketplaces by continuing to introduce new and innovative features that are hard for competitors to replicate. Some examples of such features that LooksRare already provides or plans to offer in the future are Ad-hoc notifications, NFT Aggregation, and a 3D NFT Gallery.

Demand Drivers

The primary driver for holding LOOKS is the staking rewards users can earn as a share of revenue and incentives paid out by LooksRare. When LooksRare generates higher revenue, it results in increased fees for token stakers, thereby increasing the annual percentage rate (APR). This higher APR can attract more users who may purchase LOOKS tokens to stake and earn a share of staking rewards. Conversely, if LooksRare's generated revenue decreases, token stakers may choose to unstake their LOOKS and sell them on the market, creating selling pressure.

It is worth noting that LooksRare is planning to introduce more utilities for the LOOKS token in the future to reduce its dependence on the fee-sharing feature. One of these utilities will be the governance feature, enabling LOOKS token holders to submit and vote on proposals to influence the future direction of the LooksRare protocol, including decisions on features, upgrades, and parameters.

Observations/Thoughts

In order to sustain its success, LooksRare must strive to enhance its competitive advantage beyond incentivizing users to use the platform. If LooksRare exhausts its allocation for incentivizing platform usage or even decides to continue to offer incentives and risks market inflation, it will need to attract users through more sustainable means, such as by introducing more innovative features. Failure to do so risks a loss of market share which could be in the worst-case scenario around -95% as this is estimated to be the share of incentive-fueled wash trades. The loss of market share could lead to a significant decline in revenue-based rewards paid out to LOOKS token stakers, ultimately resulting in a lower (real) APR.

Why (real) APR? Because the APR is the sum of the real - or sustainable - yield coming from the generated revenue (i.e. WETH) and the artificial yield coming from the staking rewards allocation (i.e. LOOKS rewards). Since the staking rewards allocation will be fully exhausted at some point in time, the total APR will be lower since the artificial APR will go to zero.

Without introducing other valuable token utilities besides staking, users may be more inclined to unstake and sell their tokens due to the lower APR.

The accompanying chart visualizes the revenue generated by the LooksRare marketplace and the token incentives paid out to encourage platform usage and staking rewards. The chart clearly shows that for every dollar of revenue, LooksRare spends one dollar on token incentives. This indicates that LooksRare's success thus far is heavily subsidized, and it needs to focus on generating more sustainable revenue to surpass the token incentives paid out in the long run.

Summary

In conclusion, LooksRare is a community-centric NFT marketplace that has experienced noteworthy success since its launch in early 2022. The platform distinguishes itself from its main rival, OpenSea, by offering its token stakers 100% of the trading fees generated and incentivizing collectors and traders with its LOOKS token to bootstrap platform usage.

The tokenomics of LooksRare are fairly straightforward, with users being able to buy and sell NFTs on the marketplace, with every transaction incurring a 2% fee in WETH. This revenue is split proportionally among LOOKS token holders who have staked their tokens. Additionally, LooksRare offers three types of token incentives to its users, which include additional staking rewards, trading rewards, and listing rewards.

Excluding the significant volume of wash trades, LooksRare has managed to attain roughly 10% of OpenSea's trading volume within the first few weeks of launch, which is a significant achievement.

There are still some challenges that LooksRare needs to overcome, especially the transition from an incentive-fueled platform usage to a sustainable platform usage that is a result of a strong competitive advantage against other established NFT marketplaces. For additional reading to gain a better understanding of the significance of this transition, I would suggest reading my article that addresses the fate of unprofitable blockchains.

It will be exciting how LooksRare will manage this important challenge and what its future will look like.