Tokenomics 101: Klima DAO

35024% annual yield? Even in crypto, that’s huge. When it sounds too good to be true, it often is. How does a protocol achieve this, and how long can they sustain paying out rewards this big? Before I cover that, let’s look into the basics of this protocol.

Klima DAO is a fork of Olympus DAO, so if you are unfamiliar with protocol-owned liquidity, I recommend checking out this great intro.

Klima DAO uses a similar concept to Olympus, but the goal is different.

Klima DAO’s goal is to accelerate the price appreciation of carbon assets. A high price for carbon forces companies and economies to adapt more quickly to the realities of climate change, and makes low-carbon technologies and carbon-removal projects more profitable.

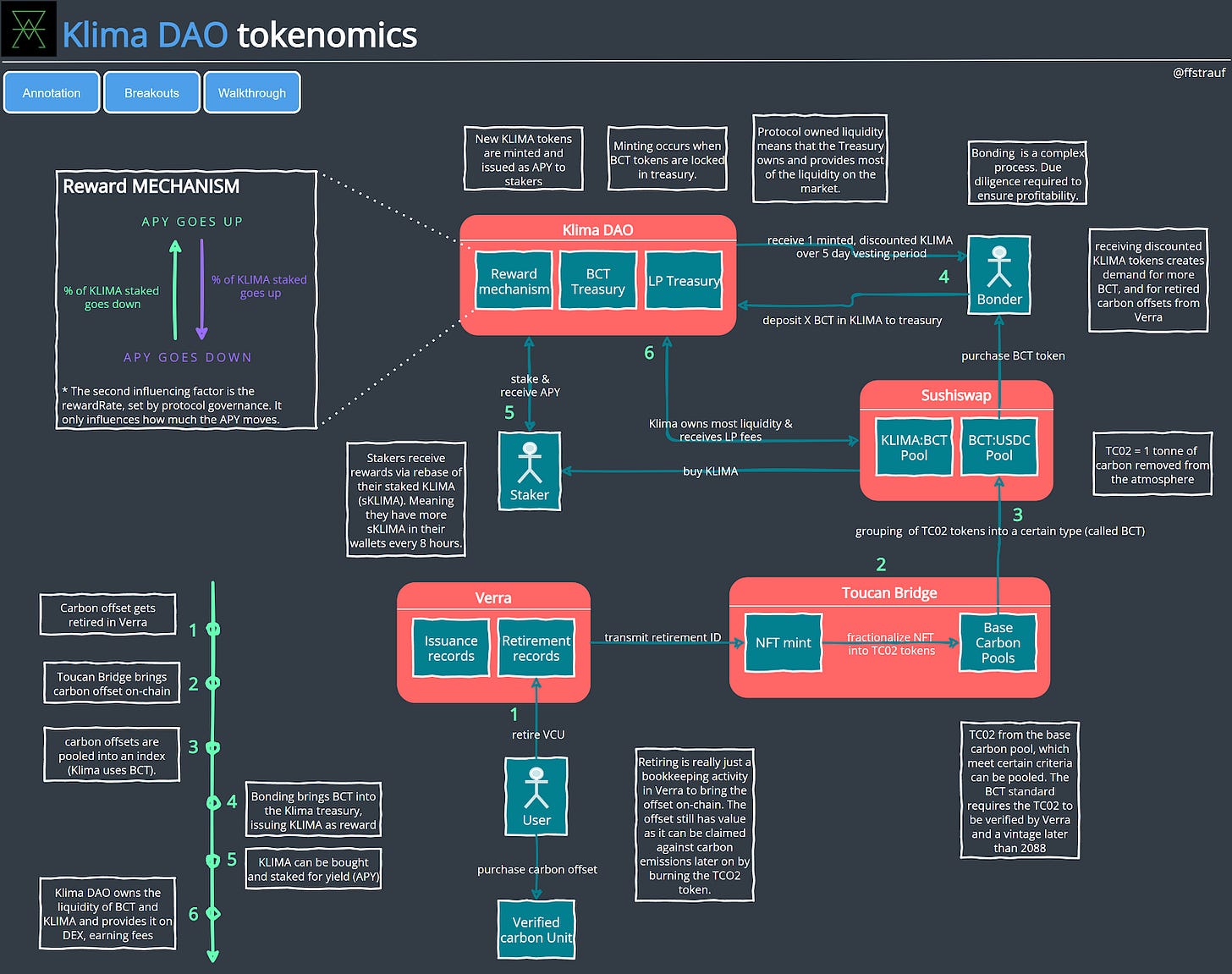

This is such an interesting project as it goes beyond just DeFi and connects to something tangible: carbon offsets. If you don’t know much about carbon trading, it can at first be quite challenging to wrap your head around it. Essentially, Klima DAO is engaging in a voluntary market of carbon emission offsets. Businesses who don’t pollute or who capture carbon (by planting trees) can collect offsets and sell them to participants who emit carbon. By buying carbon offsets, and claiming them against their emissions, a company emitting a lot of carbon can reduce their emissions (on paper at least). Klima DAO simply tries to bring these offsets on-chain, by buying as many as they can.

These on-chain carbon offsets, in the form of tokens, have not been claimed i.e., they still have value since the token can be burned to claim it against emissions. The tokens are called BCT (Base Carbon Tonnes) and create the backing for the reserve currency: KLIMA. KLIMA is not pegged to anything; its price is defined by supply and demand.

A critical piece of infrastructure making Klima DAO possible is the Toucan Carbon Bridge:

“The Carbon Bridge allows anybody to bring their carbon offsets on-chain in a tokenized form. Tokens have multiple advantages over legacy offsets, including full transparency, programmability, fractionalization, and composability with the emerging DeFi ecosystem.”

The Carbon Bridge is what connects the real-world and DeFi, and potentially enables a DAO to have an impact on the climate. Klima DAO really is a bet on more people caring about the environment. It’s a bet that more people will buy into the idea of increasing demand (and price) of carbon credits to pressure corporations into reducing carbon emissions instead of just buying and claiming offsets.

The mechanics are complicated.he chart gives the big picture view, with details per section underneath. An interactive version of the diagram can be found here.

Klima DAO - Treasury

The Klima DAO is the ‘central’ entity of the protocol. It is a DAO and decisions run via governance and can change aspects of Klima DAO.

Klima DAO can mint new KLIMA tokens upon receiving BCT backing the KLIMA. The current backing rate is about 4 BCT per 1 KLIMA, as indicated in the chart below:

The backing is called risk free value: this is the amount the treasury holds to back KLIMA. Every KLIMA holder can use this as a guidepost on how well the protocol is running.

A KLIMA token is backed by at least one BCT. At a price of $2700 per KLIMA, $2700 worth of BCT needs to be supplied. At a BCT price of $6, that would result in 450 BCT to receive 1 KLIMA.

The treasury also takes care of the runway - the duration at which rewards at the current rate can be paid out before the treasury is depleted. The current APY of 35K% can be paid for the next 100 days, assuming no additional income.

The reward rate can be adjusted via governance. This introduces a manual step to ensure that backing and income streams match with the payouts and the financials stay solid.

Bonding

BCT is supplied to the treasury via bonding. Bondholders will receive KLIMA at a discount to market price from the treasury for providing BCT. KLIMA and BCT will be paid out over the course of 5 days to avoid immediate arbitrage trading.

Klima DAO can mint new KLIMA at no cost and receive BCT in exchange (this process is called seigniorage). The bondholder however, needs to pay for buying BCT. This is one of the income streams of Klima DAO.

A similar income stream is the bonding of LP (liquidity provider) tokens. Klima DAO offers a discount on LP tokens and adds them to the treasury.

The protocol offers the high yield via staking to incentivise Bondholders not to sell, but to hold KLIMA. This reduces the general supply as KLIMA is locked up in staking.

Staking

Klima DAO encourages staking of KLIMA by rewarding stakers with currently 35K% APY (we will get to why it’s so high). The purpose of this is simple. Klima DAO wants to own its liquidity instead of paying liquidity providers farming yield.

Staking KLIMA gives liquidity to the treasury. In return, users receive an equivalent amount of sKLIMA in their wallets.

If KLIMA holders can make better returns by simply staking KLIMA instead of selling it, timing the market, they will do so.

Staking rewards are paid out via a rebase mechanism. The protocol issues new KLIMA tokens based on the calculated reward rate, increasing the supply of KLIMA.

The supply of staked KLIMA (sKLIMA) is then rebased according to the supply increase of KLIMA. Simply put, sKLIMA in a user's wallet increases over time.

Rewards are calculated by using a reward rate defined by governance. The main driving factor for APY is the percentage staked. The protocol wants to encourage a high percentage of KLIMA to be staked. To achieve this, APY increases as the percentage of staked KLIMA declines. A higher APY will increase demand for KLIMA to be staked. A very simple sample calculation can be found here.

Holding KLIMA or sKLIMA will allow participation in governance.

@Asfi simulates an unstaking event here. Ultimately, the treasury would be able to sell BCT to keep KLIMA above its intrinsic value.

Sushiswap Liquidity

Klima DAO owns most of its liquidity; KLIMA via staking, treasury with BCT and LP tokens.

Klima DAOs goal is to provide a liquid market for BCT. To achieve this, the protocol provides its assets as liquidity to decentralized exchanges. This is an income stream (~4m in 10days) for the protocol:

Currently pools of BCT:KLIMA and BCT:USDC are provided on Sushiswap.

Verra

Verra (Verified carbon standard) in itself has nothing to do with crypto. Think of it as a registry for carbon offsets.

Offsets can be retired, meaning they are locked into the Verra platform in a bookkeeping process called retiring. This mechanism is commonly used for moving carbon offsets between different systems.

Retiring an offset however, does not mean it is claimed. This is very important to the protocol. Unclaimed offsets still have value since they can still be claimed against carbon emissions.

Toucan Bridge

Toucan mints an NFT for the carbon offsets (a batch) that are to be retired. The NFTs transaction hash is used in the retirement process, saving the hash in the retirement note in Verra. This connects the NFT on-chain and the carbon offset batch in Verra.

The offset batch NFT can now be turned into tokens by fractionalizing it. An NFT representing a batch of 100 offsets would result in 100 TCO2 tokens. Every TCO2 token now represents 1 tonne of carbon offsets (the details are explained here).

TCO2 of certain types are grouped together in indexed pools. BCT is the pool for TC02 tokens, verified by Verra and with a vintage later than 2008.

So where does the 35K% really come from?

The economics of Klima DAO are built around growth of the network and the number of participants supplying BCT and that’s kind of how a ponzi scheme is often described, but Klima DAO is not fraudulent. What the protocol is doing is open; smart contracts, analytics and statistics all exist on-chain, reviewable by anyone. If demand for houses in beach proximity were to decline, that market would most likely collapse like a ponzi scheme too.

To answer the original question, the income streams are fees from liquidity provided to the market and seigniorage from bond sales. As long as Klima DAO has an income and achieves the targeted backing rate of 1 BCT to 1 Klima, it will be able to pay out an APY. Like with Olympus DAO, the APY will likely decrease over time, but the current Olympus DAO APY of 8K% is still pretty good. As long as there is demand for this project, it will likely be able to support a healthy APY.

The whole model is built around the climate change narrative. The more people get interested in supporting it, the more demand for KLIMA and BCT will arise. Demand for BCT will help drive up its price and impact the backing of Klima DAOs treasury and the incentive for real-world companies to produce carbon offsets. It’s a bet on saving the planet, and I can see a lot of demand for that.

Closing Thoughts

The most exciting thing about this protocol is that it can and will have real-world impact. Increasing demand for offsets increases the price of offsets and makes it worthy for businesses to capture or reduce carbon.

In light of COP26, Klima DAO has made it into mainstream news by being one of the driving forces increasing the price of carbon offsets:

As Jacob Greber writes in this Australian Financial Review article, there is:

“ … potential demand created by a new carbon backed digital currency called KLIMA, which in the past two weeks has absorbed and retired 7 million carbon credits, which is 23 times more than BHP required in the last year.”

That ’crypto enables us to coordinate at a larger scale’ is something I’ve heard on the Bankless podcast, and it just perfectly sums up what Klima DAO is doing and achieving here. To see protocols like Klima tackling major practical issues such as climate change, whilst also offering opportunity for financial reward, is a major benefit of Web3 technology and one we all hope to see more of.

Interested in collaborating on tokenomics and discovering new protocols? Join our tokenomics discord channel.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Thanks for this excellent article, Florian. I've been watching KLIMA as I really like the idea and I want this project to succeed. The anonymity of the folks behind it gives me great pause but I love the concept. It's been dropping like a stone and I can't understand why. But something you raised in your article sparked this question - is there a point to which KLIMA could fall where it would be equal in value to a BCT and would this price constitute a 'floor' for the token? Would that be an optimal buy point?