Tokenomics 101: GMX

A GMX glance: The next level derivatives platform

TL;DR: Read the summary on the Tokenomics Hub

Introduction

Are you curious about how perpetual contracts work and want to explore decentralized trading’s full potential? You are hitting the right article, which is your first step to properly evaluate one of the most successful and unique decentralized derivatives trading exchanges. If you don’t know how perpetual trading works, here is a valuable article to read before going on.

GMX is a decentralized spot and perpetual swap exchange built on Arbitrum and Avalanche networks that support low swap fees and zero-price impact trades. Launched in Sept 2021 on Arbitrum - an Ethereum layer-2 Rollup designed to boost the speed and scalability of Ethereum smart contracts - there is no clear information about the team behind it: a certain Gambit Financial led the project, a spot and perpetual exchange on Binance Smart Chain. GMX is a rebrand from the now deprecated Gambit exchange.

Perpetual contract traders can use up to 30X leverage, and the trading experience resembles the functionalities of centralized exchanges. Still, it’s done directly through a non-custodial wallet, with lower fees and faster trade settlement time. In addition, the protocol uses Chainlink oracles for dynamic pricing to aggregate prices from other relevant exchanges without having a single point of failure.

The protocol has a native token called $GMX, which functions as a governance, utility, and value-accrual token. Trading is supported by a unique multi-asset pool (called “GLP”) that earns liquidity providers’ fees through market making, swap fees, leverage trading, and asset rebalancing.

At the time of writing, GMX counts around $750 million (staked tokens included) in total value locked, and it is 16th in the DeFiLlama TVL ranking list.

Source: DefiLlama

Tokenomics

Before going on, let’s have a look at the high-level diagram (zoomable version here):

The protocol relies on Liquidity Providers (LPs) who deposit liquidity in different cryptocurrencies such as wBTC, ETH, LINK, UNI, and some significant stablecoins. By doing this, they mint $GLP (LP token). The user can trade against the so-called GLP pool, where liquidity is added, by placing perpetual trades and depositing some collateral. All the collected fees go to the GMX fee pool, which issues fee rewards in $ETH/$AVAX, depending on the transacting blockchain. Notice that the GLP pool is a counterparty to traders: if they make profits, then LPs incur a loss, and vice-versa.

Supplying liquidity is one of many ways to earn from the platform. In turn, a trader can use three tokens to compound yield:

GMX token

$GMX is a utility and governance token. Users can choose to stake their tokens and get three rewards:

Participate in 30% of all generated protocol fees.

Earn escrowed GMX (esGMX) tokens. These can be staked for rewards or vested to gain other $GMX over a 12-month vesting period.

Earn Multiplier Points (MP) that boost the yield. These MPs reward long-term holders without contributing to token inflation.

Source: GMX dashboard

esGMX token

A user can earn such tokens by staking $GMX or $GLP. If staked, they accrue rewards as follows:

Participate in 30% of all generated protocol fees (compounded to the payments received for GMX/GLP staking alone).

Earn additional escrowed GMX (esGMX) tokens (compounded to the esGMX received for GMX/GLP staking alone).

Earn Multiplier Points (MP) that boost the yield (compounded to the MPs received for GMX/GLP staking alone).

The esGMX tokens can also be vested. In this case, the GMX/GLP staked are reserved, and esGMX no longer accrues the above staking rewards. Instead, staked GMX/GLP continues to accrue staking rewards. During the following 12 months, vested esGMX gets converted back into $GMX. If a user wants to unlock his vested esGMX, he has to keep some $GLP in the pool.

GLP token

At the core functionality of the exchange is a community-owned multi-asset liquidity pool — the GLP pool. The Automated Market Maker (AMM) algorithm uses the pool to serve the decentralized spot exchange (swap) and perpetual contract services. Contrary to some liquidity pools, GLP suffers no impermanent loss.

A user can choose to lock assets in the pool, and mint $GLP, representing the user’s stake in the pool. Newly minted $GLP are automatically staked and provide earnings to the user:

Participate in 70% of all generated protocol fees.

Earn escrowed GMX (esGMX) tokens. These can be staked for rewards or vested to gain other $GMX over a 12-month vesting period.

A user can close the position and withdraw supplied collateral at any moment, which triggers a $GLP burn mechanism. That is the case with a non-inflationary tokenomics model since incentives do not directly yield newly minted $GMX.

Source: GMX dashboard

The protocol also established a Floor Price Fund that helps ensure liquidity in the GLP pool and provides a reliable stream of $ETH rewards for $GMX stakers. As the floor price fund increases, it could be used to buy back and burn $GMX if the Floor Price Fund/Total GMX supply < Market price of GMX. Such a mechanism would set a minimum floor price for $GMX in terms of $ETH and $GLP.

Distribution and Unlocks

The Initial token distribution (TGE) of $GMX is as follows:

45.28% (6.000.000 $GMX) allocated to XVIX and Gambit migration

15.09% (2.000.000 $GMX) allocated to the Floor Price Fund

15.09% (2.000.000 $GMX) allocated to reserve (for vesting from esGMX rewards)

15.09% (2.000.000 $GMX) allocated to liquidity (paired with ETH for liquidity on Uniswap)

7.55% (1.000.000 $GMX) allocated to the presale round

1.89% (250.000 $GMX) allocated to marketing & partnership (distributed to contributors linearly over two years)

Source: CoinGecko

Following the GMX exchange’s rebranding from Gambit and merging XVIV tokens, a considerable portion (45%) of the GMX token supply belongs to old Gambit ($GMT) and $XVIX holders who migrated their tokens to GMX. The motivation behind such migration was to consolidate all the tokens and simplify the overall tokenomics so that the token’s utility is not outsized compared to other tokens.

Each converted GMX had a starting price of 2 USD, below the initial conversion rate:

14.585 GMX per XVIX

5.485 GMX per GMT

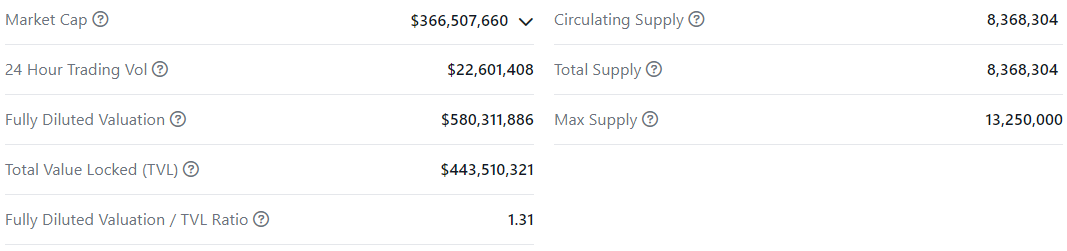

The forecasted max supply of $GMX is 13.25M, with around 8.4M circulating. The increase in circulating supply will vary depending on the number of tokens (esGMX) that get vested and the number of tokens used for marketing and partnerships. In any case, minting new tokens beyond the 13.25M threshold would be possible only after a governance acceptance process, and new issuance will have a 28 days timelock. Below you can find the token emission for 2022:

Source: govGMX

At the time of writing, the MarketCap/FDV ratio is around 63%, meaning many tokens have yet to be released. Notice, however, there is no hard cap encoded in the smart contract.

Below you can find the cumulative emission so far. From this chart, we can derive the annual estimated inflation rate of 19% since Jan 2022 (note that this is not a linear emission and the slope can change based on the statements described before):

Source: Messari

With more than 184.000 unique holders, the protocol looks decentralized as smart contracts’ treasury/liquidity represents many top holders. By the way, be aware that the team controls many parameters which can be enforced without governance approval (they can also pause trading using an admin key).

The new issuance is almost entirely reflected by the actual vesting process, which will turn esGMX into GMX after a year; around 37% are yet to be released. Furthermore, since users have vested their tokens in different epochs, no specific dates are flooded by new shock emissions. Finally, almost 82% of the circulating tokens are currently staked (for yield compounding), so a supply shortage leads to buying pressure.

Source: CoinGecko

Value creation and value capture

GMX provides users with unique features:

| Minimal liquidation risks

The GMX's high-quality aggregate price feeds (powered by Chainlink) enable precise computation of the current position price, allowing an accurate liquidation point compared to the margin ratio.

| Low costs

GMX allows users to enter and exit positions with minimal spread and zero price impact. This design may help traders get better entry prices than some order book-based exchanges, which might suffer from slippage.

| Simple swap

GMX users can open positions through a simple swap interface. This function lets users conveniently swap from any supported asset into the position of their choice.

| Capital efficiency

Its dual exchange model supports both spot and leveraged trading of perpetual swaps, improving capital efficiency due to the high asset utilization of the GLP pool, which lets user deposits generate extra yield and not sit idle.

| Do the incentives create commonwealth, and are they value-aligned?

Absolutely yes.

Governance rights are desirable by token holders since they can take advantage of protocol decisions which may lead to higher revenues. All stakers receive fee revenues, so a considerable incentive exists to lock their tokens. A part of the revenues is allocated as real cash flow in $ETH/$AVAX, relieving $GMX emission, and the $GLP mint/burn mechanism connotes a non-inflationary tokenomics model. Finally, the referral program is the extra boost a DEX needs besides that low fee, minimal liquidation risk, and capital efficiency.

Demand Drivers

| Is the token supposed to be held or spent?

To answer this question, we should analyze how users interact with the platform:

Token holders: are incentivized by governance rights over the protocol and rewards in terms of esGMX, MPs, and sharing protocol fees (30%) if staked token.

Liquidity providers: are encouraged to supply collateral (i.e., mint $GLP) to increase GLP pool size by receiving esGMX and participating in a consistent percentage (70%) of the protocol fees.

Traders: GMX allows future perpetual trading whose market size is far vaster than the spot market. Furthermore, the protocol’s referral program drives adoption by incentivizing new users’ onboarding and generating discounts for the referral code owner.

The token $GMX is supposed to be held since it grants the owners voting rights. Furthermore, the overall staking mechanism is a massive incentive for token holders to earn passive yield, and traders benefit from the referral bonus. Regarding revenue, GMX ranks seventh among Dapps with an 18M half-year revenue. It is rapidly reaching the first-mover dYdX:

Source: Token Terminal

Since token holders/stakers receive all generated platform fees, more protocol revenues increase the token holders’ value. The protocol’s revenues come from the following primary sources:

Swap fees: ranging from 0.2% - 0.8% depending on the asset composition of the GLP pool.

Trading fees: to manage the position and deposit/withdraw collateral accounting for 0.1% of the position size for each trading operation.

Execution fees: to execute the trade. The keepers collect them in $ETH/$AVAX.

Liquidation fees: paid to the keepers. The value depends on the type of collateral involved.

Borrow fees: the hourly borrowing fee will vary based on utilization and is equal to (assets borrowed)/(total assets in the pool)*0.01%.

Such design is a huge demand driver given that GMX is so appealing that the platform’s trading fees have overcome Uniswap’s:

Source: Bitcoin insider

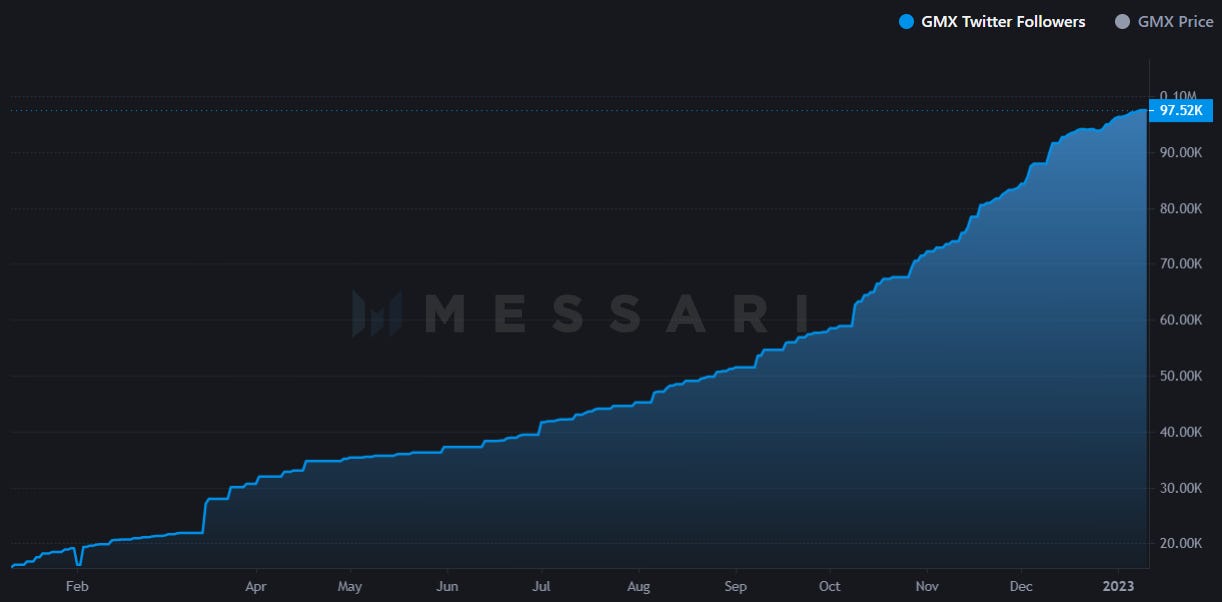

Finally, GMX has a solid and active community which could lead to long-term sustainability since they can help to promote the token and drive adoption:

Source: Messari

Observations/Thoughts

Although GMX is not the first-mover among derivatives DEXs, over time, it has outclassed the competition and climbed the TVL ranking, overcoming dYdX. GMX provides traders and investors with a well-developed platform to perform various financial activities like investing, trading, and passive earning.

Being built on low-fee blockchains and Layer-2 solutions, allows cryptocurrency investors to rotate their assets and pay pocket-friendly fees. This guarantees a consistent demand over time from users. As a result, it is the leading player in the crypto derivatives field whose market is far more significant than the spot.

Comparing it to dYdX, it accepts only $USDC as liquidity, and $DYDX acts as governance and utility token (earn trading rewards, fee discounts).

Another relevant player is Gains Network, built on Polygon, which offers synthetic assets trading with up to 1000x leverage. Users can provide liquidity in the form of $DAI, and traders benefit from two-sided tokens:

$GNS which accrues $DAI rewards if staked

GNS NFT grants holders benefit from boosted rewards and spread reduction

As for downsides, the team is anonymous, and the DAO is far from true decentralization. Nevertheless, it planned its roadmap through an internal governance process which would bring more community participation in the protocol’s critical decisions. The vision of GMX is to become an even more complete and user-friendly DEX for on-chain leverage trading. The current roadmap includes many improvements, such as:

Better UI and UX to improve traders’ experience

Synthetic assets will be available on the platform

Network expansion alongside Arbitrum and Avalanche

Below are some relevant risks GMX has to take into account:

Liquidity risks. As stated, the GLP pool is the counterparty to traders. If profit traders » profit liquidity providers, the GLP pool could get drained and suffer low liquidity, so the protocol should allow more yield to be attractive for LPs. Often, more yield means more token inflation at the end, even though the GMX token mechanism leads to controlled inflation.

Market manipulation. The token is highly volatile, and the price action looks like a spiky chart. To make an example, on September 22, a DeFi trader manipulated $AVAX by taking advantage of the difference in the slippage between GMX and CEXs. Although GMX worked “as designed,” the team decided to cap at $2M AVAX open interest on their exchange.

Centralization risk. Per the current configuration, the keepers — some team members who choose assets’ price GMX — have some degree to charge an extra invisible price to the user. A poor initiative only sets a spread if the keeper’s price deviates from the Chainlink price by more than 2.5%. This means that a keeper can charge up to such spread value. And this would only make the price worse for the traders (non-value-aligned).

Scalability risk. For the GMX growth, it is necessary to scale up and offer more and more assets on the platform over time. However, this could be limited and lead to a scalability issue since high-volatile crypto assets (the majority) don’t have enough liquidity and can be manipulated.

As a result, we can assume some ideas for improvement that may lead the protocol to capture even more value:

Security. Market manipulation has already occurred. The platform needs to enhance its security framework. It could involve implementing cutting-edge security measures, such as advanced encryption and multi-factor authentication, to protect against hacking and other security threats.

Tradable assets. Following the GMX roadmap to extend available assets within the platform, such as synthetics (the team must exert caution in order not to fall inside the boundary of the securities framework), more and more asset types could be game-changing for the protocol. It could include adding new cryptocurrencies and other assets, such as stocks, commodities, or even fiat currencies.

Decentralization improvement. Given that the protocol is far from true decentralization, the protocol should make several improvements to increase DAO power at the team’s expense. SourceCred, for example, is a tool that allows DAOs to measure and automatically reward value creation inside the organization. In such a context, good decision-makers inside the DAO should be rewarded, while the bad ones should be slashed.

Summary

GMX is the leading DEX derivatives platform for users who want to trade with leverage on cryptos without incurring high fees and slippage. Several opportunities to earn through different token staking mechanisms make the protocol attractive for speculation and governance rights. Although the team is anonymous and controls many protocol parameters that can enforce without formal governance approval, there are some initiatives to further decentralize the decision process by giving more and more responsibilities to token holders.

Although 37% of tokens are yet to be released, the annual inflation rate is small enough. Furthermore, more than 82% of the circulating tokens are currently staked (for yield compounding), so there is a supply shortage, leading to buying pressure. The business model is robust since most rewards come from real cash flow ($ETH/$AVAX) from user trading.

Now you have the tools to start your journey, will you act as LP and support the protocol with liquidity or start perpetual trading by showing your strengths?

Always be responsible

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

nice!