Tokenomics 101: Convex Finance

The Tokenomics of a Yield Bearing Asset

Intro

Convex is a product built to work within the Curve ecosystem and therefore cannot be fully understood without having a basic understanding of Curve, the veToken model and the Curve Wars.

However, the crux of the argument for Convex revolves around the demand that exists to buy and hold $CRV (Curve’s native token) and –due to how Curve is designed, the pain points for certain users which make it a less attractive hold.

So, what is the demand for $CRV and what are the pain points?

$CRV Demand

$CRV’s meta demand is the desire from LPs to increase their income (yield on assets). The mechanism that Curve employs to capture this demand is known as the veToken model. LPs who buy and lock $CRV attain $veCRV (vote-escrowed $CRV) which is the token that has the voting power to determine which pools get $CRV emissions, and thus, determine the yield on LP positions.

Therefore, we can break $CRV demand down into 3 types:

$CRV Pain Points

Since liquidity follows yield, it will flock to wherever it can generate the best return. In the case of Curve, in order for LPs to generate the best return they have to have a certain amount of locked $CRV for the maximum amount of time, which is 4 years. The amount of $CRV required to ascertain this max return depends on the size of the LP position.

This is where the first pain point lies: having to lock up tokens for 4 years in order to gain the max yield (known as max boost in the Curve ecosystem) on your LP is ungodly. Nobody likes having illiquid capital, especially in a sector as fast moving as the crypto space.

“Well just lock it up for less time” you may be thinking. But alas, we humans are greedy and want that juicy max boost. So the issue boils down to (1) wanting max boost but (2) not wanting to have to lockup for 4 years to get it.

The second pain point relates to the difficulty of use and level of understanding/maintenance needed to attain max boost using Curve. Simply put it’s not easy, takes time and requires the user to have a decent understanding of the system.

This is where Convex comes in.

Yield Optimizer – Convex’s First Product

Convex solves these pain points by allowing users to easily gain max boost whilst remaining liquid by depositing their $CRV into the protocol. It does this by (1) allowing users to pool their $veCRV together with other holders in order to generate the highest yield and by (2) providing a liquid wrapper, known as $cvxCRV for those who wish to exit their positions before the 4 year period is over. This means that Convex is essentially unionising $veCRV and that its first product is essentially a yield optimizer for holders & LPs.

This results in an interesting flywheel:

Read the full breakdown by Delphi Digital here

In essence, users voluntarily, permanently deposit their $CRV into Convex because they want max boost without all the hassle and a liquid wrapper. Convex gives them this and in turn increases the incentive for other $CRV holders to do the same since the more $CRV Convex accumulates the better it will be able to control Curve emissions and vote in the favour of the pools they’re LPing.

Via its yield optimisation service, convex has been able to acquire a majority (~57%) of the $veCRV voting power and has essentially cornered the Curve market and won the curve wars.

You may be thinking; well that’s great, but what does this have to do with $CVX?

Tokenomics of $CVX

As seen in the diagram, the goal is to accumulate as much $veCRV as possible. Convex accrues $CRV via new deposits and by claiming $CRV rewards from its LP positions. Upon claiming, $CVX is distributed to LP token holders and $cvxCRV stakers.

Convex takes a cut of the claimed $CRV rewards which are split between $CVX stakers, $cvxCRV stakers & $vlCVX holders. Notably, vlCVX holders and CVX stakers are distributed these rewards in the form of Convex’s wrapper ($cvxCRV), so as to accrue as much veCRV as possible.

Finally the LP token holders get their boost which comes from the claimed $CRV from the pools.

You can watch a full diagram walkthrough here.

Supply

$CVX has a max supply of 100M tokens, a circulating supply of ~67M and a total supply of ~94M.

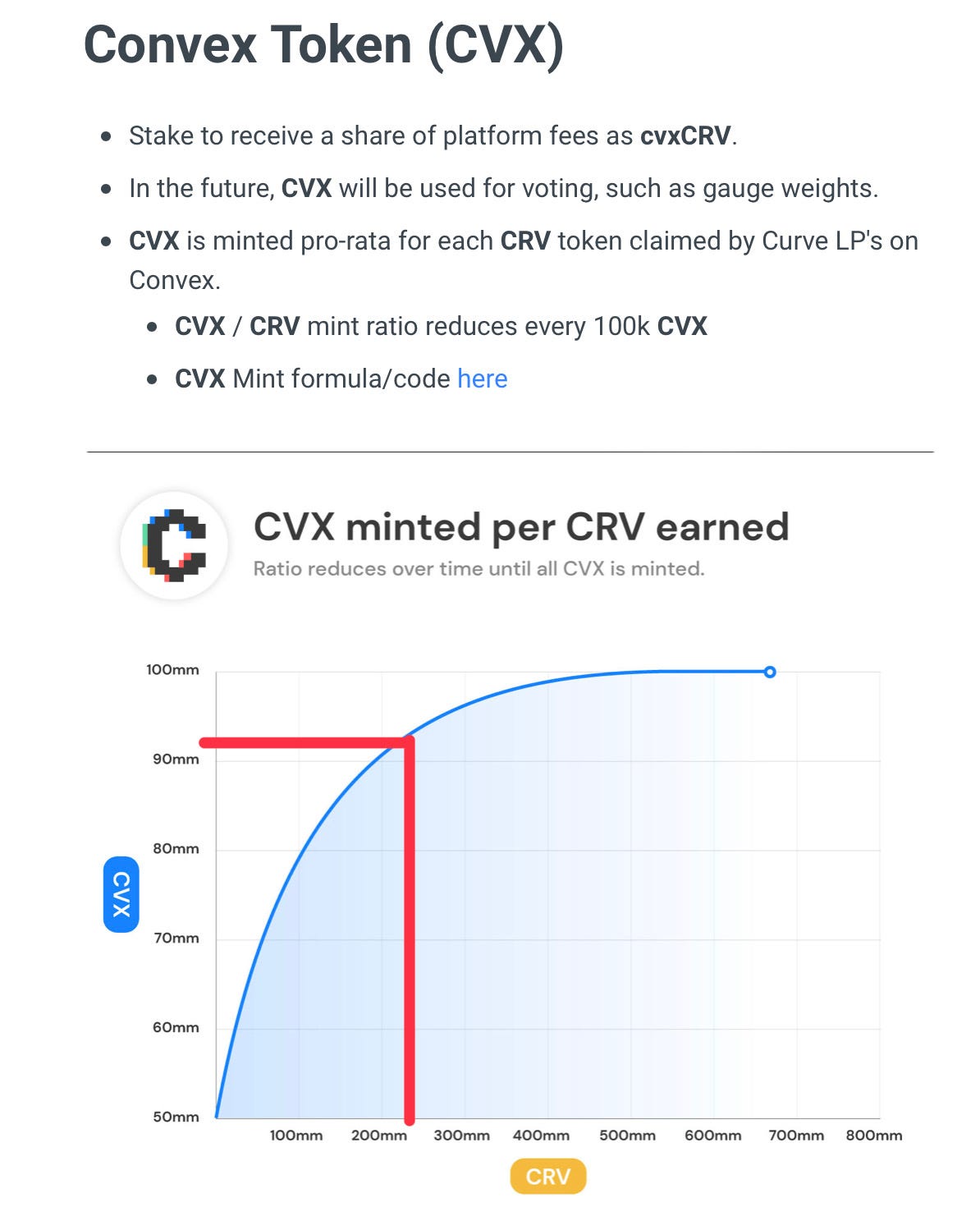

With regards to the total supply, the way tokens are minted is quite unique, rather than being a function of time, it is linked to the amount of $CRV earned by the protocol. Convex currently holds ~280M $CRV which equates to ~94M $CVX or ~94% of max supply (i.e total supply).

As the chart indicates, minting follows a logarithmic curve where gradually, the more $CRV earned, the less $CVX is minted until max supply is reached. For every 100k of $CVX minted, the CVX/CRV mint ratio decreases, see the formula here. Users voluntarily, permanently deposit their $CRV into Convex.

This means that there is a relationship between the amount of $CVX minted and the amount of $CRV locked in the protocol. As of writing the ratio is 1:5.49, meaning that 1 $CVX currently controls 5.49 $CRV. Check the current ratio here.

Additionally, this results in some interesting dynamics:

As more $CRV is accumulated, more $CVX will be emitted until max supply is reached, once that happens, Convex will still accumulate $CRV and this has the effect of increasing the $CVX:$CRV ratio. Meaning that once the max supply is hit, the minimum ratio will be 1:6.5 and as more $CRV is accumulated the ratio only increases.

Since each $CVX essentially contains an underlying amount of $CRV, there also exists a relationship between the two token prices. This is best illustrated with an example:

If you want voting power, you have two options: buy $CRV and lock it or buy $CVX and lock it. Nuance aside, buyers will tend towards the cheapest option.

Using the current prices, $CVX = $5.18 and $CRV = $1.07

Meaning that it is currently more capital efficient to buy $CVX over $CRV. The below chart indicates this quite nicely;

If purple line is below 0 line = cheaper to buy CVX over underlying CRV

If purple line is above 0 line = cheaper to buy underlying CRV over CVX

Furthermore, this results in an interesting price dynamic:

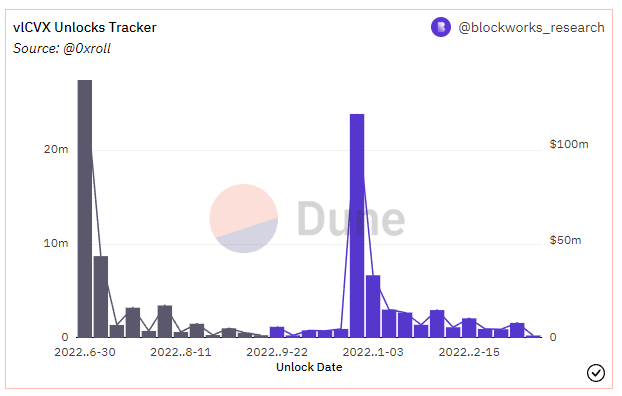

The last thing to mention with regards to the $CVX supply is unlocks. There is an interesting locking mechanism that $CVX employs. Similar to how users have to lock up $CRV to gain $veCRV for emissions voting, $CVX holders have to lock up their tokens to gain $vlCVX if they wish to participate in the bribe marketplace (explained below). Holders lock up their $CVX for ~17 weeks. This means that tokens will be unlocked after this period and have to be relocked. Ideally, we would like to see a fair distribution of locks/unlocks and a lack of grouping to make drastic selloffs less likely.

Demand

Convex quickly understood the value of the $veCRV they were accumulating via their Yield Optimisation service and the demand it garnered in being able to control deep liquidity. Liquidity is the name of the game. This is especially important for protocols looking to deploy a stablecoin or synthetic such as $FRAX or $stETH. The reason is that a protocol of this kind wants its product (i.e stablecoin or synthetic) to keep a tight peg. They need deep liquidity to do this, liquidity comes from high yield, which comes from emissions, which comes from the governance power of $veCRV, which Convex has a majority share of, which can only be acquired via $CVX.

This is where the demand for $CVX comes from.

Bribe Marketplace – Their Second Product

What do you do when you have something that someone else wants? You can either sell it to them or even better, let them rent it from you. Convex created a bribe marketplace where protocols looking to deepen their liquidity can bribe $CVX holders to vote for their gauge on Curve. A gauge is simply what determines the amount of $CRV emissions a pool will receive, thus driving liquidity and a better peg to their products ($FRAX, $stETH, etc).

Convex essentially productised their $veCRV that they had accumulated via their LP Yield Optimiser product and in doing so turned $CVX into a yield bearing asset.

This means that demand for $CVX comes from the desire for its underlying locked $CRV AND from the yield generated by bribes.

Value Creation and Capture

How Does Convex Create Value?

The way Convex creates value for its users is twofold. The yield optimisation service creates value for the user of the protocol in that it allows max boost with no lockup. Subsequently, the more users that deposit their $CRV into Convex the more value that is created since it allows for better yields and makes the flywheel spin faster. As long as there’s an incentive for users to deposit their LP and $CRV into Convex, this competitive advantage will only grow.

Furthermore, the bribe marketplace creates value for protocols in that it allows for a more efficient way to drive liquidity, as this video explains.

How Does Convex Capture This Value?

Convex takes a 16% fee in exchange for providing max boost and no lockups. It is split between $cvxCRV stakers (Convex’s liquid wrapper of $CRV), paid in $CRV and $CVX stakers, paid in $cvxCRV.

Another form of value capture comes from the fact that $CVX is a type of leveraged $CRV wrapper and, as mentioned above, experiences an interesting price dynamic in that it is ‘paired’ with $CRV. This price dynamic works thanks to the productisation of $veCRV, i.e the bribe marketplace, thus it can be seen as a type of value capture mechanism.

Distribution and Unlocks

50% Curve LP rewards Rewarded pro-rata for CRV received on Convex

25% Liquidity mining Distributed over 4 years. (Incentive programs, currently CVX/ETH and cvxCRV/CRV)

9.7% Treasury Vested over 1 year. Used for future incentives or other community driven activities

1% veCRV holders Instantly claimable airdrop

1% veCRV holders who vote to whitelist Convex Instantly claimable airdrop

3.3% Investors Vested over 1 year. 100% of investment funds used to pre-seed boost and locked forever(no cvxCRV minted).

10% Convex Team Vested over 1 year

Convex launched in mid-May 2021 and this means that tokens distributed to the Treasury, Investors and Team members have already been unlocked, this is good. Furthermore, ~67% of supply has already been emitted, meaning that there will be an inflation of 33%, which $CVX demand will have to absorb to maintain current price.

Observations/Thoughts

Curve🤝Convex

Convex is essentially a yield optimiser for veTokens. Currently, the majority of the tokens that it has accumulated has been $veCRV, meaning that if Curve fails or loses importance, then this will directly affect $CVX. However, Convex has recently started to offer a similar service for $veFXS (vote-escrowed $FXS) which somewhat reduces its dependence on Curve’s dominance/success.

$CRV Wrapper

$cvxCRV is a Convex $CRV wrapper, as mentioned above, when you deposit $CRV into Convex you get an equal amount of $cvxCRV which can then be sold for whatever asset you like. Those with a keen eye will have noticed that what this means is that, in order for $cvxCRV to perform its purpose, it has to maintain peg with $CRV. From the distribution breakdown we can see that 25% (25M) of supply is designated as rewards for the LPs of the cvxCRV/CRV & CVX/ETH pools. Looking at the Masterchef contract shows us that 17M of this allocation is remaining. Furthermore, Convex is itself a user of its bribe marketplace, looking to deepen liquidity for its wrapper and maintain a tight peg.

In practice we can see that $cvxCRV has maintained a decent peg, but it remains to be seen how the peg will hold up once the LP rewards dry up in May 2025.

Terra & Their $CVX bag

Terra currently holds ~2.3M $CVX which used to make sense. But now that $UST is no longer around, it is questionable what they’re holding this for, thus it falls into the category of possible sell pressure. The current daily volume of $CVX is ~$11M. Buyers beware, by selling at current prices Terra could double that volume.

Bribes Dry Up

In order for a protocol to accumulate $veCRV they have to be whitelisted by Curve. Convex was one of the first 3 protocols to get this privilege but now we are seeing more and more protocols being approved to accumulate $veCRV.

This reduces the necessity for them to bribe $CVX holders, thus reducing the desirability /holdability of the asset. A counter argument to this is that, since Convex holds the majority share of emitted $CRV, $CVX will always be relevant due to it acting as the ‘difference’ in voting power required to gain majority vote.

Unlocks

Due to an issue with the locking contract there was a large $CVX unlock (roughly 27M) on June 30th (the first large candle on the chart below). Due to the vote lock system, the next major unlock will be on the 26/10 where 23M is projected to unlock (the second large candle on the chart below).

Smol $CVX bags

The bribe rounds occur biweekly where $CVX holders vote on what protocols they want to subsidise. Protocols normally bribe in their own token, i.e Frax bribes in $FRAX. What this means is that you can choose what you want to be paid in, this is somewhat of a double edged sword if your $CVX bags are on the small side. The reason being that you won’t get much per round and due to Ethereum gas fees it may not be worth it to claim the reward, i.e 0.98 $FRAX to claim but gas costs $3 –and this is bear market gas we’re talking about. There are solutions for this like the Llama Airforce Union and other pounders, but that then exposes you to further smart contract risk.

No Treasury Inflow

Even though there is a 16% fee that Convex takes, none of that gets redirected to the treasury. This is great for users, but what happens when the initial allocation distributed to the Treasury runs out? The Docs indicate the possibility to set a "treasury address" and allocate up to 2% of platform fees back to this address. Also, there is a supposed mechanism in place that allows for $CVX to be deposited back into the treasury (voluntarily) but it hasn’t been enabled yet.

Summary

Convex has been able to provide great value for $CRV holders & LPs and was quick to understand the value of $veCRV and the desire it garnered from protocols looking to deepen liquidity. This all translates pretty decently to $CVX and thus makes it even more desirable as an investment in itself. Furthermore, the CVX:CRV ratio will only get better over time (granted users still see value in depositing $CRV into Convex), meaning that the leverage will only get better. The distribution of $CVX is also favourable since the Team/Investor allocation is way below industry standard and has already vested. It remains to be seen if the drying up of bribes and the stability of cvxCRV wrapper will be issues in time to come. For now however, Convex seems to have solidified its role in the Curve Ecosystem and DeFi has undergone a considerable change thanks to it.