Tokenomics 101: Brave (BAT)

The Brave Browser rethinks advertising and keeps on growing -- can they increase BAT utility to capture more value?

Introduction

Brave is a software company that has the Brave Browser as its core product, which aims to make web3 easily accessible while providing a user-centric design that natively blocks third-party ads and trackers to preserve user privacy. It was elected the most privacy-preserving browser by Douglas Leith, a professor at Trinity College Dublin.

Besides its built-in privacy features, the Brave Browser natively supports advertising (Brave Ads), video calling (Brave Talk), VPN and Firewall, news feed (Brave News), private browsing with Tor and a web3 wallet (Brave Wallet). Brave also developed its own search engine (Brave Search).

Source: Brave

Brave Ads is key to the company’s value proposition, which strives to fundamentally change the attention economy. Brave Ads seeks to create a decentralized ad marketplace where users opt in to ads and are rewarded for their attention (Brave Rewards), advertisers benefit from lower transaction fees and increased conversion, and publishers and creators can monetize their content through a built-in user donation feature.

Brave Rewards and Brave Ads Example (sponsored image)

Brave attempts to tackle structural issues within the attention economy and programmatic advertising, such as decreasing attention quality, increasing ad block usage, low conversion rates, high transaction fees due to intermediation, opaqueness and fraud.

The Brave Browser blocks third-party ads by default, but incentivizes users to opt in to Brave Ads with Basic Attention Token (BAT) rewards. Ad blocking also makes the browser faster and reduces users’ battery and data usage.

Brave is able to collect more accurate metrics on user attention while protecting user-privacy through zero-knowledge proof technology. It’s a win-win for users and advertisers – users maintain ownership over their data while advertisers pay for true attention received. In contrast, the traditional ad industry loses approximately $51M USD per day due to ad fraud.

Brave reports an average 9% click-through rate (the percentage of viewers that clicked an ad) for sponsored images served – vs Google Ads that averaged 3.17% click-through rate for search and 0.46% for display across all industries.

Source: Brave Media Kit

Tokenomics

The BAT token is the currency for Brave’s ad marketplace. Users earn BAT for watching Brave Ads, advertisers can purchase Brave Ads’ inventory, and publishers and content creators receive user donations in BAT.

Brave Protocol

Advertisers use USD or BAT to purchase Brave Ads’ inventory, which are currently sponsored images (new tab page), push notifications and Brave News’ ads. Brave Rewards distributes rewards to users for their attention. The Brave Browser allows users to donate BAT to publishers and creators either manually or by using the auto-contribute feature, which distributes donations according to user attention.

Treasury

Brave’s revenue consists of selling ad inventory and collecting fees from user donations to publishers and token swaps on the Brave Wallet. Brave Ads’ USD revenues are used to buy back BAT from the market.

70% of Brave’s revenue is transferred to the User Growth Pool for Brave Rewards’ redistribution. The remainder is used for infrastructure maintenance and product development, with the allocation defined by the Brave team (centralized).

Centralized Exchanges (CEX)

CEXs play a key role in the Brave Rewards ecosystem, since users must have a verified custodial wallet with Gemini or Uphold to withdraw BAT rewards (even to the Brave Wallet). The main reason is to comply with regulatory and KYC requirements.

Users are still able to donate BAT earned to publishers/creators without a verified CEX wallet but can’t take advantage of other BAT utilities within the partner network (e.g., use BAT in other DApps).

Brave Wallet

The Brave browser comes with a native wallet to provide easy access to web3 for users with high performance and security. In Jun-22, Brave launched their Wallet Partner Program, which aims to increase the wallet and BAT utility by integrating with multiple DApps. Brave’s partnerships range from decentralized finance (DeFi) to gaming and greatly complement Brave’s already impressive product stack with additional web3 capabilities. Some of the most notable partnerships are (check out their blog for details):

Cross-chain support: Solana, Near and Binance Smart Chain,

DeFi: ApeSwap, ElkFinance, OpenOcean (and many others),

Liquid staking (Lido), email (Skiff) and file storage (Filecoin).

Distribution & Liquidity

BAT launched in 2017 amidst the Initial Coin Offering (ICO) fever – 1B tokens were minted for the public sale and allocated to Brave’s development and infrastructure. Another 500M tokens were minted upon launch: 300M to the User Growth Pool (rewards distribution to early adopters) and 200M to Brave. The supply was capped at 1.5B BAT, so there were no further token emissions.

Budget Allocation of ETH Raised upon ICO

Source: BAT Whitepaper

After launch, BAT’s liquidity has been mostly distributed organically. As of Aug 29th, 2022, Externally Owned Accounts (EOA) owned 71.8% BAT, Exchanges 26.8% and the User Growth Pool 0.1% (UGP rewards are redistributed within 90 days) – check out this Dune dashboard I made with BAT distribution details.

Although the leading exchange in BAT liquidity is DeFi’s Compound (39% of supply on exchanges), most BAT is held in CEXs, such as Binance (25.9%) and Gemini (10.2%). Binance pioneered BAT’s multi-chain support, while Gemini provides custodial wallets for Brave Rewards’ users. Brave’s recent focus on DeFi partnerships could add more BAT liquidity to decentralized exchanges.

The distribution among EOAs has been trending towards concentration in fewer hands compared to the Apr-19 distribution (per Glassnode). Although the number of BAT EOAs increased by 234% (Aug-22: 348.9K vs Apr-19: 104.6K), BAT held by the top 1% increased from 87% to 92% of total EOA supply! If we take into account the full 1.5B BAT supply, the top 1% EOAs hold 66% of all BAT.

The highest trading volume for top 1% EOAs was at the $0.60 to $0.90 USD price range (346M BAT bought; 285M BAT sold), which could pose significant headwinds for BAT’s price appreciation (BAT price on Aug 29th: $0.35 USD). The supply concentration also puts retail investors at risk of “pump and dump” schemes. Improving BAT utility could mitigate those risks by reducing speculation and short-term sell pressure, which brings us to the next (and probably hottest) topic in this article.

Value creation and value capture

Brave is a truly one-of-a-kind protocol. Not only does the ever-growing product stack positions the protocol to become a “web3 Google” without the creepy user espionage, it also proposes a new economic model for attention where users own their data and choose to opt in to advertisement to earn rewards.

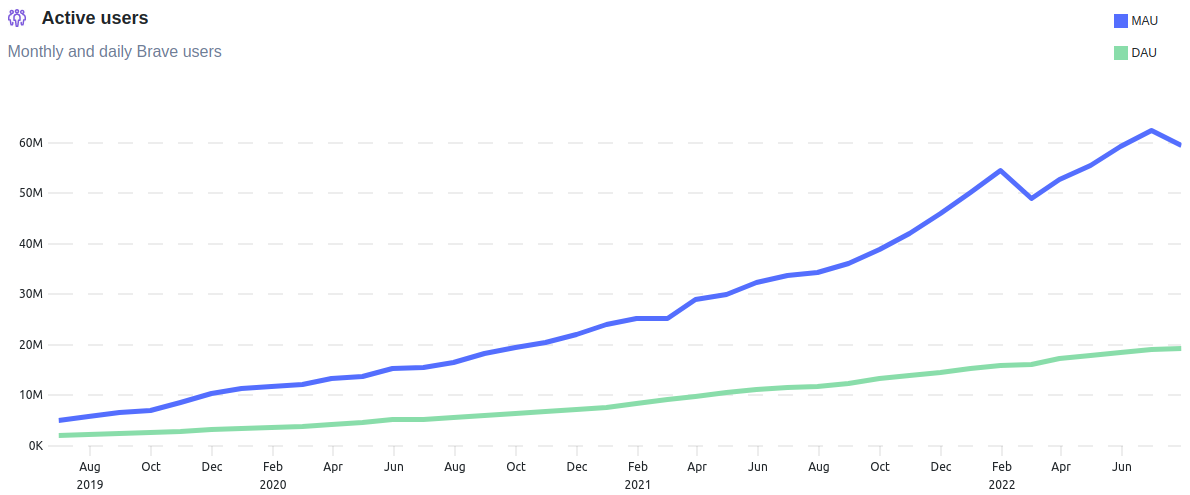

The results have been impressive: in Jul-22 the Brave Browser registered 73% YoY growth in monthly active users (MAU: 59.6M users) and 63% in daily active users (DAU: 19.4M); verified creators’ grew 33% YoY to 1.6M.

Source: Brave

The user base growth should increase Brave’s advertisement revenue, allowing BAT to capture part of this value via treasury buybacks. For example, Brave’s BAT buybacks decreased by 74% in Jul-22 vs the Dec-21 all-time high ($722.6K USD vs $2.8M USD), whereas BAT’s price decreased by 67% ($0.42 USD vs $1.25 USD at each month’s closing). We can hypothesize that user growth hasn’t translated into increased ad revenue in 2022 due to macroeconomics factors (e.g., rising interest rates), dumping BAT’s price.

Source: Brave

Nevertheless, a key piece of the puzzle seems to be missing: the actual advertisement marketplace. Without the ability for publishers to sell ad inventory to advertisers, BAT seems to lack utility within the ecosystem. The Wallet Partner Program seems like a step in the right direction, however it captures value outside the Brave ecosystem and there’s still not a lot of reason to use or hold BAT – users could access the same functionalities with BTC or ETH, for instance. That’s where the token fails to capture value, in my opinion.

What’s even more odd is that Brave seemed to envision this exchange between publishers and advertisers in the BAT whitepaper (see below), but recently haven’t mentioned any developments in that direction.

Value Flow of the BAT (whitepaper proposal)

Source: BAT whitepaper

That is not unheard of in web3. AdShares, a L1 blockchain designed to be a decentralized ad network, launched a few months after BAT with this capability from the start. One interesting aspect of AdShares’ tokenomics is that holding their native token ADS, which is used to settle advertisement transactions, provides users with part of the network commission.

That said, AdShares just reproduces the web2 advertisement model on the blockchain. Instead of empowering users, they claim their ads are harder to block with ad blocking software. That could be a reason for them to share only a fraction of Brave’s success in terms of social engagements and market cap, given that crypto users are still the majority of adopters for such solutions (e.g., ¾ Brave users own cryptocurrency and consider themselves early technology adopters).

Social and Financial Metrics (Brave vs AdShares)

Source: Lunarcrush.com

Another interesting use case is Dragon X. Launched in 2021, Dragon X provides a P2P advertisement marketplace where advertisers fund campaigns with DAX tokens and publishers can redeem DAX tokens for clicks on ads. DAX used to pay for advertising gets burned to create deflationary pressure, while new DAX tokens are only minted through staking to incentivize HODLing. The project seems off to a slow start (only 1.7K transactions recorded) but the idea looks promising.

These examples show there are tokenomics designs that favor utility in a decentralized advertisement marketplace. Adding similar capabilities could bring additional revenue to the Brave protocol (in turn adding more funds to Brave Rewards) while reducing BAT’s vulnerability to market sentiment.

Brave could also leverage its own product stack to add BAT utility. For example, the Brave Swap Rewards proposal rewards in BAT but has no BAT holding requirements – that could be an effective short term market strategy to accelerate wallet adoption, but longer term it does little to improve BAT’s tokenomics. Another idea would be to create membership tiers to advertisers and/or publishers based on BAT held, similar to Bankless DAO’s recent WEALTH proposal. It’s obviously up to the team to decide how to best leverage BAT, but there’s room to improve utility given the browser’s increasing adoption.

Demand Drivers

Given that BAT’s main utilities are to reward user attention and allow user donations to publishers and creators, there are few reasons to purchase the token in the market – which could pose problems to keep the token economy flowing.

BAT demand is mainly driven by Brave’s buybacks. Hence, BAT demand is tied to Brave’s revenue – which, in turn, is mainly driven by selling advertising, with additional revenue streams being fees charged from users’ BAT donations and Brave Wallet’s swaps.

Since the value of advertising (and BAT) are derived from user attention, BAT demand should correlate to Brave’s number of active users and their engagement (unless demand for advertisement decreases, as observed in 2022). The number of verified creators is another demand driver given the 5% fee on donations, but probably to a much lesser degree. It’s disappointing that Brave doesn’t disclose more information that would allow us to better assess the success of their business model.

Closing thoughts

Brave’s product development strategy positions it as one of the key pillars in web3. The protocol is highly innovative and was able to build a solid product stack that empowers users to navigate the web privately while providing convenient options to interact with other DApps with minimum effort. Their user base growth since launch speaks to the quality of products delivered and underlines that the team is solving real customer problems.

However, the BAT token doesn’t really interact with this ecosystem. Apart from user donations to publishers/creators – which provide a new content monetization stream –, there are very few reasons for users to utilize BAT instead of other cryptocurrencies they’d prefer as a payment method. Brave has been strengthening partnerships with other DApps to provide additional utility, but I believe there’s a huge opportunity in overhauling their own ecosystem to improve token utility as well.

The lack of utility makes BAT especially vulnerable to price fluctuations, especially given the large concentration of tokens on a few hands. Therefore, enhancing BAT utility would not only be a move to capture more value, but could also greatly benefit the project’s long-term sustainability by incentivizing HODLers instead of speculators.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.