Tokenomics 101: Aave

governance token, revenue generating to treasury, decentralized distribution

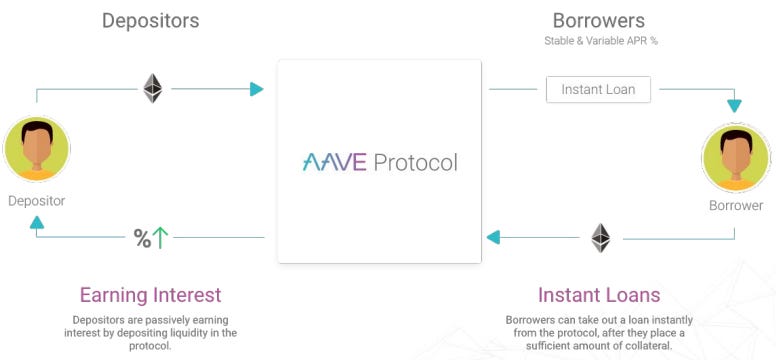

Aave is a decentralized liquidity protocol that enables users to borrow and lend crypto assets. The protocol aims to create an alternative decentralized money market accessible to anyone who holds crypto assets. There are no restrictions based on KYC, minimum deposit, or country. Platforms like Aave play a vital role in the decentralized financial system (DeFi). Let's start by understanding how the lending and borrowing process works:

If a depositor wants to deposit ETH in an ETH pool, they will receive a token called aETH that earns interest over time. The aETH token can be moved within the ecosystem. When the depositor wants to withdraw their deposit, they must return their aETH token to receive their original ETH plus the accumulated interest.

During the loan period, the deposited ETH will create a pool from which borrowers can submit collateral in any currency and borrow ETH. All loans are overcollateralized, meaning the collateral's value must be higher than the value of the borrowed asset. Borrowers can hold the borrowed asset for as long as they want, provided the price of the collateral remains above its liquidation level.

The protocol uses an algorithm to determine the interest rates for both borrowers and lenders based on the utilization of assets in a liquidity pool. The more assets used in a liquidity pool, the higher the interest rates for lenders, which encourages them to add more liquidity to the pool. On the other hand, if assets in a liquidity pool are not being used, interest rates are low to incentivize borrowers to take out loans. In other words, the interest rates for both lenders and borrowers are determined by the principles of supply and demand. The illustration below provides a visual summary of the process.

Aave, a lending protocol, offers many unique features that set it apart from competitors. These features include flash loans, rate switching, and credit delegation, which are all industry-first innovations. They have helped Aave become a leader in the DeFi space. Let's take a closer look at how each of these features works.

Flash loan: This is a loan where you can borrow millions of dollars without collateral. The loan must be paid back in the same block it was borrowed; if it is not paid, all transactions are canceled. There are currently three use cases for flash loans: arbitrage, collateral swap, and liquidation (more details).

arbitrage because interest rates across lending platforms are not coordinated, allowing users to profit from the spread.

collateral swap and liquidation when a borrower’s collateral price falls toward the liquidation level.

Aave currently charges a fixed 0.09% fee per flash loan transaction.

Rate Switching: Borrowers can switch between fixed and variable interest rates to take advantage of market conditions at any time. Generally, the stable rate is always higher than the variable rate.

Credit Delegation: Besides earning interest on your deposits, Aave also allows you to make extra yield by managing your loans to others. In other words, you will give others access to your credit line by depositing funds on Aave, approving users (or users) to draw credit, and then letting them draw up to that credit amount in their own time (check the diagram below).

Tokenomics

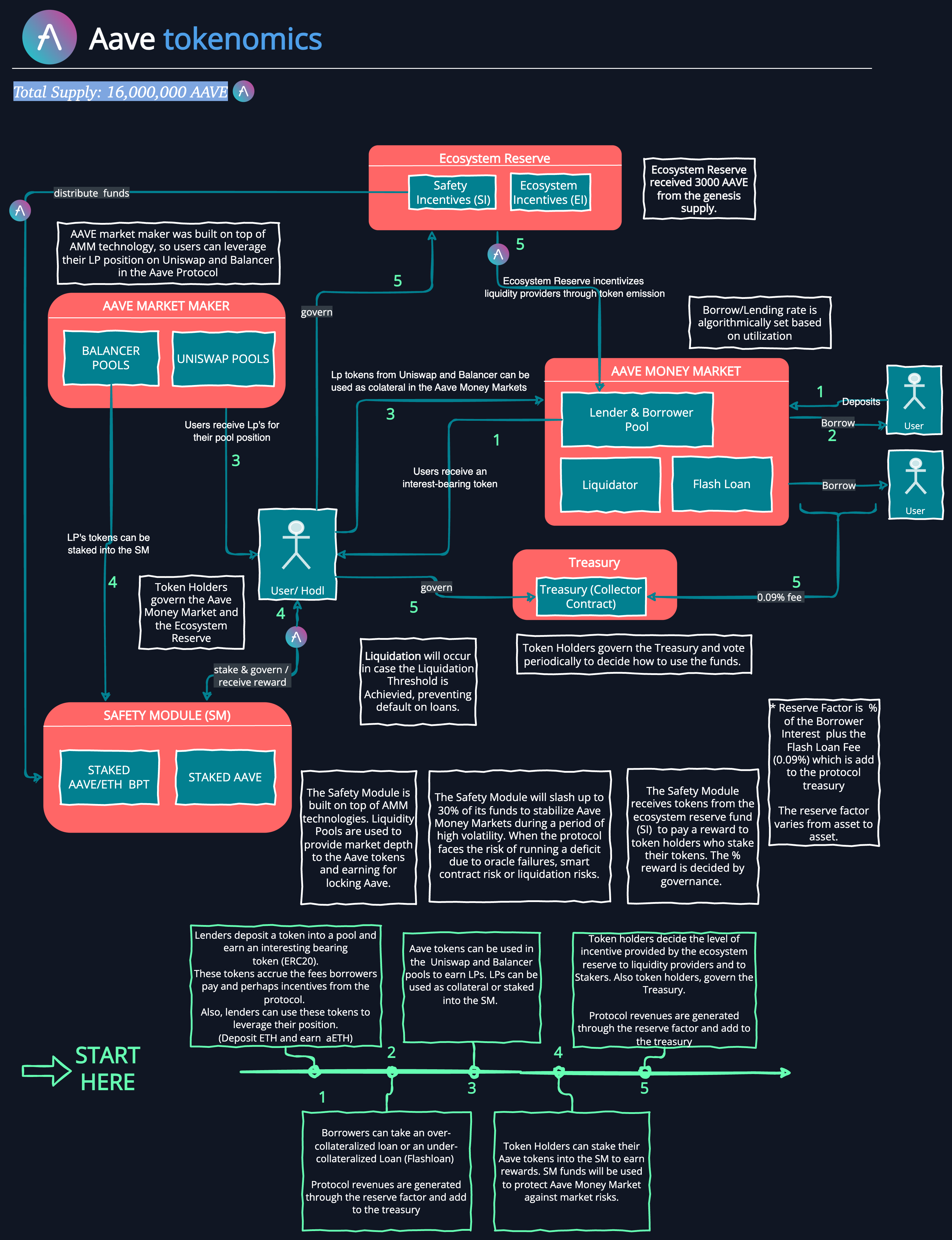

The role of the token in the Aave ecosystem is to decentralize governance, ensure the protocol's safety, attract liquidity, and incentivize the protocol's economic expansion.

Let's analyze how its tokenomics mechanics play out. A zoomable version of the diagram can be found here.

Token Utility

The Aave token has two key utilities: governance and staking.

The protocol is operated and governed by the token holders in the form of a DAO, and their governance power is proportional to their token balance. Governance is used to support or submit improvement proposals (AIP). These cover topics such as:

Decisions about risk parameters change in the Aave markets;

The amount of tokens issued by the ecosystem reserve fund (safety or ecosystem incentives);

How to allocate treasury funds;

The second function of Aave is staking, whereby users can deposit their tokens into the Safety Module (SM). The deposited funds are used to secure the protocol and users are rewarded with Aave tokens as an incentive. These incentives are issued by the ecosystem reserve and the percentage of the bonus is decided periodically by governance. These token emissions are classified as safety incentives (SI).

The Safety Module functions to protect the protocol from shortfall events which can occur when unexpected losses of funds happen due to smart contract risks, oracle failures, and liquidation risks. In such cases, the Safety Module can use up to 30% of its deposited funds to stabilize the protocol. However, the Aave protocol has been tested and has proven to function optimally even during extreme market conditions.

Liquidity

Attracting and retaining liquidity is crucial for any lending or borrowing platform as it is the primary resource used by the protocol to provide benefits to its users. The most common approach to achieve this is through issuing the protocol's native tokens, which is also the case with Aave. Aave incentivizes its users by distributing tokens, and these tokens are generated from the ecosystem reserve fund. The fund was allocated with 3 million tokens from the genesis supply to invest in the ecosystem.

In addition to its token incentive programs, Aave implemented liquidity pools on top of Automated Market Maker (AMM) technologies that allow Uniswap and Balancer liquidity providers to use their LP tokens as collateral on the Aave protocol. This increases Aave's access to new customers and potentially attracts more liquidity.

Supply and Distribution

Aave has a total supply of 16 million tokens, all of which are unlocked. 13.9 million tokens are currently circulating, while the remaining 2.1 million are deposited in the ecosystem fund. What sets Aave apart from other crypto projects is its decentralized token distribution. Unlike most other projects that reserve a significant percentage of tokens for the founding team, advisors, and investors, Aave has fully distributed its tokens with no central entity or group holding any significant amount of tokens.

However, it is important to note that Aave started its operation with centralized token distribution, and the protocol has achieved its current decentralized state after some years of transition. In 2020, the protocol officially handed over its governance keys to the community (Decrypt has the story).

Below, you can see the stages of its decentralization process:

When the protocol was launched under the name of LEND

Initial token distribution

Current token distribution

The safety module is the largest holder of staked tokens, followed by the ecosystem reserve fund. The largest individual address holding AAVE holds slightly over 250,000 tokens, which is only 1.6% of the total available supply. This low percentage ensures that no single holder or group of holders can easily reach a majority to enforce their will, resulting in a genuinely democratic vote. This decentralization level is much higher than that of Compound, its main competitor, where the founding team and investors still own almost 50% of the tokens.

Value creation and value capture

Aave stands out from the crowd and has become number one in the Defi competitive landscape by TVL, according to Defi Llama. Its key features (aTokens, Rate Switching, and Flash Loans) are highly innovative and pioneering by providing more capital efficiency to its users than its competitors; in other words, when using the Aave protocol, you can do more financial operations with your capital and spend less.

Aave is a lending platform that constantly innovates its services. What sets it apart from other Ethereum-based lending protocols is that it heavily incentivizes the development of a multichain strategy and a diversified ecosystem. Aave initially started on Ethereum and it remains its main market. However, it has expanded to nine other chains, with Polygon and Avalanche gaining popularity among users and Total Value Locked (TVL). This multichain strategy has enabled Aave to reach different communities across the blockchain space and offer the broadest selection of tokens for lenders, which is approximately 22 tokens.

In its V3 version, the protocol provides new features, like an interoperability function called Portal, which allows the flow of liquidity between Aave V3 markets across different networks. More specifically, it will enable governance-approved bridges to burn aTokens on the source network while instantly minting them on the destination network (more here).

As a result of its success, the protocol has seen a constant growth in its user base.

Furthermore, Aave is also a pioneer in offering a Defi protocol exclusive for real-world assets, a permissioned and compliant Defi platform for institutions (ARC), and a decentralized social media platform.

In the early stages of DeFi, Aave seems to foresee a promising future for decentralized finance. It is continuously creating multiple ways to attract new users and establish an edge over its rivals. On the other hand, when compared to Compound and Maker, I can't observe the same degree of creativity and variety.

Aave, like most platforms, has a treasury that collects a portion of the spread earned from lending and borrowing activities, as well as the fees charged from flash loans. These funds are governed by the Aave token holders. Furthermore, it is important to note that the fees collected are reflected in the value of the token through governance rights.

Demand Drivers

The token's primary use cases within its ecosystem are governance and staking. However, there are also various use cases outside of the ecosystem. For instance, Aave can be deposited on Maker to create DAI. Additionally, it can be used to earn BAL rewards by providing liquidity on Balancer or earn trading fees on Uniswap by participating in trading.

Besides, there are discussions to add more utility to the token on the governance forum. According to Mark Zeller, an influential team member, as Aave embraces the multiverse, many possibilities of new utilities can be unlocked and positively impact the demand (full post here).

" This fact can offer opportunities to generate new use cases for the Native Asset of Aave. What if the governance deploys an Avalanche subnet, a rollup, or a parachain using aUSDC as the native asset for gas? Validators must stake AAVE to process transactions and earn fees from the network transactions.

This cycle seems to give a premium to L1 assets; it doesn’t seem impossible to consider an “AAVE chain” linked to all networks with portals. This chain would make sense to have cheap and fast usage of Aave, and if the main DeFi protocols also deploy there and allow use-cases, it might gain traction.

What if Bridges and protocols using the portals would be required to own amounts of StkAAVE to reduce fees and/or credit lines? Let’s focus on long-term building and added-value creation instead of daily charts and short-term plans.

All this is a marathon."

In this context, I see Aave creating an evolving ecosystem with many possibilities for further development, and the token gives governance power and a reasonable staking reward.

I understand that, at the moment, the usefulness of the token does not seem to be a significant factor in its demand. This is mainly because the staking rate is low compared to the circulating supply, and it only pays out in the native token. Additionally, the protocol does not offer much redistribution of the value it generates to its users, unlike Balancer, Curve, and GMX. However, the fees that the protocol generates go into the treasury, which is controlled by the token holders. So far, the protocol has managed its treasury with a long-term view, which has placed Aave in a leadership position.

Closing thoughts

After looking into different aspects of the project, I believe that Aave has a reason to be the sector leader. It has an evolving ecosystem, a well-designed economic incentive program, and a secure smart contract structure, according to high-level audit firms like Gauntlet.

The distribution of tokens is highly decentralized, both in relative and absolute terms. A substantial portion of tokens is owned by the community, while long-term holders who stake their tokens to secure the protocol get rewarded with more governance tokens, thus increasing their voting power and stake in the game. This creates a healthy economic co-dependency between the protocol and its long-term holders.

This alignment is essential for a decentralized decision-making process, where the community agrees on critical decisions through voting, such as risk parameters, economic investments, assets to be listed, and new chains to expand.

The incentives of the ecosystem are being directed towards liquidity providers and developers, who are the most important stakeholders of the protocol. They contribute liquidity, security, and development skills to expand and integrate Aave into the crypto ecosystem, which creates more value for its users.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.