The Token Behind The Ultimate Yield Aggregator

A Deep Dive Into Yield, Vaults, Bribes, and the Feedback Loops That Fuel the Growth of the Protocol

Introduction

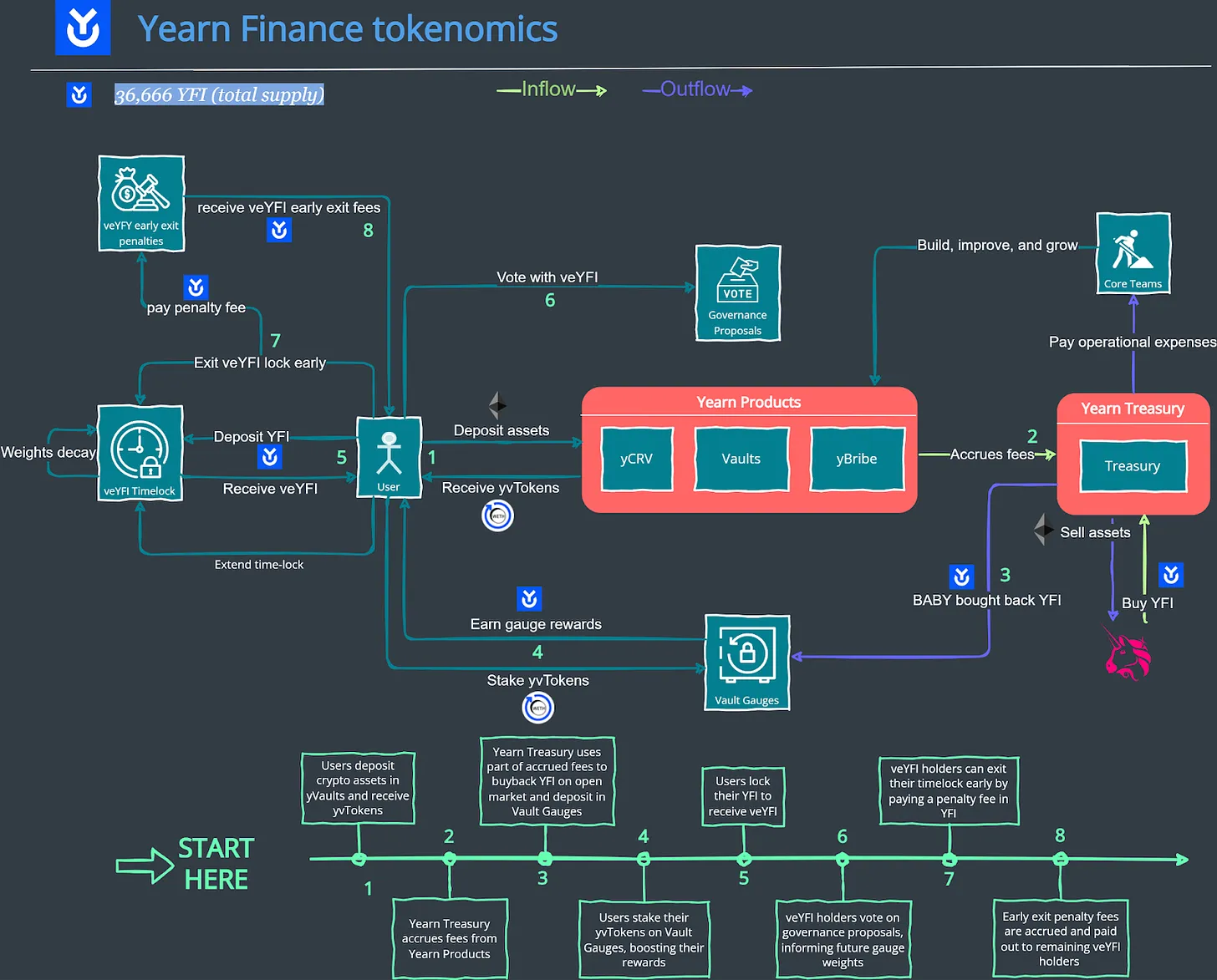

For our regular readers, Andre Cronje is a familiar name, and this article aims to shed light on his notable project, Yearn Finance, particularly following the significant developments since the adoption of the YIP-65 governance proposal at the close of 2021. This article is timely in exploring the recent evolutions in the largest yield aggregator in the decentralized finance (DeFi) space. The proposal introduced veYFI, following a veToken model, a topic we've touched on previously, but the revamped tokenomics of Yearn Finance merit a deeper exploration. Before delving into those specifics, it's essential to understand what a yield aggregator is, Yearn Finance's role in this DeFi sector, and the dynamics surrounding the $YFI token.

Yearn Finance, with a total value locked (TVL) nearing $500 million according to DeFi Llama, is the leading yield aggregator in the DeFi landscape. But what exactly is a yield aggregator? Picture it as a digital financial advisor, utilizing 'vaults' filled with cryptocurrency assets to engage in lending, borrowing, and liquidity provision across various protocols, aiming to maximize investor yields. Yield aggregators, like Yearn, automate numerous yield-earning processes across different platforms, simplifying the user experience. Users only need to deposit their assets into Yearn Vaults, leaving the complex tasks to the platform.

Yearn Vaults employ advanced algorithms to optimize returns and seamlessly integrate with prominent DeFi applications such as Aave, Compound, Curve, and Uniswap. While Yearn Finance continually evolves, its pioneering approach to vaults, sophisticated yield optimization algorithms, and effortless integration with existing DeFi platforms solidify its position as a cornerstone in the DeFi ecosystem.

$YEARN Tokenomics

Vaults are a cornerstone feature of Yearn Finance, functioning as collective pools of assets that the protocol utilizes to automatically generate yields by identifying lucrative opportunities in the market. This automation allows users to gain access to high-yield opportunities passively, without requiring extensive technical knowledge.

Yearn Finance's operational framework and governance are primarily managed by the holders of its native token, $YFI. The governance process is structured in a two-step manner: initial off-chain proposals are followed by on-chain implementations, which are executed via multi-signature wallets. For Yearn Finance, a consensus of 6 out of 9 wallet signatories is necessary to enact changes within the protocol.

Returning to the topic of Yearn Vaults, which may still be a bit unclear, imagine a vault as a kind of savings account. In this account, you can deposit your cryptocurrency assets. Once deposited, these assets are strategically routed through various investment strategies within the DeFi ecosystem, all with the goal of maximizing yield. Essentially, Yearn Vaults simplify and amplify the process of earning returns on crypto assets by leveraging the diverse opportunities available in the DeFi space.

Much like traditional financial institutions, the Yearn Finance protocol charges fees for managing assets on behalf of its users. There are two primary types of fees associated with Yearn Vaults:

Performance Fee: This fee is only applied to the profits generated and is paid to the protocol when a strategy is successfully concluded. It's a way for Yearn to earn from the successful management of assets, aligning its interests with those of the users.

Management Fee: This fee is levied on the total assets deposited in the vaults over a year. It is implemented through the minting of new vault shares, which effectively results in the dilution of existing vault participants' shares.

These fees are not static and can vary over time, reflecting a dynamic fee structure. Users can always check the current fee rates at yearn.watch. While anyone can deposit into the strategies (vaults), there's a cap on the amount that can be deposited. This cap is in place to prevent over-allocation to strategies that may not yield expected returns due to excessive fund sizes, as yields can diminish with larger vaults.

Upon depositing assets in Yearn Vaults, users receive yVault tokens, representing their share in the vault. These tokens can be thought of as proof of your deposit. As the vault generates yield, the value of yVault tokens increases, reflecting the growth of the underlying assets in the vault. When users withdraw their assets, these yVault tokens are burned.

A recent addition is the "Vault Factory" feature, enabling users to create their own Yearn Vaults and yield strategies. This feature, however, is more complex and would need a detailed explanation, which users can find on the Vault Factory User Interface.

Regarding the $YFI token, its primary role is in governance. Holders of $YFI have voting rights on governance proposals, influencing the direction of the Yearn Finance platform. $YFI was initially distributed in 2020 through a fair launch, where tokens were sold to team members or investors without pre-allocations, ensuring equal purchase opportunities for the public.

With the introduction of $veYFI, governance power transitioned from $YFI to $veYFI. $veYFI, which emerged from YIP-56, includes a Buyback and Build feature. Here, users lock $YFI tokens for a certain period (1 week to 4 years) and receive $veYFI in return. This token allows users to boost vault rewards and vote on the allocation of bought-back $YFI. Thus, $YFI also functions as a Yield Boost Token. Unlike $YFI, $veYFI is non-transferable and carries governance power. While users can exit the locking period early, unlike veCRV, they must pay a penalty fee, which can be as high as 75% of the locked amount and decreases over time according to a specific Penalty Formula.

Exit penalty fees accrue over time and are distributed to the $veYFI tokens holders still within the locking terms, thus rewarding the lockers in the ecosystem.

Ecosystem Participants

The Yearn Finance ecosystem comprises three key types of participants, each playing a distinct role:

Yearn Users: These individuals represent the most general participant category in the Yearn ecosystem. Their primary goal is to maximize the yield on their cryptocurrency assets. These users typically interact with the protocol through Yearn Vaults by depositing their assets and in return, receiving yvTokens (Yearn version tokens). This group is primarily driven by financial incentives.

$veYFI Holders: This group comprises users who have staked their standard $YFI tokens. $veYFI holders represent a more specialized category of Yearn users actively participating in the protocol’s governance. They exercise their voting rights on various governance proposals. Compared to general users, $veYFI holders are often more aligned with the protocol's mission, as they have a vested interest (or "skin in the game") through their locked $YFI, which is converted into $veYFI. This commitment incentivizes them to make decisions that benefit the protocol and positively impact the $YFI price. Besides governance participation, these users are motivated by financial incentives, as locking their YFI can increase yields.

Yearn Treasury: The Yearn Treasury is a vital component of the protocol, acting as an active participant in the ecosystem. The Treasury is involved in active asset management, deploying assets across other protocols to optimize yield and executing buybacks in the "Buyback And Build Yearn" (BABY) program.

It's also important to highlight the evolving nature of the protocol's engagement within the DeFi space. Initially, Yearn Finance's growth was predominantly fueled by individual users. However, there's been a noticeable shift towards greater collaboration with other protocols and DeFi entities. This trend gained momentum following the introduction of the Yearn Partnership Program in 2021, signaling a strategic expansion of Yearn's interactions and collaborations within the broader DeFi community.

Protocol Components

Yearn Finance, a complex and multifaceted protocol in the DeFi space, consists of several integral components:

Yearn Treasury: This is the financial backbone of the protocol, providing funding for the core team's activities. The core team is responsible for contributing to Yearn Finance through open-source development and enhancements to the protocol. The Treasury's role is crucial in ensuring that the protocol continues to evolve and improve, maintaining its competitiveness and functionality in the DeFi landscape.

Yearn Products: These are the services and tools offered by the protocol to its users. Key elements of Yearn Products include:

Vaults: As previously discussed, Vaults are the central feature of Yearn Finance. They are pools where users deposit their crypto assets for yield optimization across various strategies and DeFi protocols.

yCRV: This is a specialized yVault dedicated to the Curve Finance (CRV) ecosystem. yCRV allows users to engage specifically with CRV-related strategies, leveraging the opportunities within the Curve Finance space.

yBribe: This feature enables users to monetize their governance power. Users can effectively sell their votes to the highest bidder by voting in favor of the briber’s gauge and subsequently claiming a reward. This process, often referred to as "bribing," is a unique aspect of decentralized governance, allowing users to leverage their voting power for personal gain while influencing protocol decisions.

Vault Gauges: In this component, users stake their yVault tokens in a gauge to earn YFI rewards. These gauges play a crucial role in determining the distribution of rewards within the Yearn ecosystem. By staking in a gauge, users vote on which vaults should receive rewards, effectively guiding the allocation of resources and incentives across different strategies. This mechanism not only incentivizes participation in the Yearn ecosystem but also fosters a dynamic and user-driven approach to reward distribution.

Each of these components plays a vital role in the functionality and success of Yearn Finance, collectively contributing to its status as a leading platform in the DeFi space. Through a combination of innovative products and governance mechanisms, Yearn Finance has established a comprehensive and user-centric ecosystem that caters to a wide range of needs and preferences in the DeFi community.

Value Creation

Yearn Finance's approach to value creation is centered around addressing the challenge of suboptimal yield aggregation in the decentralized finance (DeFi) sector. Value creation in this context is about solving specific problems for users, which in Yearn's case, is maximizing returns from yield farming.

Automated Yield Farming via yVaults: The primary means of value creation in Yearn Finance is through its yVaults. These are automated yield farming strategies designed to optimize returns for users. By pooling assets and employing sophisticated strategies, yVaults provide a more efficient way for users to earn yield across various asset classes and risk profiles. With over 35 yVaults in operation, Yearn offers a wide range of options for users to choose from, each tailored to different needs and investment preferences.

Role of Strategists: Yearn Finance employs individuals, known as "Strategists," who continually identify and implement the most profitable yield farming strategies across the DeFi landscape. These strategists propose new strategies, which are then subject to approval by veYFI holders. This ensures that the strategies align with the community's interests and the protocol's long-term goals.

Yearn Partnership Program: Another key aspect of value creation stems from the Yearn Partnership Program. This initiative enables Yearn Finance to collaborate with other DeFi protocols, such as Alchemix, to integrate $YFI and yVaults into their offerings. The program has attracted over 30 protocols, expanding Yearn's value proposition beyond individual users to larger, more institutional players in the DeFi market.

Through these mechanisms, Yearn Finance solves a significant problem in DeFi and creates substantial value for a diverse range of participants, from individual investors to larger institutional entities. Integrating automated strategies, community-driven governance, and strategic partnerships positions Yearn as a key player in optimizing yield aggregation in the DeFi ecosystem.

Overall Goal

The primary objective of Yearn Finance is to seek and deliver the highest possible yield from various decentralized finance (DeFi) products to its users. This goal is particularly significant for those who may not have the expertise or resources to manage multiple yield-generating strategies independently. By simplifying and automating the process of yield farming, Yearn Finance provides an accessible platform for users to optimize their earnings from DeFi investments without the need for in-depth knowledge or constant management of their assets. This approach democratizes access to advanced yield strategies, making high returns in the DeFi space more attainable for a broader range of investors.

Value Capture

This pertains to how the protocol retains the value it generates. Fundamentally, if there's value creation, it must be directed somewhere (preferably to where the protocol considers most effective). The concept of value capture can be segmented into two parts: (1) value accumulation by the protocol itself, and (2) value accumulation by the token.

Value Accrual to Protocol

The protocol accrues value through two primary methods:

Revenue from Fees: Yearn generates significant income through a 2% management fee and a 10% performance fee on the yields from its yVaults, which are directed to its treasury. This is Yearn's revenue's main source, amounting to over $65 million annually.

Buyback and Build Yearn (BABY) Strategy: A portion of the funds in Yearn's treasury is used to repurchase $YFI tokens, which are then held in the treasury. This strategy redistributes value to $YFI token holders and ensures that the treasury maintains sufficient reserves for further development.

With the implementation of YIP-56, Yearn transitioned from a staking system, where all fee revenues were distributed to stakeholders, to the aforementioned buyback system. This new system allocates a portion of the revenue to repurchase $YFI tokens.

Consequently, the treasury of Yearn now experiences growth in two ways: (1) an increase in size, as a quantity of $YFI tokens are now accumulated in the treasury, contrasting the previous practice where they were distributed to stakers, and (2) an enhancement in value, as the buyback of $YFI tokens is anticipated to lead to a rise in their market price.

Value Accrual to Token

Value accumulation for the token happens in several ways:

Buyback and Build Yearn (BABY) Strategy: As previously discussed, this strategy also benefits the token directly. By conducting buybacks, Yearn effectively reduces the circulating supply of $YFI, enhancing its value.

$veYFI Gauges: Holders of $YFI can lock their tokens in non-transferable $veYFI forms to increase yields from Yearn's yVault gauges. These enhanced yields are sourced from $YFI acquired through the BABY strategy and fees Yearn collects.

Penalties from $veYFI Early Withdrawals: If a holder decides to exit their $veYFI lock early, they face penalties as high as 75% of their locked $YFI. The penalties collected in this manner are then accrued to Yearn's treasury, contributing to its growth.

Business Model

Revenue comes from:

The business model of Yearn Finance is fundamentally based on fee generation.

Presently, the protocol levies two primary types of fees:

Management Fee: This fee is charged for using Yearn Finance's services, which are upheld by the protocol and its active community.

Performance Fee: This fee is applied to the profits earned from the various yield strategies users invest in through the platform.

After subtracting operational costs, these fees are directed into Yearn’s treasury. The treasury is then responsible for determining the best use of these accumulated funds, guided by governance proposals. In the project's initial phase, these fees were allocated towards paying dividends to $YFI token holders. However, following recent governance changes, especially the introduction of YIP-56, there has been a shift in revenue distribution strategy from rewarding token holders to implementing buybacks.

Moreover, Yearn Finance accrues additional income through one-off penalty fees. These are imposed on $veYFI holders who opt to withdraw from their locked positions prematurely. A significant portion of these penalty fees is distributed to the remaining $veYFI token holders.

Revenue is denominated in:

The revenue generated by the protocol through fees from its yVaults is denominated in the same type of asset deposited in these vaults. This includes cryptocurrencies like ETH, USDC, DAI, and others. Essentially, when users pay fees on the yields they earn from these vaults, the fees are collected in the same currency utilized in the vault.

Revenue goes to:

The fees gathered from yVaults are predominantly allocated to Yearn's treasury, utilized for several key purposes. Following the adoption of YPI-56, a significant portion of these fees is now used in the Buyback and Build Yearn (BABY) program to repurchase $YFI tokens. Besides this, the remaining funds in the treasury are strategically used to cover development costs and operating expenses and to maintain a liquidity buffer. This buffer is essential for managing market volatility and uncertainty, ensuring the protocol's stability and resilience.

Token Utility

The primary function of the YFI token is to serve as a governance token, granting $YFI holders the power to vote on governance proposals. The scope of this governance encompasses several key areas:

Proposing and Voting on Yearn Improvement Proposals (YIPs): These proposals are crucial in shaping the protocol's operations and modifying its tokenomics.

Deciding the Allocation of Fees: Holders have a say in how the fees collected by Yearn Finance from yVaults are allocated. This is done through different veYFI gauge weights, influencing how yields are distributed.

Authorization of Treasury Expenditure and YFI Buybacks: Token holders vote on using treasury funds, including authorizing buybacks under the BABY program.

Determination of yVault Parameters: This includes setting critical parameters for yVaults, such as the minimum deposit thresholds.

Beyond governance, YFI also plays a role as a Yield Boost Token. By locking YFI into $veYFI, holders can earn enhanced rewards. It's important to note that the governance influence and the yield rewards are directly proportional to the size and duration of the $veYFI lock.

$YFI Demand Drivers

The demand for the $YFI token is influenced by various stakeholders, each with distinct motivations for holding the token. Breaking down these demand drivers by stakeholder categories clarifies the diverse interests.

$YFI Token Holders: General users are attracted to holding $YFI primarily for the governance rights associated with the token. This is particularly relevant when $YFI is locked into $veYFI, as larger and longer locks confer greater governance power. Since governance proposals can alter key financial aspects like reward structures and fee distribution, there's a heightened interest in acquiring and holding $YFI to actively participate in governance and benefit from the protocol's earnings.

$veYFI Lockers: Users who lock their $YFI are motivated by the yield rewards they can earn. The locking mechanism boosts their yields and amplifies their governance influence.

yVault Token Holders: Those who have invested in yVaults seek to maximize their yield on these deposits. They can enhance their gauge rewards by acquiring and locking more $YFI into $veYFI, thereby increasing their overall yield.

Aggregators: These entities aim to acquire $YFI to create substantial $veYFI locks, enabling them to earn higher yields. Their gains are derived from yield spreads, yield farming, and bribes from third-party protocols.

Bribing Protocols: Protocols in this category purchase $YFI to lock into $veYFI to redirect yield allocations towards their own yVaults. This is achieved through offering bribes, which are then paid to $veYFI lockers as an incentive.

While the predominant demand drivers are financially incentivized, revolving around governance rights that dictate reward and fee distribution, it's evident how each stakeholder group views these incentives from their unique perspective. This diversity is crucial in ensuring that incentives are aligned across all participants in the ecosystem, fostering effective and functioning feedback loops.

$YFI Distribution & Unlocks

The $YFI tokens were initially released through a fair-launch process in 2020, with a strict cap set at 30,000 tokens. These tokens were made available for purchase without any vesting period, ensuring an equitable distribution. However, this cap was subsequently revised following the approval of YIP-57, titled "Funding Yearn's Future." This proposal allowed for the creation of an additional 6,666 $YFI tokens.

The distribution of these newly minted tokens was strategically planned: one-third was allocated for vesting to key contributors of the Yearn Finance ecosystem, recognizing their significant role in the protocol's development. The remaining two-thirds of the new $YFI issuance was directed to the treasury. This allocation was intended to empower governance, giving $YFI holders the authority to decide how these treasury-held tokens should be utilized and deployed. This decision aligns with Yearn Finance's ethos of decentralized decision-making and community-driven governance.

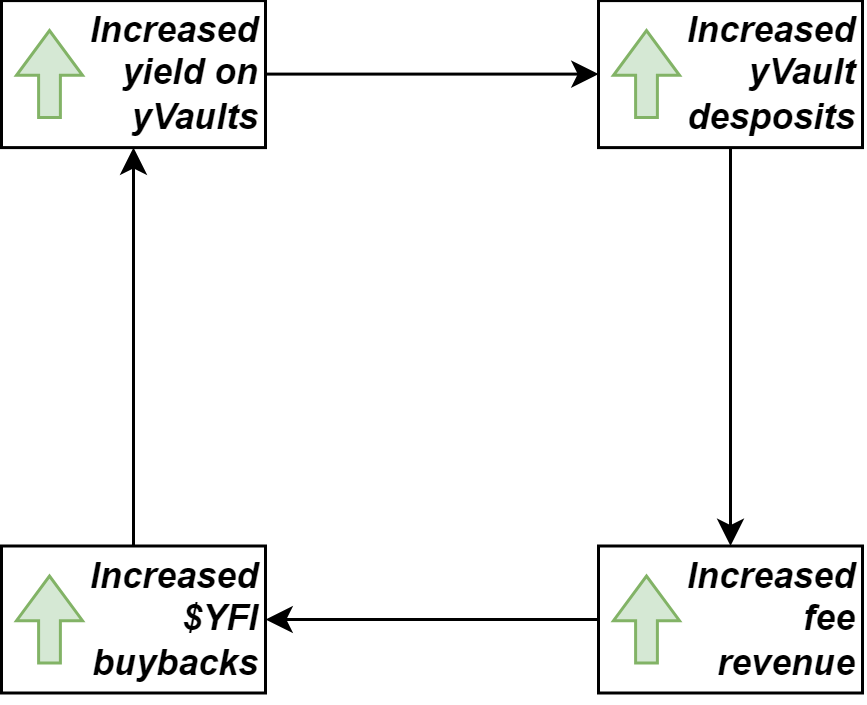

Feedback Loops

Yearn Finance's growth is propelled by a self-reinforcing feedback loop, pivotal in escalating its fee collection – the primary revenue source for the protocol. Here's a breakdown of how this feedback loop operates:

Growth in yVault Deposits: When there's an uptick in the amount deposited in yVaults, this naturally leads to an increase in fee revenue. This is because Yearn Finance imposes two types of fees on users – one fee when they deposit and another when they earn a profit.

Increased Fee Revenue Leading to More $YFI Buybacks: With more fee revenue, Yearn Finance has a larger budget for buying back $YFI tokens in the open market, adhering to its BABY program's guidelines.

Boost in $YFI Buybacks Enhances yVault Yields: The $YFI tokens bought back through this program are then distributed as rewards to users who lock their $YFI into $veYFI. This process effectively increases the yields offered on yVaults.

Higher Yields Attract More Deposits: As the yields on yVaults become more attractive, they are likely to draw increased interest from potential depositors, leading to a further increase in yVault deposits.

To encapsulate, as $YFI deposits escalate, this results in enhanced gauge boosts and subsequently higher liquid wrapper yields, which further encourages more $YFI deposits. A key aspect of this model, distinct from veToken systems based on fixed emissions where increasing Total Value Locked (TVL) can dilute yields, is that yield increases are proportionally aligned with the rising TVL is system.

Observations/Thoughts

The Feedback Loops section illustrates how Yearn Finance's model can initiate a beneficial positive feedback loop for the entire ecosystem and its stakeholders. However, it's crucial for readers to understand that this same mechanism can also operate in reverse, potentially exacerbating negative market conditions.

In scenarios where market conditions are unfavorable, this could lead to a decrease in yVault deposits. A reduced level of deposits means lower fee revenue for Yearn Finance. This, in turn, limits the protocol's ability to buy back $YFI tokens under the BABY program, subsequently reducing the yields available to $veYFI lockers. Lower yields might lead to further reduced interest in yVault deposits, creating a downward spiral.

It's also important to consider the inherent risks and limitations associated with the veToken model, initially pioneered by Curve for use in decentralized exchanges. Curve’s model was heavily focused on liquidity mining, supported by an unlimited supply of the protocol's incentive token. This contrasts significantly with Yearn Finance’s approach. Unlike Curve, Yearn is not a decentralized exchange but a yield aggregator. Moreover, Yearn's protocol token, $YFI, has a fixed hard cap supply, which fundamentally alters the dynamics of its veToken model compared to those with unlimited token supplies.

Understanding these differences and the potential risks of the veToken model is essential for anyone engaging with these protocols, as it provides insight into how market conditions and protocol-specific factors can impact the overall ecosystem.

Summary

In this article, you will gain an in-depth understanding of Yearn Finance, one of the most well-known DeFi protocols and the largest yield aggregator. The article covers the concept of Vaults, which are integral to Yearn's design, and how they are also used in other protocols with slight variations. Furthermore, you will learn how the insights gained from this piece can also help us understand similar protocols.

With big names such as Vitalik Buterin with Ethereum, Daniele Sesta with Wonderland, and Andre Cronje with Yearn associated with a project, it often generates a great deal of interest. In the case of Yearn, this resulted in $YFI's price skyrocketing past the value of 50,000 USD, effectively surpassing that of 1 BTC. However, it's important to keep in mind that while hype is temporary, the value of a solid project should be sustained over time.

Initially, Yearn failed to capture value with its token. However, after the introduction of a new, sophisticated tokenomics upgrade at the end of 2021, its tokenomics have improved significantly. A positive feedback loop has emerged, which has improved Yearn's overall performance. It's worth noting that feedback loops can also work in reverse, so only time will tell if the renewed design will ensure sustainability over the long term.

In conclusion, Yearn Protocol is a foundational pillar of DeFi, which enables users to maximize their yields on crypto assets with a simple tool. Yearn's success in the DeFi space is not just limited to the $YFI price, but it's also reflected in its utilization by users.

If you’re interested in the condensed, need-to-know tokenomics information for Yearn Finance including all the resources used for this article, check out the report on Tokenomics Hub

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Feedback and Collaboration

Interested in having your protocol reviewed by Tokenomics DAO or want to collaborate on an article? Feel free to reach out via email here. Feel free to join the Tokenomics DAO discord if you want to learn more about tokenomics.