How a Token is Unlocking the Value of Data

The Key Role of $OCEAN in Revolutionizing AI and the Data Economy

Introduction

The advent of Artificial Intelligence (AI) is reshaping our global landscape, promising a future where our interactions, work, and daily lives are fundamentally transformed. AI's reach extends from enhancing personal digital assistants and self-driving vehicles to advancing fields like natural language understanding and predictive healthcare. However, as AI continues to evolve, driven by vast amounts of data, a critical question arises: How do we ensure the data's reliability, impartiality, and trustworthiness fueling these AI innovations?

Enter Ocean Protocol, established in 2017. This decentralized data exchange framework is designed to recognize and leverage data as a pivotal asset class, propelling the data economy forward. Ocean Protocol offers a secure, privacy-conscious environment for the transaction and exchange of data, addressing a crucial hurdle in the AI advancement journey: acquiring diverse, high-caliber data.

Our discussion will delve deeply into Ocean Protocol, examining its fundamental components, the economics driving its tokens, and its potentially transformative effect on the AI sector. We will explore the challenges and prospects within the data economy and how Ocean Protocol is championing a future of equitable and sustainable data access. This approach democratizes data availability and motivates both data providers and users, thus spurring innovation in the data sphere.

Furthermore, we will scrutinize Ocean Protocol's unique aspects, including dataNFTs, datatokens, and the Ocean Market, and how these elements contribute to the protocol's growth and the broader data ecosystem. Join us as we explore Ocean Protocol and its pivotal role in reshaping the AI and data landscapes.

Tokenomics

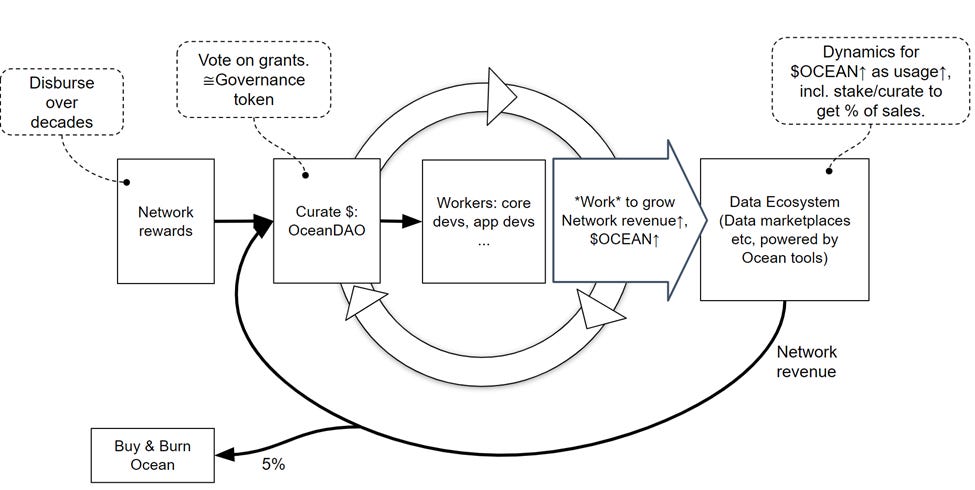

A zoomable version of this diagram can be seen here.

The whitepaper defines Ocean Protocol as the “on-ramp for data services into crypto ecosystems” comprising decentralized data-sharing technologies. These being:

Ocean’s “compute-to-data” feature, which gives compute access to privately held data

Ocean-based marketplace enables monetization of these data while preserving privacy.

Since its inception in 2017, Ocean Protocol has been designed following the best practices in token design and token engineering to maximize the supply of high-quality AI data & services, also referred to as the objective function of the protocol. Ocean Protocol needed to provide value to all its stakeholders to achieve the objective function. The first formulation of the stakeholder map in 2018 looked like the figure below.

Initially, the team behind Ocean Protocol embarked on a journey to find an existing design that could fulfill their specific goals. They explored a range of pre-existing structures, notably including:

Token-curated registries aimed at ecosystem participants and data/services.

Curation markets specifically for data and services.

Regrettably, these pre-established models fell short of meeting the project's objectives for various reasons. Key shortcomings included inadequate spam prevention, insufficient incentives for participants, and considerable onboarding hurdles. Faced with these challenges, the Ocean Protocol team convened to brainstorm and iterate on these existing models. This collaborative effort led to the birth of a tailor-made token pattern for Ocean Protocol: the Curated Proofs Markets.

In the Curated Proofs Markets model, the acts of selecting and organizing resources (curation) and the evidence supporting these selections (proof) work in a synergistic manner. This model ensures that proof not only bolsters the curation effort by signaling quality but also that the curation process, in turn, amplifies the value of the proof, thereby fostering more robust participation.

Notably, the final token design that Ocean Protocol adopted deviated from the original Curated Proof Markets concept. However, the foundational principles remained largely intact, particularly evident in implementing the Data Farming Program, which we will explore in more detail later.

The architecture of the Ocean ecosystem might be complex to visualize for readers therefore, let’s take a look at the Ocean architecture schematics:

The uppermost and perhaps most pertinent layer for our readers consists of what are referred to as “apps.” These apps serve as critical portals through which users can integrate data assets and services into the cryptocurrency world. This layer includes:

Data Assets:

DataNFTs, which are essentially compilations of data and/or algorithms.

Datatokens, functioning as access tokens to these DataNFTs.

Services:

The Compute-to-data service, enabling users to execute computations on private data without direct access.

Data wallets provide a means for users to store data tokens as crypto assets.

Data marketplaces, like the Ocean Market, facilitate the purchase and sale of data.

Significantly, the protocol boasts robust interoperability. Ocean’s smart contracts have been implemented across multiple blockchain networks, including Ethereum, Polygon, Polkadot, Binance Smart Chain (BSC), Moonriver, and the Energy Web Chain, ensuring wide-ranging compatibility and flexibility.

DataNFTs and Datatokens

As previously hinted in the introduction, Ocean Protocol has innovatively developed two key primitives:

DataNFTs are akin to digital intellectual property, taking the form of non-fungible ERC721 tokens. They symbolize the copyright of a data service. Publishers, or the creators of these DataNFTs, engage with Ocean's marketplaces to set up data NFT contracts. This action occurs whenever they upload a dataset, effectively minting a DataNFT. Once a DataNFT contract is established, it’s possible to mint multiple data token contracts linked to it. Crucially, the DataNFT retains the metadata and the regulations dictating how and to whom information access is granted. Here, DataNFTs serve as the foundational asset, with data tokens acting as keys that allow interaction with this asset. The proprietor of the DataNFT holds the rights to the core intellectual property.

Data tokens: Analogous to licenses, these are fungible ERC20 tokens that enable access to the corresponding DataNFTs. This access could manifest as downloading the data or executing computational processes on data held by third parties. It's possible for a single DataNFT to be linked with one or multiple data tokens, each with distinct access capabilities, such as download or compute-to-data. Suppose a dataNFT is published without associated data tokens. In that case, it indicates the author's reluctance to license the intellectual property, though they may choose to do so later by minting data tokens. Upon availability, users can purchase data tokens to gain access. Utilized data tokens are then transferred back to the DataNFT owner, who can decide their subsequent fate, whether to reoffer them in the market or withdraw them from circulation. For further insights into data tokens, please refer to this detailed section.

The owner of a DataNFT enjoys the exclusive right to the income generated from its sale or that of any connected data tokens, endowing DataNFTs with inherent value. This value is directly tied to the potential revenue stream they represent.

Data tokens, functioning as ERC20 tokens, can be traded like well-known ERC20 tokens like USDC. This characteristic ensures their wide interoperability. Specifically for these tokens, Ocean Protocol offers a unique trading platform, the Ocean Market. This marketplace is tailored to exchange data tokens, enabling protocol users to publish and monetize their data. The Ocean Market is decentralized and non-custodial, offering users the flexibility to trade data tokens through fixed-price or dynamically determined pricing mechanisms. For readers interested in a deeper dive into the technical aspects and functionalities of Ocean marketplaces, further information is available at this dedicated resource.

The OceanDAO

Within the Ocean ecosystem exists a decentralized autonomous organization (DAO) known as OceanDAO. This entity is dedicated to financing initiatives that benefit the community, encompassing outreach and open-source development. OceanDAO operates on a fee-based model, consistently earning fees whenever data is listed or exchanged or when tokens are staked. A notable aspect of its operation is the burning of 5% of the total fees it accumulates.

OceanDAO's funding is derived from several sources:

Network Revenue: This includes fee income from applications and services within the Ocean data ecosystem, such as sales in Ocean Markets and Compute-to-Data services.

Ocean Network Rewards: Earnings stemming from the broader Ocean Network's reward mechanisms.

Ocean Protocol Foundation Support: Contributions from the Ocean Protocol Foundation.

Initial Treasury Funding: The OceanDAO treasury's initial capitalization was achieved with 51% of the $OCEAN tokens that were yet to be minted.

Cryptocurrency Assets: This includes ETH, DAI, and other cryptocurrencies obtained through the sale of time-locked $OCEAN tokens, similar to a bond-like mechanism.

With its independent treasury, OceanDAO is actively involved in treasury management activities. These include serving as a liquidity provider for OCEAN-ETH and OCEAN-DAI pools and participating in yield farming endeavors.

Being a DAO, it is controlled by token holders who, to be able to vote, must lock their $OCEAN tokens in a vesting contract, receiving $veOCEAN tokens; more on this later.

The $OCEAN Sustainability Loop

At the very core of the Ocean Protocol lies a fundamental mechanism known as the sustainability loop, which is pivotal in fostering the ecosystem's growth. While central to Ocean Protocol, this concept extends beyond the larger Web3 sphere. Trent McConaghy, co-founder of Ocean and a leading figure in token engineering, first introduced this idea. The sustainability loop draws inspiration from the operational mechanisms underlying thriving businesses and countries.

The utility of the $OCEAN token within this framework is as a work token. It is intricately woven into this sustainability loop, playing a crucial role in the seamless functioning and expansion of the Ocean Protocol ecosystem.

A work token can be defined as a token that curators of the protocol can earn for their "work".

In the context of Ocean Protocol, contributing work could involve engaging in open-source development or undertaking outreach initiatives. This labor benefits the protocol by enhancing its functionality and making it more attractive to potential users. This, in turn, could lead to increased revenue, given that Ocean's revenue model is fee-based.

Furthermore, the $OCEAN token serves as the primary currency for transactions within the Ocean Market. It enables the buying and selling of data assets, including DataNFTs and data tokens, thus allowing data owners to effectively monetize their datasets by creating and trading data tokens.

The design of the $OCEAN token is inherently growth-oriented. It is structured to boost its value by escalating the use of the Ocean ecosystem's services. The operational logic is straightforward: the more the services of Ocean Protocol are utilized, the higher the generated fees. These fees allow for the burning of tokens, leading to a reduction in supply, which, in theory, should result in an upward trend in token value.

An increase in the volume of usage within the Ocean Protocol directly leads to a surge in Network Revenue. This boost, coupled with a 5% fee burn and reinvestment in community activities, triggers a beneficial impact on the price of $OCEAN. Network Revenue primarily stems from fees associated with dataset operations, such as publishing DataNFTs (although the Ocean Market currently does not impose a publishing fee, third-party marketplaces may choose to do so) and purchasing DataNFTs and datatokens. In these transactions, the revenue earned is rightfully claimed by the owners of the DataNFTs.

OceanDAO is allocated 95% of these collected fees, labeled as Network Revenue, while the remaining 5% is dedicated to the buyback and burning of $OCEAN tokens. A comprehensive breakdown of the various fees within the Ocean ecosystem is available for those seeking detailed insights.

The role of OceanDAO is crucial in this ecosystem. It utilizes the funds acquired to compensate workers who are tasked with expanding the usage of Ocean tools. This creates a self-reinforcing cycle within the Ocean system, where increased usage of the protocol leads to more funding for working groups. These groups then focus their efforts on further boosting the protocol's usage, closing the loop and ensuring continuous growth.

Data Consume Volume (DCV)

Ocean Protocol primarily focuses on the ambitious goal of augmenting the availability and quality of AI data and services. The ecosystem relies on a key performance indicator, Data Consume Value (DCV), to gauge its success. DCV is a metric that quantifies the amount of money expended on purchasing and utilizing data assets within a given timeframe.

The DCV associated with individual data NFTs is anticipated to fluctuate over time. This variation depends on the interest these data NFTs garner among the user community. Some data NFTs may attract more attention and, consequently, a higher DCV, reflecting their perceived value and utility to users.

$veOCEAN

For those acquainted with veCRV, grasping the concept of $veOCEAN should be quite straightforward. $veOCEAN, as an integral part of the Ocean Protocol, draws significant inspiration from the veCRV model. This similarity implies that a solid understanding of veCRV provides a helpful foundation for comprehending the nuances of $veOCEAN.

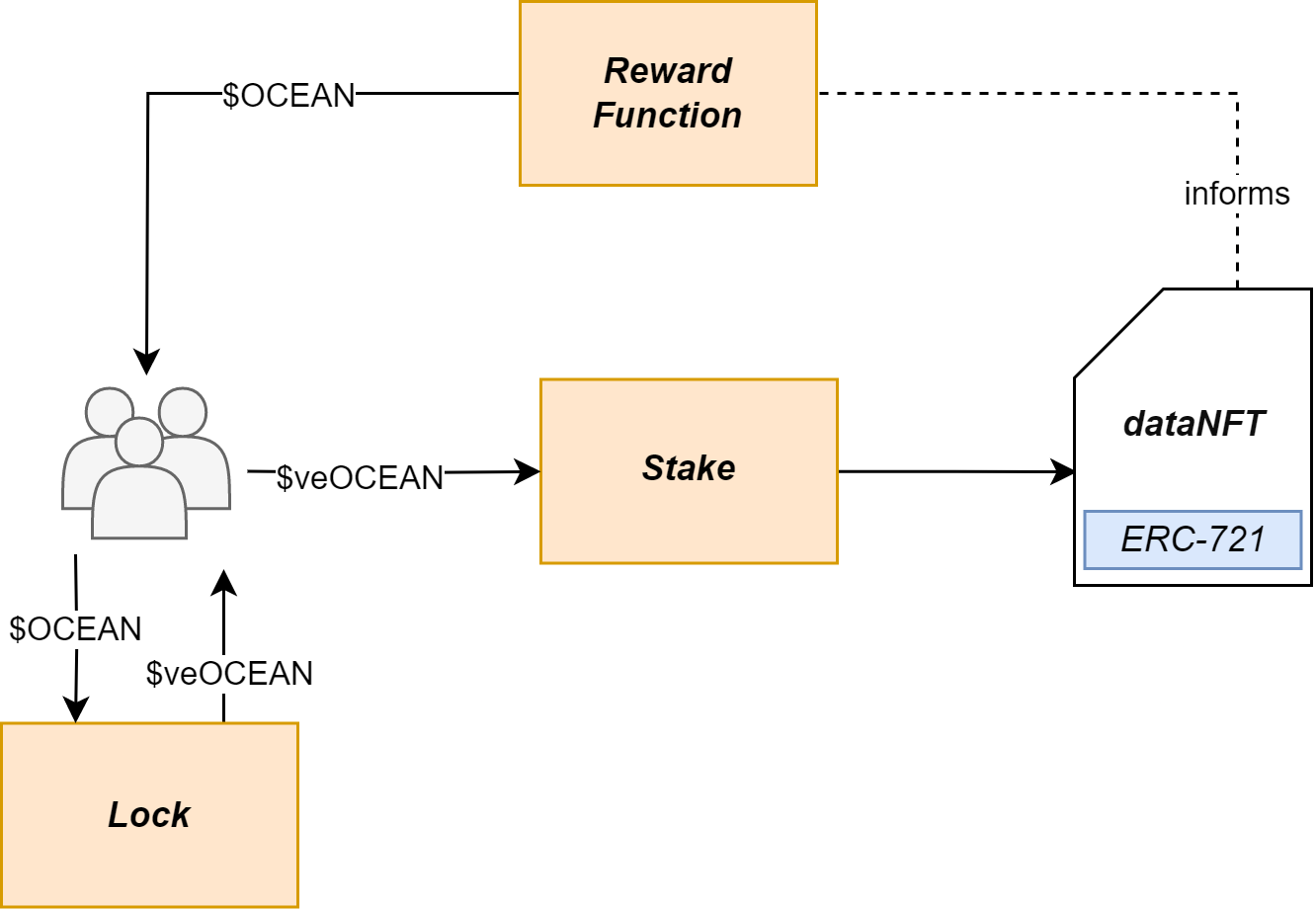

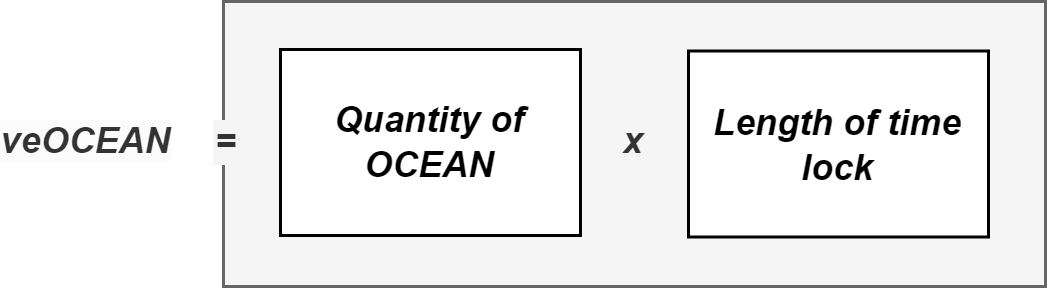

Token holders of $OCEAN can engage in a process where they lock their tokens in a specific contract. In return for this action, they receive a certain quantity of $veOCEAN. The amount of $veOCEAN granted is a product of the quantity of $OCEAN tokens locked and a lock multiplier. This multiplier varies and is contingent on the tokens' duration; the longer the lock period, the higher the multiplier.

Additionally, it's important to note that $veOCEAN is non-transferable. This means that users cannot sell or transfer $veOCEAN to other addresses, marking a significant characteristic of the token.

$veOCEAN is ingeniously designed to balance short-term gains, like maximizing Annual Percentage Yield (APY), with long-term commitments through extended token locking. This system effectively introduces loyalty tiers based on the duration for which tokens are escrowed. In essence, the longer a holder locks their tokens, the more their loyalty is recognized and, consequently, the higher their rewards. The scale of these rewards is directly linked to the length of the lock-in period, with the maximum duration being four years.

Holders of $veOCEAN tokens are entitled to passive $OCEAN rewards. However, there's an additional avenue for enhancing these rewards through active participation in the Data Farming program. By staking their $veOCEAN tokens on data assets, token holders can potentially increase their earnings. This creates a dual opportunity: earning passively by simply holding the tokens or pursuing a more active approach to maximize returns by strategically allocating them.

Data Farming (DF)

Ocean Protocol has rolled out an incentivization scheme, the Data Farming Program, designed to enhance the Data Consume Volume (DCV) and catalyze network effects, thereby setting the wheels of growth in motion.

This program divides rewards into two main categories, collectively termed DF Rewards, with each category contributing up to 50% of the total tokens allocated for Data Farming:

Passive Rewards: Users accumulate $OCEAN weekly by possessing $veOCEAN tokens.

Active Rewards: These rewards are governed by a specific function tied to the DCV. Users can earn them exclusively by staking $veOCEAN tokens on dataNFTs.

All $veOCEAN holders receive passive $OCEAN rewards in sync with the Network Revenue (generated from publishing dataNFTs and the buying/selling of datatokens). However, they can also gain additional rewards by participating in the Data Farming program by staking their $veOCEAN tokens on datasets exhibiting high DCV.

DF Rewards are accessible only through active engagement in staking $veOCEAN on dataNFTs. These rewards are closely linked to network transaction activities, as they are allocated based on the DCV metrics. Consequently, dataNFTs with higher DCV receive a more substantial share of DF Rewards.

In the Ocean ecosystem, an uptick in the usage of apps and services leads to more $OCEAN being staked, enhancing the demand for the $OCEAN token and potentially driving its price upwards.

Essentially, the Data Farming program offers additional rewards drawn from a dedicated pool by Ocean Protocol. This "liquidity mining" mechanism is employed to stimulate active market participation.

Ocean Protocol's overarching goal is to amass sufficient data (via dataNFTs) to trigger network effects and accelerate growth. The primary strategy involves staking $veOCEAN to dataNFTs, thereby curating datasets. This curation aids buyers in identifying valuable assets, thus improving the purchasing process, escalating interest, and boosting DCV. Additionally, an increase in $veOCEAN staked on a dataNFT enhances market liquidity, reduces slippage, and creates a more favorable environment for data asset transactions.

Ocean Protocol has undergone a strategic evolution, pivoting from the use of liquidity pools to implementing the Data Farming program. This shift marks a significant change in the protocol's operational dynamics.

Previously integral to Ocean Protocol, liquidity pools have now been phased out. As a result, users no longer have the option to contribute liquidity directly to data asset pools. Instead, the focus has shifted to a new mechanism involving $OCEAN and $veOCEAN tokens.

Under this revised system, users can lock their $OCEAN tokens to obtain $veOCEAN. They can then stake these $veOCEAN tokens on dataNFTs. This process bears resemblance to traditional liquidity provision methods, albeit with a distinct approach tailored to the unique structure of the Ocean Protocol.

Distribution and Unlocks

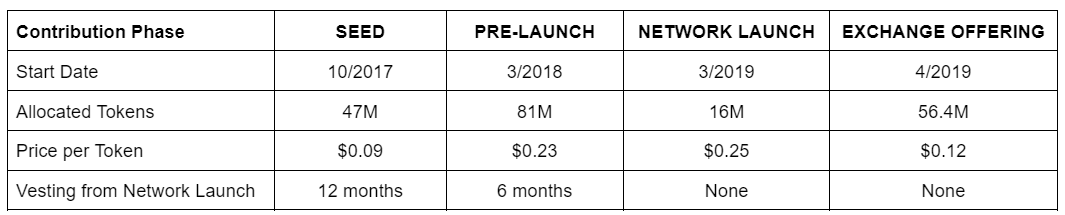

The native token of Ocean Protocol, $OCEAN, saw its initial distribution through various rounds: a seed round, a pre-launch round, a network launch round, and an exchange offer. The total supply of $OCEAN tokens has been capped at 1.41 billion. Since its inception, Ocean Protocol has revised its token allocation strategy, resulting in the following current distribution:

51% for Protocol Incentives: This includes initiatives like Data Farming, support for Network Nodes, and OceanDAO.

10% Reserved for the Team: Allocated with a 5-year vesting schedule, incorporating a 3-year cliff followed by monthly releases.

18.84% for Fundraising: These tokens have a 6 to 12 months vesting for the unlocked portions.

20.16% Dedicated to Community Grants: Managed and disbursed by the Ocean Protocol Foundation.

Additionally, a comprehensive table exists detailing the various stages of fundraising and token allocation, complete with information on the number of tokens allocated and their respective vesting schedules up to April 2019.

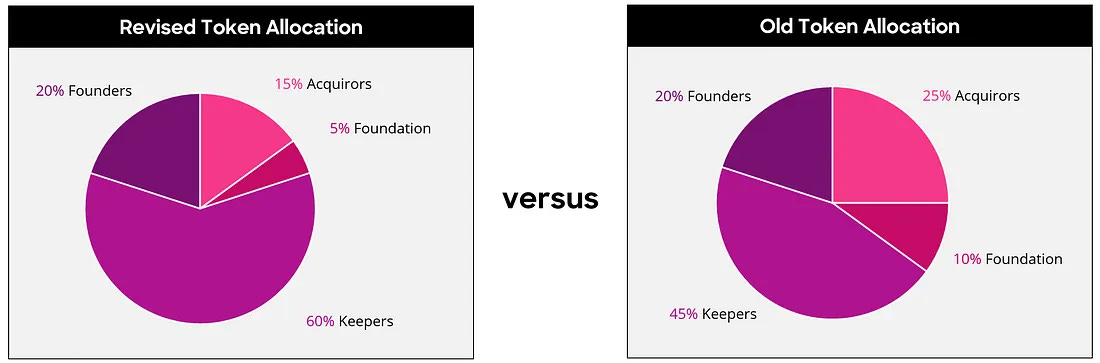

Ocean Protocol has undergone a significant adjustment in its token allocation strategy. The accompanying figure illustrates both the original and the updated allocations, clearly showing the shifts in distribution.

In this revised allocation, the portions previously designated for the Foundation and the Acquirors (investors) have been noticeably reduced. This reallocation strategy was implemented to enhance the share allocated to Network Rewards.

The primary motive behind increasing the Network Rewards is to draw in more developers and data providers to the network. This strategic move is crucial for the long-term health and viability of the Ocean Protocol. It aligns with the overarching objective of the sustainability loop, which is to foster a robust, enduring, and self-sustaining ecosystem.

The Ocean Protocol team's revision of token allocation was driven by a clear goal: to cultivate a thriving ecosystem around the protocol and to robustly seed the community to realize this vision. In line with this strategy, the team has pledged to dedicate 5% of all Network Revenue towards repurchasing and burning $OCEAN tokens. This action is aimed at decreasing the overall supply, thereby potentially enhancing the value of the existing tokens. Regarding the remaining tokens in the Ocean Treasury, it's important to note that there is no predetermined schedule for their introduction into the circulating supply.

Regarding the circulating supply of $OCEAN tokens, the initial phase involved emission solely from pre-mined tokens allocated to Acquirors, the Ocean Foundation, and the team. Starting in March 2020, network block rewards began to complement these pre-mined tokens, contributing to the circulating supply. The emission of pre-mined tokens came to a halt in Q3 of 2022. Since then, the increase in the circulating supply of $OCEAN has been exclusively through network rewards. For a clearer understanding of this transition, a graph depicting the emission schedule is provided, offering a visual representation of these changes.

A closer look at the network rewards within the Ocean Protocol reveals a meticulously structured approach. An initial "warm-up" phase ran from March 2020 to November 2021. During this period, the network rewards were intentionally restricted to a fraction of their full potential, varying between 0 and 50% of the normal rates.

The zenith of network rewards distribution occurred in November 2021. Following this peak, there has been a systematic decrease, adhering to a predefined schedule to gradually reduce token supply inflation. Initially, this inflation rate was set at approximately 17-21%. However, it is on a downward trajectory, anticipated to fall to about 3.3% by 2030 and further to a minimal 0.58% by 2050.

The distribution and unlocking strategies for the $OCEAN token have been thoughtfully designed to ensure a balanced and sustainable approach. This structured planning is central to achieving a fair distribution of tokens, thereby supporting the long-term stability of the Ocean Protocol ecosystem.

A key aspect of this strategy is the commitment to a buyback and burn policy for $OCEAN tokens. This move is instrumental in managing the token supply and potentially enhancing its value over time. Complementing this approach is the community-driven grants program, which underscores the team's focus on empowering and involving the community in the development and growth of the Ocean Protocol.

Together, these initiatives reflect the team's deep-rooted dedication to cultivating a sustainable and thriving ecosystem, firmly positioning Ocean Protocol as a forward-thinking player in the blockchain and data economies.

Value creation and Value capture

Ocean Protocol distinguishes itself with a robust data privacy and security commitment, upheld by its Service Execution Agreements (SEA) and access control tools. Moreover, the dynamics of its $OCEAN token, functioning as a work token, play a pivotal role in incentivizing contributions across the Ocean ecosystem, encompassing marketplace tools, governance, and workers' efforts. The value-adding activities conducted by these workers are regularly assessed by OceanDAO, ensuring the retention of only those endeavors that enhance value creation and capture.

At its core, Ocean Protocol's business model is engineered for progressive growth and enduring sustainability. This model thrives by capturing a fraction of transaction volumes within the data ecosystem, redirecting these resources towards community-led projects that further propel the ecosystem's expansion.

The $OCEAN token serves multiple purposes:

As a Medium of Exchange: It facilitates the buying and selling of data assets in the Ocean Market, enabling data owners to monetize their datasets through data tokens. A surge in transaction volumes could potentially elevate the token's value.

Through veOCEAN: Staking $OCEAN to acquire $veOCEAN garners both passive and active rewards, based on user engagement. Allocating $veOCEAN to high DCV datasets amplifies rewards, thus heightening the appeal and value of $OCEAN.

In Governance: $OCEAN empowers the community in decision-making, particularly in voting on proposals submitted to OceanDAO. These proposals typically concern funding allocations and are managed through the Ocean Shipyard program. The voting criteria focus on the projected ROI and alignment with Ocean's mission and values. Importantly, if insufficient projects are deemed worthy of funding during a certain period, the unallocated $OCEAN tokens are burned, reducing overall supply.

Ecosystem users and Demand Drivers

Ocean Protocol's Ecosystem Users

Contributors: Key roles played by programmers, data scientists, and researchers involve developing and enhancing the protocol's codebase, documentation, and data assets.

Users: Daily interactions by traders and stakers include using $OCEAN for trading data assets in the Ocean Data Market and staking $OCEAN to obtain $veOCEAN for rewards and governance participation.

Governments and Stakeholders: These entities utilize the protocol for secure, private data sharing.

User Goals in the Ecosystem

Traders: Aim to efficiently exchange data assets while incurring minimal fees.

Stakers: Focus on maximizing yield by strategically staking $veOCEAN on high DCV dataNFTs.

Contributors: Seek to contribute to the protocol’s growth and earn rewards.

Partners like the Ethereum Foundation: Support the protocol's development and wider adoption.

Governments and Stakeholders: Prioritize secure and confidential data sharing.

Activities on Ocean Protocol

Launching Initial Data Offerings (IDOs).

Creating and exchanging Datatokens representing data access rights.

Staking $OCEAN and engaging in governance via OceanDAO voting.

Utility of $OCEAN Token

Serves as a medium of exchange for traders.

Offers stakers trade fee discounts and enhanced yields.

Enables participation in governance through staking.

Drivers of $OCEAN Demand

Expansion of the Ocean Data Market.

Adoption by governments and other entities.

Success of OceanDAO in supporting community projects.

Incentives for users include governance influence, fee reductions, and increased asset yields.

Key Demand Factors for $OCEAN Token

Governance: Utilization of $veOCEAN in fee income distribution decisions.

Staking: Opportunity to stake $veOCEAN in the data ecosystem, enhancing reward potential.

Token Burn: Systematic burning of 5% of $OCEAN tokens to manage supply.

Ocean Protocol's Position and Challenges

Ocean Protocol stands as a leader in the Web3 Data Economy, offering innovative data management and monetization methods. It faces competition from similar initiatives like Arweave, Filecoin, and Streamr. The protocol's tokenomics are well-structured, promoting multiple utilities for $OCEAN, including governance, value capture, and transfer. However, its future success and token demand remain areas to watch, especially considering the unique challenges of implementing the veToken model outside its original Curve ecosystem. The project's commitment to sustainability and long-term growth, mirrored in its network rewards schedule, is commendable. Yet, potential centralization within OceanDAO poses a concern for the protocol's decentralization goals. Addressing these challenges is crucial for maintaining Ocean Protocol's positive trajectory in the evolving data economy landscape.

Observations/Thoughts

Ocean Protocol stands at the forefront of the Web3 Data Economy, innovating in data management by enabling data proprietors to initiate Initial Data Offerings and harness their data for monetary gains using Datatokens. It's essential to acknowledge, however, that parallel ventures like Arweave, Filecoin, and Streamr are also venturing into decentralized data storage and monetization, marking a competitive environment for Ocean Protocol.

The project is underpinned by a robust economic framework, guided by token engineering concepts. The $OCEAN token serves multifaceted roles, encompassing governance, capturing and transferring value. The future trajectory of the token's demand and its perceived value by users within the ecosystem is yet to be determined.

The veToken model, originally tailored for the Curve ecosystem, deserves particular consideration. It wasn't originally designed as a fundamental component for other protocols, necessitating additional adaptation efforts for broader applications.

A notable aspect of Ocean Protocol is its commitment to sustainability, evident in its network rewards schedule mirroring that of Bitcoin. This approach fosters long-term stability and mitigates abrupt changes in supply. Nevertheless, the project isn't without areas for improvement. A concern is the potential centralization of the OceanDAO, predominantly governed by a limited group of token holders, which could centralize power and hinder the project's decentralization initiatives. Yet, it's crucial to recognize that the issues facing Ocean Protocol are relatively minor compared to the advantageous features of the token and its ecosystem.

Summary

In summary, Ocean Protocol is a trailblazer in the Web3 Data Economy, revolutionizing how data is handled, exchanged, and monetized. Its novel offerings, including Initial Data Offerings (IDOs), DataNFTs, Datatokens, and Ocean Markets, create a secure and transparent platform for data proprietors to monetize their assets, simultaneously cultivating a dynamic environment for diverse stakeholders.

A significant insight from this review is the effectively constructed tokenomics and value capture strategies that underpin the Ocean Protocol’s growth and enduring viability. The $OCEAN token, with its multifaceted roles in governance and staking, adeptly accrues value throughout the platform, benefiting all involved. The Ocean Protocol's ecosystem is bolstered by a varied user base, including partners, developers, data analysts, researchers, traders, and stakers.

The broad range of goals and interactions these users have with the platform underscores Ocean Protocol's flexibility and capacity to meet the diverse needs of its stakeholders. Furthermore, the protocol's adoption by governmental and institutional entities highlights its potential to influence data sharing and collaboration on a larger scale significantly.

Despite its numerous strengths, Ocean Protocol faces challenges and areas that need refinement to maintain its long-term prosperity and competitive edge. Key concerns include the potential for centralization in the OceanDAO and competition from similar initiatives like Arweave and Filecoin, which are also focused on developing decentralized data storage and monetization platforms.

Conclusively, Ocean Protocol marks a transformative shift in data management and monetization, providing an innovative and holistic approach to securely and transparently leveraging data’s value in the Web3 Data Economy. As the platform progresses and adapts, addressing the identified challenges and areas for enhancement will be vital for its enduring success. Ocean Protocol, by navigating these challenges effectively, has the potential to dramatically alter the dynamics of data exchange and valuation, leading the way towards a more open, cooperative, and data-centric future.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Feedback and Collaboration

Interested in having your protocol reviewed by Tokenomics DAO or want to collaborate on an article? Feel free to reach out via email here. Feel free to join the Tokenomics DAO discord if you want to learn more about tokenomics.

If you’re interested in the condensed, need-to-know tokenomics information for Ocean Protocol including all the resources used for this article, check out the report on Tokenomics Hub

Great article! I'm excited to see if the Ocean protocol can reach its potential.