Embracing Token Depegs

How $Y2K Influences Market Sentiment

Introduction

As the Decentralized Finance (DeFi) ecosystem continues to grow, innovative protocols like Y2K Finance are surfacing to meet the dynamic needs of market participants. Y2K Finance, an avant-garde protocol built on Arbitrum, offers a variety of structured products to speculate on and hedge against the depegging risk associated with selected crypto assets. As stablecoins and other pegged assets become increasingly popular in DeFi, comprehending and managing depegging risk is turning into a key consideration for investors and traders.

Distinctly different from traditional insurance, payouts are completely guaranteed on-chain through Chainlink price oracles. Y2K Finance aims to offer an alternative to money market borrows and DeFi insurance markets, allowing risk transfer to a wider market participant pool with an emphasis on capital efficiency.

This piece will delve into the tokenomics, distribution, value creation, and demand drivers of the Y2K Finance ecosystem, offering invaluable insights and analysis for different investors regarding its potential growth and challenges.

Tokenomics

A zoomable version of the token flow diagram can be found here

If you’re interested in the condensed, need-to-know tokenomics information for Y2K Finance, check out the report on Tokenomics Hub.

Ecosystem Participants

Hedge depositors

Users who are looking to hedge against volatility in pegged assets. They deposit $ETH in the Hedge vaults. Their deposit acts as an insurance premium entitling them to a pro-rata share of Risk vault deposits upon a de-peg eventRisk depositors

Users who are looking to speculate or gain exposure to the de-peg risk market. They deposit $ETH in Risk vaults, effectively underwriting de-peg insurance. They collect a pro-rata share of the premiums from Hedge vault deposits, while creating a market for de-peg protection.

Y2K Finance offers various products explained further in the Value creation section, but for now, let's focus on Earthquake, their core product. Earthquake is a fully collateralized insurance vault where users can hedge, speculate or underwrite the volatility risk associated with a pegged asset.

Earthquake

To understand the Earthquake mechanism, it's essential to comprehend some key concepts:

Asset: The platform supports several pegged crypto assets like MIM, USDT, USDC, FRAX, DAI, WBTC, USDD, STETH, BUSD, LUSD, and TUSD.

Vaults: A vault houses users' deposited assets throughout each epoch, distributing funds at the epoch's end or when a strike price is reached.

Strike Price: The amount by which an asset's price must deviate from its peg to trigger a payout to Hedge vault depositors.

Epoch: This denotes the vault's time period. A yield is paid only if the actual price is lower than the strike price during such a timeframe.

Users can offer insurance by depositing $ETH in the Risk vault (and thus becoming a Risk depositor or insurance seller) which in turn generates an ERC-1155 Y2K token symbolizing their position. This is known as providing collateral.

Contrarily, users who are looking to protect themselves from a de-peg event can do so by buying insurance on any accepted assets. They can do this by depositing $ETH into the respective Hedge vault (and thus become a Hedge depositor or insurance buyer), which also generates an ERC-1155 Y2K token symbolizing their position. This is known as paying a premium.

In case of a de-peg below their strike, the collateral is liquidated but they receive premium payments every epoch. After the deposit, funds are locked for the duration of the epoch. When the Chainlink oracle indicates that the strike price for a given vault has been hit, the epoch will end and the vault will be closed. This will initiate a transfer of Risk vault deposits to the Hedge vault. The punctual determination of the strike price could be found in the official documentation.

In addition, both vault tokens (i.e hedge and risk depositors ERC-1155 tokens that represent their liquidity positions) can be staked to farm $Y2K rewards.

For Risk depositors it makes sense for them to stake their vault tokens since they can earn additional rewards (i.e $Y2K emissions) whilst their liquidity is idle during different epochs if no de-pegs happen.

For Hedge depositors it takes makes sense to stake since there are two possible scenarios which may occur:

Depeg event occurs

Hedge depositors receive collateral from Risk depositors.They can keep their staked ERC-1155 token for the next epoch (i.e leave it remains staked), which essentially means that the user is reinvesting earnings. By doing so the user is indicating that they’re confident that another de-peg event will occur during the following epoch.Depeg event doesn’t occur

Hedge depositors lose the assets they supplied (known as premium) but have in the meantime earned farming reward for the epoch.

It helps to think of both Risk and Hedge depositors as LPs, even if Risk depositors are the main source of liquidity for the platform.

Fees and User Scenarios

The protocol collects a 5% fee in the following scenarios:

5% of Hedge Vault deposits, no matter if there is a de-peg event or not.

5% of Risk Vault deposits upon a de-peg event, of which:

70% of it goes to Y2K treasury

30% of it distributes back to token stakers

No fee is charged if peg is maintained

Another 0.25% fee are taken from premiums and collateral deposits, of which:

70% of it goes to token stakers

30% of it distributes back to the protocol

Let’s take a look at an example

Before epoch starts, 2 users deposit 1 $ETH each in the Hedge vault while 20 other users deposit 0.5 $ETH in the Risk vault,a total of 10 $ETH.

If a de-peg event occurs, then the 2 users receive 5 $ETH each from Risk deposits (minus fees), while the other 20 users will just retain and divide among them 2 $ETH (minus fees). Thus a hedge user will earn on net 4 ETH$, instead a risk user will lose on net 0.4 $ETH.

If no de-peg event occurs within a month, then hedge users will lose their $ETH and each risk user will receive 0.1 $ETH.

$Y2K Token Utility

Y2K Finance's native utility token serves several functions within the protocol, including governance, protocol revenue sharing, and emission direction.

$Y2K can be locked for $vlY2K, allowing lockers to accumulate a larger share of governance power and accrue protocol fee revenue. $Y2K is paired with wETH in a locked 80:20 BPT. The BPT is a Balancer Pool Token that serves as the liquidity base for Y2K, this token can be obtained by providing liquidity in the Y2K Balancer pool. The lock has 2 periods: 16 weeks and 32 weeks. 32 week lockers will receive 2x more protocol fees and governance power than 16 week lockers to ensure protocol alignment.

Based on the outcome of YIP:1, the governance voting power is split as follows:

$Y2K token (no lock) has 1 vote

$vlY2K locked for 16 weeks has 5 votes

$vlY2K locked for 32 weeks has 10 votes

While in the early stages $vlY2K holders received 30% of all protocol revenues, with the introduction of YIP:2, they now are entitled to a 50% portion of all protocol revenues, whilst the remaining 50% will accrue to the treasury for protocol maintenance. As said, such holders will be able to direct $Y2K emissions through a gauge system. Gauges are contracts that allow $vlY2K lockers to direct which markets (vaults) to allocate $Y2K emissions to. Gauges will follow Snapshot votes that will include all available markets, with $Y2K token emissions being allocated to said markets based on the outcome of the vote. The voting power of $vlY2K will be based on the lock period.

Stakeholders and Competitors

The current main investor of Y2K Finance is New Order (@neworderDAO), a community-led incubation DAO, which was raised through a crowdfunding round. New Order has previously invested in GMX. According to the whitepaper, the founders are @0xdrej and @0xSami from New Order Dao, in addition to @dcfintern, @slumdogy2k, and @badquant1.

The known competitors are the ones as below where you purchase insurance on the number of assets that you would like to cover, similar to Real World Assets (RWA):

They generally offer services like protocol hacks, ETH staking cover, yield token cover and custody cover. Unlike Y2K Finance, the payouts from these projects typically occur after the event. Y2K Finance, on the other hand, offers on-chain guaranteed payouts through Chainlink price oracles during the event. This distinction provides Y2K Finance with a competitive advantage in terms of immediacy and transparency of payouts.

Distribution and Unlocks

The team decided to launch the token with IFO (Initial Farming Offer) model, essentially a massive limited $Y2K incentive program that rewards platform early adopters.

Y2K Finance's initial token distribution allocated the total supply of 20 million as follows:

30% towards Liquidity mining: Used to reward LPs

35% towards the Treasury: Used to cover maintenance costs and support long term growth

15% towards the Team with a 24 month linear vest, 9-month cliff with a 10% unlock at TGE

10% to New Order Treasury: Used in Incubator

5% towards Investors with a 24 month linear vest, 6-month cliff with a 10% unlock

5% to the IFO

The team and partnership tokens (5% Investor allocation) are vested over 24 months, ensuring long-term commitment and alignment with the project's success. Token unlocks have been scheduled over time to maintain a healthy token supply and prevent excessive sell pressure. The remaining tokens are set to be released into the circulating supply through various initiatives such as liquidity mining, staking rewards, and developer incentives (which come from the Treasury allocation).

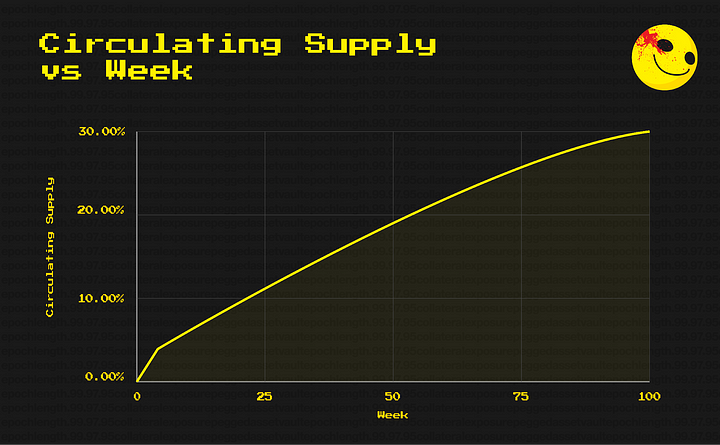

Below we can see the expected liquidity mining’s (+ IFO) circulating supply over time:

The treasury of Y2K Finance holds a significant 35% of the total token supply. For savvy investors, keeping a keen eye on the associated on-chain address will be vital to forming an effective investment strategy. Moreover, the team behind Y2K Finance retains 15% of the total supply, with a lockout period of nine months during which 10% is unlocked. Following this period, the remainder will undergo linear vesting over two years. While this vesting period is not extensive, it is another factor that investors should monitor closely for optimal decision making.

Presently, New Order is the sole investor in Y2K Finance, holding 5% of the total token supply. However, information regarding other potential investors remains undisclosed. This uncertainty might suggest the presence of angel investors or other investment funds interested in Y2K Finance. Investors should therefore stay informed about such developments, as they could significantly influence the project's future trajectory and market dynamics.

Value Creation and Value Capture

At its core, Y2K Finance strives to create value by offering innovative financial products that empower users to manage depegging risks within the volatile crypto market. Catering to diverse risk profiles, the protocol's products enable users to adjust their exposure to depegging events. The project's competitive edge lies in its unique approach to structured products and the use of the Arbitrum Layer 2 scaling solution, which ensures quicker and more cost-efficient transactions compared to Ethereum Layer 1.

Y2K Finance's core product, Earthquake, is not its sole value generator for users. The protocol also plans to introduce the following services:

Wildfire (upcoming)

Tsunami (upcoming)

Bond Markets

The Bond market concept allows users to exchange select crypto assets for native tokens at a reduced rate. In return, users receive the discounted asset over several days. Specifically, $Y2K bonds bolster the Y2K treasury by offering users a chance to purchase $Y2K at a discount in exchange for $USDC. Initially, only $USDC deposits were supported, and users could participate via either the Y2K Finance or Bond Protocol apps. Bonds are vested linearly over five days, allowing participants to gradually acquire their discounted $Y2K.

Wildfire - A Market Making Hedging Formula

Wildfire is an in-development secondary market platform, built on Earthquakes' tokenized vaults, which will allow real-time entry and exit positions via an on-chain RFQ (Request for Quote) order book. This market-making formula provides flexibility and options for risk management and liquidity provision, enabling traders and depositors to hedge or underwrite positions outside epoch times. It aims to enhance liquidity and foster market efficiency between epochs.

Let take a look at an example to better understand the process

John deposits 1 ETH (suppose 1 ETH = $1.200) in an Earthquake vault (Hedge or Risk) and receives the correspondent vault ERC-1155 token.

Since John wants to make a profit as soon as 1 ETH reaches $1.700, he can approve and sign a message to place a sell limit order (maker) into the order book at a price of $1.700.

Marie wishes to enter the market and is convinced that such a token vault could be worth $1.800. So, she places a taker order to buy the John position at a current price ($1.700). At this point, Marie can:

A. Place a new sell maker order at $1.800

B. Keep the position and earn the expected payout, by burning the vault ERC-1155 token

Tsunami - Y2K lending market

Tsunami is a Collateralized Debt Obligation (CDO) powered lending market for pegged assets with MEV-proof liquidations. This product will take advantage and ownership of the debt that backs many of these assets.

Tsunami adopts a GLP-like product where the collateral is pooled from various liquidity providers into a host liquidity pool, which provides users with a mechanism for aggregation of debt positions in multiple lending agreements. These aggregated agreements will be represented by Collateral-Debt Obligation (”CDO”) NFT tokens.

Users who provide liquidity to the CDO NFT have exclusive access to the liquidation bot, where in the event of a leveraged position being liquidated, the yield generated by the liquidation event is passed on to them and is added to the yield they are already earning. Since a portion of the profit from the liquidation will be returned to users, this attracts them to borrow from the protocol and not from providers directly.

With Tsunami, the host liquidity pool itself represents a dedicated loan underwriter that monitors, facilitates, and liquidates loan positions.

Imagine you're playing a game of Monopoly. Tsunami is like a banker. It's like a big pool of money (called a liquidity pool) that acts like a special bank. This "bank" does a few important things:

It watches over loans just like your parents might watch over your piggy bank, making sure everything is safe.

It helps people get loans, just like when you want to buy a new property in Monopoly and you don't have enough money.

If someone can't pay back their loan, Tsunami will step in and sell their property (or in real terms, their loan position) to get the money back. This is called liquidation.

In terms of value capture, Y2K does this through charging fees and the revenue share mechanism which requires users to lock the $Y2K token. As the platform grows and attracts more users, both the protocol and token holders gain from value accumulation. This model of value creation and capture is a hallmark of successful DeFi projects such as Aave and Compound.

$Y2K Demand Drivers

Y2K Finance attracts a range of users who are interested in the protocol primarily for hedging and speculative purposes on pegged crypto assets. The token has multiple demand drivers, and the team continuously introduces new products/services to boost these drivers. Below are the main drivers through which users request to buy/holding the token:

Bonding

A user can buy $Y2K at discount with a vesting period of 5 days in exchange for $USDC.Staking

Users are able to stake their ERC-1155 vault tokens and farm $Y2K rewards. They are incentivized to participate in the protocol and increase the use of $Y2K.Governance

By locking $Y2K users receive $vlY2K which has governance power. Note that also a $Y2K holder has voting rights, less than $vlY2K holders.Revenue sharing

By locking $Y2K users get $vlY2K and are entitled to receive a pro-rata of protocol generated fees.Emissions direction

By locking $Y2K users get $vlY2K that also allow lockers to direct which markets (vaults) to allocate $Y2K emissions to.Wildfire

By allowing users to trade their positions in Earthquake vaults at any time, Wildfire improves the liquidity of the $Y2K ecosystem. This increased liquidity can foster adoption of the $Y2K token, as it reduces the risk and uncertainty associated with holding and trading the token.

Before an epoch starts, there is a time period to deposit funds into vaults. After this period no more funds can be deposited. Once funds have been deposited they cannot be withdrawn until the epoch finishes.

To gain an advantage, users tend to deposit funds as late as possible so as to see the TVL in the vault and, in general, have more information regarding the distribution of the vaults. Essentially, a user who deposits later has an asymmetrical advantage over those who deposited earlier. This resulted in 30% of platform TVL coming from deposits made in the last 30 minutes of an epoch’s deposit window. These late depositors had major advantages over early depositors who are already locked in, since locked-in depositors cannot adapt to new market information.

In V1, Y2K compensated for this by offering enhanced rewards determined by a bonding curve that tracks the Total Value Locked (TVL) of each vault. Thus, solving the chicken-and-egg problem. But with the recent introduction of Carousel V2 additional improvements will be deployed. By introducing penalties to late depositors to counteract the information asymmetry, a form of deposit tax. The new V2 tax mends depositor information asymmetry, gamifying the deposit period to encourage earlier deposits. Late depositors incur a fee for the informational advantage they possess, and this levels the playing field to ultimately benefit everyone.

Essentially, users pay increasing fees if they join when the TVL is already big. Since part of such fees are re-distributed among $Y2K holders, this makes revenue share demand driver stronger. The deposit tax also acts as a risk management tool for users. By paying the tax and depositing late, users can limit their exposure to unpredictable changes in the market. This functionality might attract risk-averse users to the protocol, potentially increasing demand for $Y2K token.

Y2K Finance has charted out a future roadmap that has the potential to increase the protocol value creation and token demand. These include supporting various stablecoins across multiple chains, launching rebase mechanisms, Wildfire, and Tsunami, supporting exotic stablecoins, auto-compounding the $Y2K token, and launching fixed arbitrage trading vault and options trading.

Observations/Thoughts

Pegged-asset Y2K markets deserve attention since they are trying to bridge a gap in DeFi: the lack of hedging instruments on some of the most capitalized assets in the entire crypto space, stable-coins.Y2K Finance's unique approach to managing depegging risk sets it apart from other DeFi projects.

Comparing Y2K Finance to other web3 projects, like GMX, reveals that Y2K's Earthquake Vaults offer a novel way to address depegging risks. Still, the platform could benefit from integrating with more external partners, such as oracles and other DeFi platforms, to improve the efficiency and effectiveness of its structured products. The advent of innovative products such as Wildfire and Tsunami, can give a relevant boost to protocol adoption. Another critical aspect to consider is the role of the community in the governance process, ensuring that the protocol remains decentralized and adapts to the ever-evolving DeFi landscape.

The collection of fees from Hedge and Risk vault deposits, as well as premiums and collateral deposits, contributes to the protocol's revenue sharing and incentivizes token holders and liquidity providers. This value accrual mechanism aligns the interests of stakeholders and ensures that as the platform grows and attracts more users, both the protocol and token holders benefit.

However, it faces challenges such as potential regulatory scrutiny and competition from other DeFi platforms offering similar solutions. To stand out, Y2K Finance needs to effectively communicate its unique value proposition and differentiate itself from competitors. Clear messaging and distinct features will be crucial to capturing market share and attracting users. The inherent volatility of the market poses challenges and risks for both users and the protocol itself. Continuously monitoring and adapting risk management strategies will be critical to maintaining the stability and sustainability of Y2K Finance.

Summary

Throughout this article, we have explored the tokenomics, distribution, value creation, and demand drivers of Y2K Finance. It is a groundbreaking protocol that addresses depegging risk in the crypto market with innovative structured products.

As stablecoin valuation reaches record highs with participation from both institutions and retail, protocols like Y2K Finance will play a crucial role in helping users navigate and manage the inherent risks of the crypto market. Layer 2 solutions like Arbitrum also pave the way for more sophisticated financial products, ensuring that DeFi remains at the forefront of financial innovation. The importance of governance and community involvement cannot be overstated, as they drive the protocol's continuous growth and adaptation to the needs of its users.

While the project faces competition and challenges, its strengths, such as innovative product offerings and revenue-sharing mechanisms, position it for potential success. Depegs can happen at times of extreme volatility (FTX, Luna, FOMC). Users want protection to hedge or bet against extreme volatility, and Y2K Finance could well be the go-to option in such scenarios.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Feedback and Collaboration

Interested in having your protocol reviewed by Tokenomics DAO or want to collaborate on an article? Feel free to reach out via email here. Feel free to join the Tokenomics DAO discord if you want to learn more about tokenomics.

If you’re interested in the condensed, need-to-know tokenomics information for Y2K Finance including all the resources used for this article, check out the report on Tokenomics Hub.