A fresh take on liquidity mining and bootstrapping for a healthier ecosystem

Breaking boundaries with ve(3,3): the heart of Chronos Finance

In the heart of the ever-evolving world of decentralized finance (DeFi), an unlikely love story unfolds—one that brings together cutting-edge technology, innovation, and fervour for sustainable financial growth. The tale is set against the backdrop of Chronos Finance, a pioneering decentralized exchange (DEX) and liquidity provider on the Arbitrum Layer 2 (L2) network. This narrative doesn't just involve lines of codes and tokens, but a deep affection for solving pressing challenges in the DeFi space and a shared dream of fostering sustainable liquidity.

The model used by Chronos is built around the Ve(3,3) approach. This concept combines the vote escrow tokenomics, known as "ve," from protocols such as VeChain, Curve, and Convex, with Olympus DAO's (3,3) design. In simple terms, "ve" means that a user typically has to lock up a project's tokens to receive the corresponding ve token, which can provide voting rights, fee rewards, or other benefits. The "(3,3)" portion comes from Olympus DAO's design, which yields a particular set of results for users as illustrated in the table below:

The goal of ve(3,3) design is to merge these two powerful tokenomics strategies to overcome the challenges presented by current ve gauges models, liquidity mining and the liquidity bootstrapping method employed by most DeFi projects. Some key aspects of a ve(3,3) model are:

Focus on fees incentives, as well as liquidity incentives (i.e. earn fees by locking the project’s token)*

Typically uses a dual token system

Capital efficiency

Sustainable liquidity

The novel ve(3,3) model balances the incentives of all stakeholders involved in the Chronos protocol, including $veCHR voters, liquidity providers, traders, and protocols. This harmonic structure fosters a virtuous cycle effect that balances incentives, rewards, and demand, leading to a healthier and more efficient ecosystem.

* The reader will get later in the article how Chronos implements a model that aligns emissions with fees and liquidity.

$CHR Tokenomics

The Chronos ve(3,3) system guarantees a steady cash flow to $CHR lockers from swap fees, along with voting rights, which give the power to direct $CHR emissions towards high-volume and bribed pools – a function that lets protocols to induce holders to direct more $CHR emissions toward specific pools. Interestingly, protocols can directly incentivize $CHR lockers to allocate more emissions to their own liquidity pools. When lockers are deciding on emissions, they are influenced by the fees generated and bribes offered, optimizing the gauge system and resulting in better-aligned $CHR emissions. This solution aims for improved capital efficiency and sustained liquidity for DAOs and protocols. It is also worth mentioning that Chronos isn't really a typical ve(3,3) DEX as it gets rid of the rebase function present in most ve(3,3) protocols.

Chronos, indeed, opted to implement a zero-rebase mechanism for long-term sustainability and maturity-adjusted LP returns, to align incentives with the project's long-term health. The team has also decided to not include certain ve(3,3) model functions such as the voters’ ability to receive boosted emissions by voting to their own liquidity pools. The rebase mechanism, intended as token inflation protection, can paradoxically cause inflation. In this scenario, if $veCHR voters aren't subject to dilution, they may neglect economic gauges, thus leading to unproductive capital. They could also unfairly direct emissions to uneconomical pools at minimal cost, potentially damaging the economy over time if rebase protection is in place.

Without rebasing, $veCHR voters are dissuaded from these harmful practices. Although they can still vote for uneconomical pools, their influence wanes over time. To sustain emissions to such pools, they must reintroduce capital into the system through bribes or additional $CHR accumulation. It’s worth noting that prospective entrants into the economy can be dissuaded from joining due to the substantial influence wielded by the initial participants in the governance process.

Ecosystem Participants

As anticipated, Chronos utilizes a custom ve(3,3) model to better incentivize all participants in the protocol. These are:

Users

They perform swaps within the platform and aim for the lowest slippage. Thus, they benefit from the high liquidity (TVL) that resides in the Chronos pools. They pay swap fees, which are then distributed to token lockers ($veCHR) based on their votes. I.e., $veCHR holders (token lockers) receive a pro-rata share of generated swap fees only for those pools they vote for.

Liquidity providers (LPs)

When depositing liquidity, they get LP tokens that can be staked to obtain maNFT. They don’t directly receive fees generated from swaps, as per usual AMMs design, rather they receive newly minted $CHR. With the maturity-adjusted return model, which directly derives from the Reliquary framework, LPs are also incentivized to commit their liquidity for a longer duration to receive maximal rewards. This aligns Chronos TVL with the long-term health and sustainability of the project.

Holders ($veCHR voters)

This kind of agent buys and locks $CHR to receive an ERC-721 (NFT) $veCHR to be eligible to participate in the governance process and control $CHR emissions direction. In order to maximize the fees he gets, he is incentivized to vote to direct incentives to high-volume and most bribed pools. The ERC-721 token can be traded in the Chronos marketplace. Finally, holders interact with protocols to accumulate bribes if they vote (direct emissions) for selected pools (the pool that the protocol is bribing).

Protocols

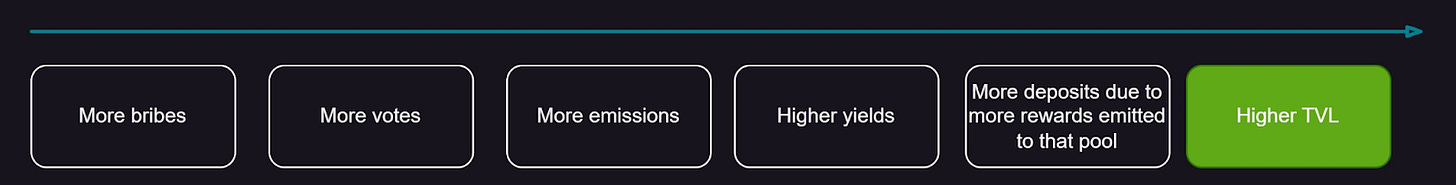

They benefit from a public liquidity layer and can easily bribe $veCHR voters to attract more incentives – and therefore, more liquidity – to their pools. The reader can clearly see how such a process can provide benefits for a specific gauge:

NFT holders

Minters and holders of the Lost Keys of Chronos collection are also an integral part of the economy, as they funded the project. The Lost Keys of Chronos, also known as chrNFT, is a collection of 5,555 items. Owning one of these grants gives you access to various revenue streams and a unique role within the community. It was sold at the following prices:

Private sale: 0.30 $ETH

Whitelisted minting: 0.325 $ETH

Public minting: 0.35 $ETH

Sixty percent of the funds raised from the sales were directed towards providing $CHR liquidity and establishing the treasury at launch. The remaining forty percent was allocated for ongoing development, marketing, audits, design, team support, and other related costs.

NFT holders and minters received part of the total $CHR supply as airdrop with different vesting schedules and options to claim tokens over time (see details in the $CHR Distribution & Unlocks section). While 2% of all generated secondary sales royalties go to $chrNFT minters long life, 1% is distributed to $chrNFT stakers on top of swap fees cut earned by the protocol. It is safe to assume that these types of agents are driven by speculative behaviours.

Protocol Components

AMM

Chronos leverages the same hybrid swap engine seen in other DEXs. It differentiates itself by using a different swap algorithm depending on how closely correlated assets are to one another. In particular:

vAMM — for assets with low price correlation (i.e. ETH/USDC). The AMM relies on the same Uniswap V2 swap algorithm X*Y = K.

sAMM — for closely correlated assets (i.e. USDC/USDT). Chronos uses the Solidly stable-swap algorithm X^3Y*Y^3X ≥ K.

The reason why Chronos utilizes different AMM curves is to deploy liquidity more efficiently and optimize from slippage.

Gauges

$CHR holders lock their tokens and get $veCHR to earn the right to vote on the platform's gauges.

Gauges control the rate of emissions to different liquidity pools within the DEX. Pools that receive more votes earn a greater proportion of $CHR incentives for that epoch. A $veCHR holder earns fees only from the gauges (pools) he has voted for. New gauges need to be approved by the Chronos team.

Bribes

On Chronos, outside parties provide economic incentives (bribes) to help convince $veCHR holders to vote for specific gauges each epoch. The bribe marketplace is permissionless and open to the public but only whitelisted tokens can be offered as bribes. Bribes can be made at any time during the epoch, and are held in escrow throughout the epoch’s duration. $veCHR voters can collect them as a lump sum once the epoch is concluded.

$CHRDistribution & Unlocks

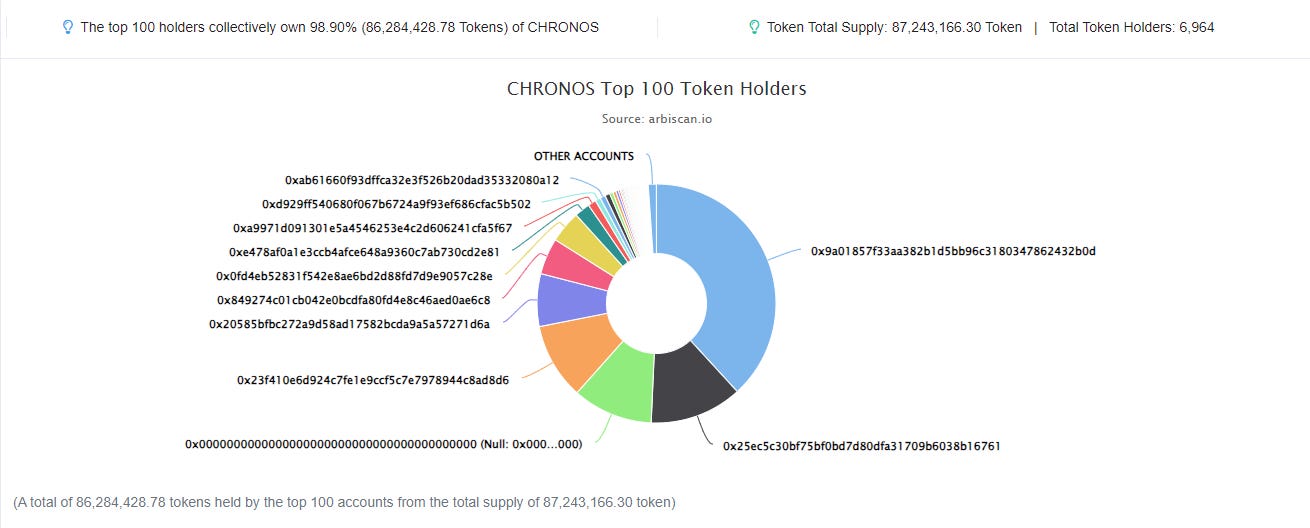

Chronos is on a mission to evolve into a truly community-owned liquidity layer on Arbitrum, which is echoed in its distribution of platform ownership to both protocols and users through a transparent airdrop launch. This ensures the utmost level of decentralization in ownership and participation within the ecosystem. Notably, no venture capitalists play a role in the distribution process. The reader can find below the current $CHR holders distribution:

The token is distributed across 7000 addresses and the majority of them are held in the veCHR address (38%), and the rest is mainly detained by smart contracts. It’s worth saying that 10% of the supply was sent to the null address so definitively removed from the circulating supply.

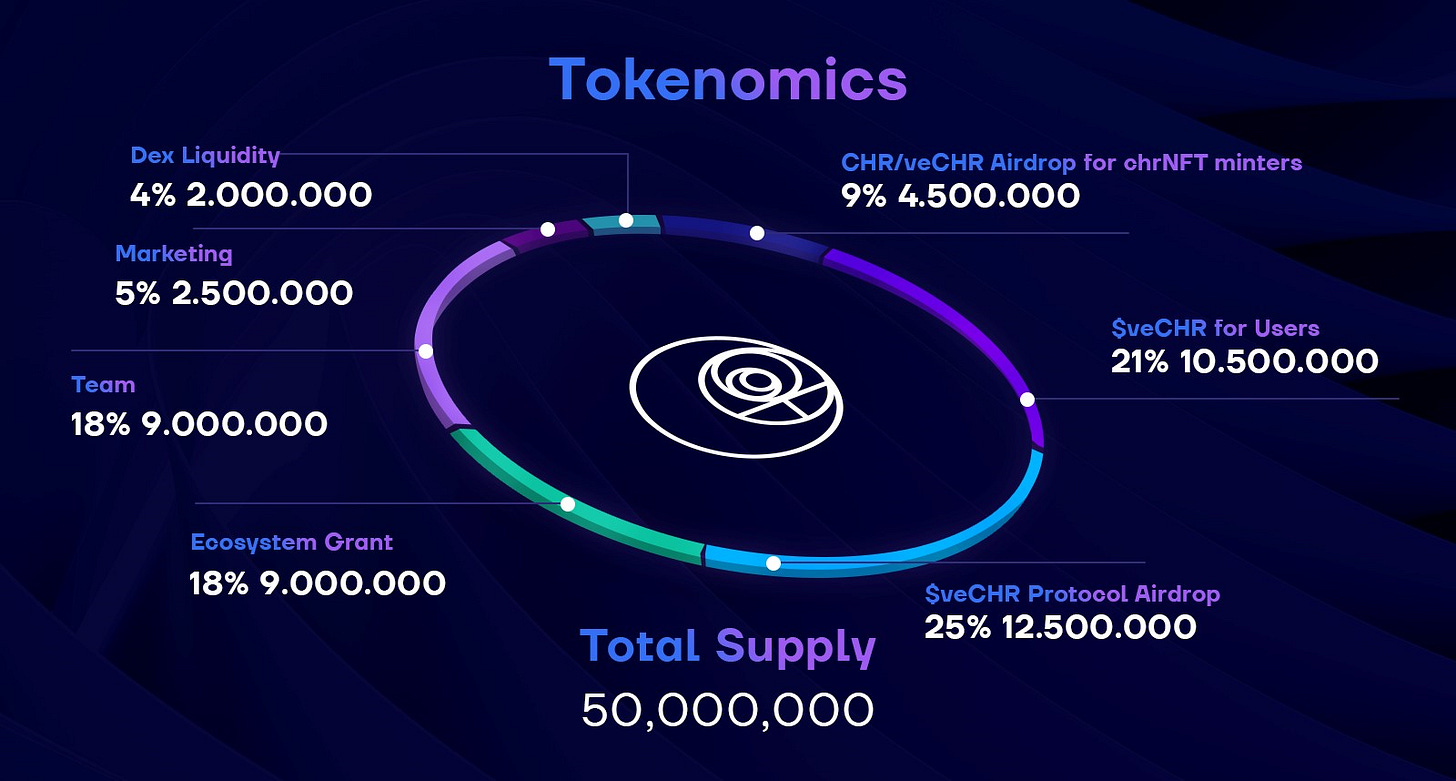

Chronos' native token, $CHR, has an initial supply of 50 million with a maximum supply estimated at 180 million. The initial allocation is as follows:

25% to veCHR Protocol Airdrop

Chronos underscores its commitment to engaging with the liquidity layer by earmarking a quarter of its tokens to $veCHR protocol airdrops. The airdropped $veCHR varies per protocol, ranging from 0.3% - 0.8%, based on the unique needs and value-add of each protocol. This creates an ideal starting point for protocols to familiarize themselves with the ecosystem, while preserving opportunities for them to acquire $CHR for long-term liquidity incentives, thanks to the no-rebase model and balanced quantities.

21% veCHR Airdrop for Users

A fifth of the total token supply is set aside for Chronos' regular users and partner protocols. Selected based on behaviors that foster the protocols' long-term stability - like locking, staking, holding, participating in governance, and continuous support - these users receive their allocation as $veCHR, locked for a maximum duration of two years.

A segment of this supply (2,000,000 $veCHR) was employed to encourage users to lock their $CHR tokens in the early stages of Chronos DEX going live. Those who opt for a two-year lock receive a bonus amount equivalent to 30% of their locked position in additional $veCHR, until the 2M token allocation is used up. This exemplifies Chronos' commitment to reward early members while ensuring the project's long-term sustainability.

9% $CHR/veCHR Airdrop for $chrNFT Minters

This portion is allocated to chrNFT minters, accessible right from the launch. A balanced split between $CHR and $veCHR is granted:

50% as veCHR, locked for 2 years

50% as $CHR, vested linearly over 8 weeks

Minters have the flexibility to claim their entire token share as $veCHR upon claiming the airdrop, instead of adhering to the 8-week vesting schedule.

18% Ecosystem Grants

A sizable segment of the initial supply funds a pool designated to back a variety of projects that intend to fast-track Chronos' growth. Shortlisted projects receive considerable support from the core team in areas like smart contract development, marketing, and business development.

4% DEX Liquidity

Paired with either $USDC or $ETH to ensure liquidity at launch, $750,000 from the $chrNFT minting funds are matched with 2,000,000 $CHR, starting at an initial price of $0.35 at launch.

18% Team Tokens

Allocated to the team to motivate their long-term involvement in Chronos.

50% as veCHR, locked for 2 years

50% as $CHR, vested over 2 years

This allocation, vested linearly over 2 years (beginning on Epoch 1) with no unlocked tokens at launch, aligns the core team's interests with Chronos. By receiving half of their supply as voted escrow tokens, team members can enjoy the protocol's success while maintaining a long-term perspective.

That’s only the initial allocation, though. To attract LPs in perpetuity, Chronos also needs to have an emission schedule that goes beyond the initial allocation, which you can find below.

Please note that this emission schedule also reflects the V2 upgrade the protocol, announced recently.

The team made some significant revisions to the emission schedule of $CHR to coincide with the V2 upgrade. The most notable change is an increase in the weekly decay, moving up from the initial 1% to an updated 2%. So, starting from an initial emission-oriented supply of around 2.5M, the overall emissions reduce by 2% each epoch.

This adjustment in the V2 emissions schedule will lead to a drop in the maximum supply - from the original 275 million down to 180 million under the V2 framework. In line with this accelerated emissions decay, Chronos also decided to increase the weekly treasury allocation. It's been ramped up from the previous rate of 2.5% to a more substantial 5%.

To give you a clear picture:

Weekly emissions at inception were 2,600,000 $CHR

The weekly emissions decay is now 2%

The weekly allocation to the treasury wallet stands at 5%

This modification affects the total $CHR emission by reducing the maximum supply and accelerating emission reduction over time. This encourages LPs to join the protocol early in order to gain the majority of the new emissions. At the same time, they benefit from a limited supply that enhances their position, as it leads to less dilution over time. To note that, while V2 was announced in June but not yet fully deployed, we can clearly see a volume and fees decline as well as a protraction of a $CHR price decline. While the V2 hypothetically should bring some major improvements, only time will tell if it is worth it.

See here the comparison with the former V1 for reference.

Value Creation

Problem

Conventional DEXs, encounter challenges pertaining to revenue accrual for governance token holders and the provision of adequate incentives for liquidity providers.

To begin with, the swap/trading fees often fail to captivate sufficient LPs, necessitating the deployment of liquidity mining programs that distribute native tokens by generating more and more inflation over time. Unfortunately, such disbursements can induce an unfavourable impact on the tokens’ long-term value.

Subsequently, the token holders face the difficult task of channelling revenue from LPs to the DEX. Any income displaced would trigger an exodus of LPs, thereby diminishing the total liquidity and consequently impairing their overall trading volumes.

Another problem Chronos is trying to solve derives from the current ve(3,3) model used by other players in the market in which LPs earn direct fees and token emissions for supplying liquidity. By rewarding LPs this way, protocols can attract mercenary agents who farm the token and create selling pressure on it, overall impacting the platform TVL and creating a misalignment incentives environment. This can lead to reduced protocol usage by users who face an increasing slippage and less favourable trading conditions.

Solution

Chronos facilitates the dependable trading of digital assets, characterized by minimal fees and limited slippage. Its routing engine is designed to automatically identify the most beneficial returns on every trade from the pools accessible.

The ve(3,3) model addresses several aforementioned challenges through an exclusive fee and incentive configuration, which includes:

Channelling all transaction fees to $veCHR voters

Incentivizing Liquidity Providers with $CHR emissions

Permitting protocols to directly incentivize $veCHR voters by offering a share of emissions

Sustaining $CHR emissions through transaction revenue and utility

This structure guarantees considerable utility and remunerations for holders who lock their $CHR, which sequentially aids in preserving the necessary liquidity.

Projects that aim to encourage liquidity for their tokens can directly incentivize $veCHR voters, thereby receiving a share of emissions. This strategy introduces an additional income source for $veCHR lockers and enables projects to efficiently procure liquidity, eliminating the need to rely heavily on high native token emissions.

Finally, Chronos is trying to propose a more incentive-aligned model, thus generating a potential increase in demand for the protocol, in which DAOs can stimulate their own pools through bribes and convey more $CHR emissions to them. The team effectively creates an incentive alignment by directing emissions based on bribes/fees generated for those pools.

Value Capture

Value Accrual to Protocol

The treasury is instrumental in bolstering ecosystem development, and initially draws sustenance from the token allocation and a portion of the $chrNFT primary sale. A significant 60% of the funds accrued from sales is allocated towards providing $CHR liquidity and enriching the treasury at launch. The remaining 40% is earmarked for ongoing development, marketing, and team expenses, among other costs. The treasury sees value accrual via a perpetual 2% inflow from all secondary NFT sales and 5% from weekly $CHR emissions.

The protocol certainly benefits from high TVL to ensure deep liquidity and low slippage so as to attract more users using the platform. For this reason, Chronos adopts a unique strategy to reward LPs. Intriguingly, LPs do not receive any trading fees, instead, they are awarded $CHR emissions subject to a voting process by $veCHR holders. The model enables liquidity providers to accrue enhanced emissions over time, whereby positions staked for longer durations garner higher $CHR percentages per epoch.

Staked positions are eligible to earn an emissions enhancement for up to 6 epochs, with the maximum boost reaching 2x, accruing linearly at 0.2x per epoch. After 6 epochs, the maNFT (LP staked token) is deemed fully mature and will persist in earning $CHR at the maximally boosted rate indefinitely, or until it is unstaked. While there is no lock-up period, LPs retain the freedom to un-stake their position whenever they desire. However, such a move will culminate in the forfeiture of any accrued emissions boost up to that point.

Value Accrual to Token

On the other side of the coin, locking is the main force that ultimately lets the token accrue value.

In the Chronos ecosystem, $CHR holders can choose to vote-escrow their tokens, obtaining $veCHR in return. These $veCHR serve dual purposes: they allow holders to participate in voting on the platform's gauges, influencing the distribution of $CHR to liquidity pools, and they also enable holders to share in the platform's trading fees. The decision to lock tokens to obtain $veCHR is equally beneficial in both aspects, enhancing participation in platform governance while also providing a source of revenue.

All in all, $veCHR holders position themselves to benefit from the long-term success of Chronos, capitalizing on potential buying pressure due to a significant percentage of the token being staked. Being a fork of Solidly, the Chronos model resembles that of Curve, where holders leverage the governance token ($veCRV) to vote and direct emissions towards preferred pools. The value of $CHR and the success of Chronos will largely depend on the number of protocols that find it beneficial to accumulate $veCHR in exchange for enhanced emissions for their pools.

Business Model

Revenue comes from/goes to:

First sale revenues

Chronos is set on becoming a truly community-owned liquidity layer on Arbitrum. Consequently, it has transferred platform ownership to the Arbitrum community via a fair-launch airdrop. No investment rounds or initial funding phase were conducted; instead, funds were gathered exclusively from the sale of the Lost Keys of Chronos ($chrNFT), a limited collection of 5,555 pieces, with the following pricing structure:

Private sale price: 0.30 $ETH

Whitelisted mint price: 0.325 $ETH

Public mint price: 0.35 $ETH

From the initial sale, 60% of the funds were allocated to providing $CHR liquidity and bolstering the treasury at launch. The remaining 40% is reserved for continuous development, marketing, audits, design, team expenses, and other costs.

Perpetual revenues

Regarding the revenue flow post-initial sale, Chronos secures an income stream for different participants. Chronos's modified fee structure ensures competitive swap prices and robust revenue generation for $veCHR voters (approximately 90% of total swap fees), and $chrNFT stakers (approximately 10% of total swap fees). This leads to an increase in both locking rates and incentives for liquidity provisions. It's important to note that swap fees do not contribute to the protocol treasury.

vAMM swap fees: 0.20%

sAMM swap fees: 0.04%

The transaction fees on pools can be strategically adjusted by the Team.

Furthermore, we can break down royalties revenues from the NFT collection into the followings:

Royalties for Minters: 2% of secondary sale royalties are permanently allocated to $chrNFT minters, irrespective of whether they hold or stake their NFTs.

Royalties for Stakers: 1% of secondary sale royalties are added to the staking pool and can be claimed by those staking their $chrNFTs.

Revenue is denominated in:

NFT royalties are collected in $ETH terms, while swap fees are distributed to holders depending on the pool. Generally, the denomination is in the token pair or $CHR. Finally, bribes can be paid with any of the supported Chronos assets.

Token Utility

Chronos employs a dual-token model to inspire various stakeholders to perform distinct roles within its ecosystem: $CHR and $veCHR.

$CHR (Utility Token)

The principal utility token for Chronos is $CHR, an ERC-20 token utilized to motivate users to add liquidity and stake their LP tokens on the platform. LPs find the token attractive as trading fees are not received directly; instead, LP tokens must be locked to obtain the right to receive $CHR emissions. The procedure of staking LP tokens results in a maturity-adjusted return model, thereby encouraging LPs to commit their liquidity for extended periods to gain maximum rewards. Consequently, this aligns Chronos' TVL with the project's long-term sustainability and health.

$veCHR (Governance Token)

Any holder of $CHR can vote-escrow their tokens and receive an ERC-721 $veCHR in return. This grants holders the ability to vote on the platform's gauges, which regulate the distribution of $CHR incentives to Chronos' liquidity pools.

The lock (vote-escrowed) period can last up to two years and not less than 2 weeks, adhering to the linear relationship depicted below:

To encourage continuous locking and enduring stakeholder engagement, $veCHR voting power decreases linearly over time until it depletes at the conclusion of the initial lock period. Users must continually renew their lock duration to retain voting power, cultivating ongoing interaction and active participation within the Chronos ecosystem. In summary, a $veCHR holder gains the following benefits:

Gauge voting: holders have the opportunity to vote for gauges on a weekly basis. These determine which pools will receive $CHR emissions for the subsequent epoch.

Governance rights: holders can participate in governance and vote on proposals for protocol enhancement.

Fee revenue: voters earn 90% of the swap fees generated by the pools voted for each epoch, with the remaining 10% allocated to $chrNFT stakers.

Bribe revenue: voters earn 100% of the bribes for the pools voted for each epoch.

$CHR Demand Drivers

Previously, we noted that Chronos closely mirrors the Curve model, wherein holders utilize the governance token ($veCRV) to cast votes and steer emissions towards preferred pools. The value of $CHR, and consequently the success of Chronos, will predominantly hinge on the number of protocols that deem it advantageous to amass $veCHR in exchange for amplified emissions for their pools, i.e., DAOs and protocols accumulating and locking $CHR for $veCHR to direct emissions to their pools.

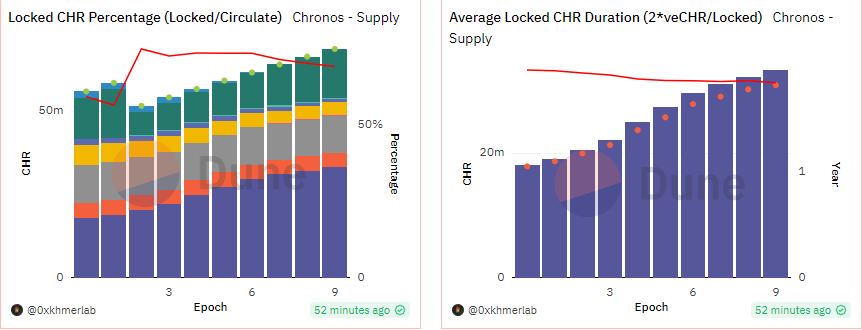

To assess the competitivity of the protocol, let’s consider the following Dune chart:

Following an initial increase during the first epochs (weeks), it shows a slow decline across the remaining ones both on fees and bribes. This suggests that, as of now, protocols are not quite interested in bribing $ve holders to accumulate more $CHR.

It's worth noting that Arbitrum's success will be crucial here because Chronos' prosperity is closely linked to Arbitrum's, mainly the activity happening on the chain (traders and DAOs/protocols on Arbitrum will need a DEX to meet their liquidity needs).

Since acquiring $veCHR necessitates staking $CHR, it is likely that this action will diminish the number of tokens in circulation over time, thereby potentially escalating the price if sufficient demand exists. A similar staking mechanism applies to $chrNFT holders to obtain the right to receive sale royalties and a portion of swap fees generated by the protocol. Other utilities, including revenue sharing, governance rights, and secondary bribe income, can undoubtedly enhance the token demand.

Another demand driver is that users can find trading on Chronos beneficial due to its low fees and user-friendly interface. It's important to mention that these users prefer token swapping with minimal slippage, which requires a large Total Value Locked (TVL). This is secured by a high deposit rate from Liquidity Providers (LPs), who are encouraged to make long-term commitments due to the platform's design (that we have discussed at length in previous sections).

Feedback Loops

Traditional ve(3,3) models often fall short when it comes to motivating liquidity providers (LPs) to support a project for the long haul. Although token voters remain engaged due to the locking function, liquidity providers have the flexibility to disengage at any point.

It has been observed in other implementations that the counter-cyclical effect which helps stabilize the emission token's price gets disrupted as soon as the price declines. In such scenarios, liquidity providers tend to withdraw their liquidity, causing a decrease in the TVL and further diminishing the token's value. This positive feedback loop interrupts the flow of operations, largely because LPs are motivated by immediate returns rather than the long-term welfare of the project.

Chronos, however, provides a solution to this problem by introducing 'maturity-adjusted returns'. This innovative feature allows liquidity providers to gain enhanced emissions over time. As a result, LPs are more likely to maintain their liquidity even amidst temporary price volatility of $CHR, fostering a robust, resilient, and sustainable platform. Moreover, $veCHR holders are insulated against short-term $CHR price fluctuations due to the locking incentive mechanism. Therefore, a minor downward fluctuation in $CHR price shouldn't sway the actions of both ve holders and LPs.

Now, let’s continue to analyze different scenarios and explore some other possible feedback loops that could emerge under certain conditions and how they may impact the project and token's value.

For instance, assuming an increase in the number of users transacting on the platform, a series of events could potentially occur. First, we would likely witness a surge in fee generation, followed by higher returns for both $veCHR and NFT stakers. This would lead to an uptick in demand for NFT staking, which, in turn, would result in a lower circulating supply. In response to these dynamics, we might see a potential rise in NFT buying pressure. At the same time, more royalties would be directed to the treasury, and the demand for $CHR locking would increase, further reducing the circulating supply. These factors could potentially amplify the buying pressure for $CHR. In addition, the platform would become more appealing to protocols, leading to more bribes paid. Motivated by the increasing price of $CHR, more liquidity providers would be drawn to deposit liquidity, thereby increasing the TVL in the platform.

Collectively, these changes form a positive feedback loop. An enhanced TVL would lead to less slippage for users' swaps, driving further fee generation and fueling the platform's growth in a positive cycle.

Moreover, if the $CHR price dips below a particular threshold, liquidity providers (LPs) who rely solely on $CHR emissions might no longer find it advantageous to invest in the protocol. If the price continues to spiral downward, this could significantly impact their profitability and prompt them to withdraw from the platform. Therefore, it's worth considering extra security measures to protect against such risks.

Observations/Thoughts

While the protocol seems to create a sustainable flywheel due to the business model and incentive mechanisms in place, we need to observe some potential downsides that can disrupt the economy which may lead to a reduced TVL and downward $CHR price action.

Furthermore, token lockers ($veCHR holders) could offset a downward trend in the $CHR price. Following a governance process, they could opt to allocate a portion of the fees to liquidity providers. This would serve to further incentivize them during the selected time period and/or based on the $CHR price movements. This proactive approach can provide a buffer against market volatility and ensure sustained participation from liquidity providers. On the other side, a lower $CHR price implies less demand for it, impacting the locking rate of $CHR. The team could explore the possibility to leverage the treasury and draw some funds from it to compensate for a decline period while increasing treasury inflows during bull periods.

It appears that following the initial launch, the Treasury, and hence the project’s runway, relies solely on royalties collected from secondary NFT collection sales and on 5% of the weekly $CHR emissions that stream to it (the treasury). This presents a risk that the project could exhaust its funds if expenses surpass revenues, given the model's dependence on a single perpetual income stream. To mitigate this risk, the team could consider diverting a portion of swap-generated fees into the treasury and/or implementing a withdrawal fee. The latter would be collected when holders decide to un-stake their $CHR, contributing further to the treasury's funds.

Ultimately, the value of $CHR and the success of Chronos will hinge largely on the number of protocols that perceive accruing $veCHR as a beneficial strategy, in return for amplified emissions for their respective pools. This shows the importance of creating a mutually beneficial environment for all stakeholders, to ensure the long-term sustainability and success of the platform.

Reviewing the latest available data, we observe that after an initial uptrend in fees, revenues, and total value locked in May, the protocol experienced a significant decline:

An extended bear market period undoubtedly had a negative impact. It is possible that we will observe a recovery in certain protocol KPIs when the market rebounds. However, when analyzing the cumulative volume generated to date, it appears to follow a logarithmic curve. This curve suggests a lack of momentum and a struggle to push the performance boundaries.

The following data showing the TVL also supports this perspective:

Looking at veCHR holders, there's an increase in the total locked $CHR and the average locking duration over time. However, the decreasing red average line indicates a challenge in attracting more users to lock their assets on the platform. The partial release of V2 update hasn't yet proven its value proposition, with its benefits still unclear. It will be intriguing to watch how Chronos's KPIs evolve over the coming months in response to these protocol improvements.

Conducting a comparative analysis with direct competitors can provide additional insights. For instance, when we look at Solidly, we see a similar logarithmic pattern in the cumulative volume. Notably, Solidly generates approximately 1.7 times more volume than Chronos.

Low trading volumes have a negative impact on fees and revenues:

Furthermore, a comparison between Chronos and Velodrome reveals that while Velodrome generates more fees, it too follows a decreasing trend.

The cumulative volume appears to be levelling off, which mirrors the benchmark trend. This suggests that the bear market has affected the entire ecosystem. Velodrome, in particular, significantly outperforms in volume, currently sitting at around 6 billion.

The unique strategic decisions of Chronos, like the zero-rebase model, aren't currently helping it stand out in a crowded market. The charts above suggest that broad market weakness is limiting the potential of all projects, regardless of their specific design choices. It would be beneficial to track this data over a longer time frame to assess whether these products garner more interest during more favourable market conditions.

Summary

In conclusion, the robust and sustainable architecture of Chronos's ve(3,3) model emerges as a beacon of resilience and longevity in the tumultuous seas of decentralized finance. The well-orchestrated incentive mechanism bolsters the retention of both governance holders and liquidity providers, creating a cohesive and committed community that's central to Chronos's ethos.

The conspicuous absence of private investors or venture capital reinforces the essence of Chronos's dedication to decentralization. This strategic choice could minimize selling pressure, as it ensures that there are no stakeholders who acquired the token at a significantly lower price than the rest of the users.

The dual token model, intertwined with the thoughtful vesting approach, acts as a shield against mid-term $CHR price volatility. In the grand scheme of Chronos's narrative, this translates to a beautifully choreographed dance of technology and economics, ultimately resulting in a more vibrant, efficient, and resilient decentralized financial ecosystem.

From addressing traditional DEX challenges to harnessing the ve(3,3) economic model's capabilities and enhancing it to ensure long-term sustainability, Chronos Finance embarks on an exhilarating journey of love and commitment. It's a commitment to its users, the DeFi ecosystem, and the future of blockchain technology. The dedication to achieving a more sustainable, rewarding, and healthier ecosystem for all participants is a romance not just with innovation, but with a vision for a better and fairer financial future. In this tale, Chronos isn't just developing a protocol; it's writing a love letter to the DeFi community—a testament to its relentless pursuit of progress and sustainability.

Sources: